Text messages and blog opinions travel flawlessly around the world, and for free. Circle Pay believes money should do the same. France and Italy are its new proving grounds. Its parent company is encouraging institutional investors to trade crypto assets with Circle Trading, an over-the-counter (OTC) brand, which offers bitcoin and Bitcoin Cash.

Also read: Circle Financial: BitLicense Granted, Circle Pay Launch

Bitcoin as usable currency rather than just a technology or speculative instrument was one of the core motivations for Circle Internet Financial Limited (Circle), according to early promotion.

Its flagship brand rode buzz and excitement surrounding bitcoin to urge adoption of Circle Pay, advertising stressed, as a way to grow familiarity with the currency.

Some application users enjoyed its crypto exchange feature as well.

The model was popular enough to earn Circle four rounds of venture capital in as many years, totaling upwards of 100 million USD.

By late 2016, Circle Pay dropped its bitcoin-centric enthusiasm.

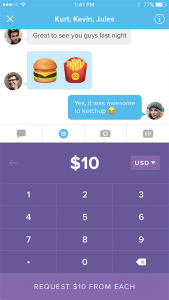

Presently it’s rebranding as a fiat payment system, personal more than commercial, using metaphors of chat and text to help potential users better understand the application (app).

During a question and answer infomercial from France, co-founders Jeremy Allaire and Sean Neville were hosted by Balthazar de Lavergne of The Family.

“… we are long on crypto assets,” Mr. Neville answered when asked about Circle Pay’s no longer exchanging bitcoin.

However, their true vision is to use existing currencies, they explained, to drive the app’s growth. Due to bureaucratic requirements, Circle Pay’s borderless open global protocol would have to wait a few years before formal licensing and government approvals.

In the meantime, bitcoin was a useful introduction to Circle Pay as a product. It got the name out there, showing the power of the app. It also introduced users to bitcoin.

The two men discussed plans to move Circle Pay as a fiat app into a dozen more European countries as well.

France and Italy, Mr. Neville said, are a “major step for us” toward that end.

Though Circle Pay doesn’t exchange in bitcoin, Circle as a company is not giving-up on the currency or technology.

In fact, Circle has a less well-known OTC crypto asset platform, Circle Trading.

OTC markets are prized for their lack central authority. Those wishing to exchange do so through proprietors in preference to public exchanges (which generally require more regulatory hoops).

Geared at whales, “trading with large institutional buyers and sellers of crypto assets,” Circle Trading requires minimum investments of 100,000 USD.

Circle Trading boasts 2 billion USD in direct trades.

Geared at whales, “trading with large institutional buyers and sellers of crypto assets,” Circle Trading requires minimum investments of $100,000 USD.

Bitcoin Cash and bitcoin are among six established cryptocurrencies supported by Circle Trading.

What do you think? Did Circle Pay’s use of bitcoin help the application gain popularity and use of bitcoin as a currency? Will Circle Trading’s OTC exchange have a positive impact on cryptocurrencies? Tell us in the comments below.

Images courtesy of: Curatti, Circle, The Family. Jamie Redman, Lead Writer/Editor, contributed sourcing for this article.

At Bitcoin.com there’s a bunch of free helpful services. For instance, have you seen our Tools page? You can even lookup the exchange rate for a transaction in the past. Or calculate the value of your current holdings. Or create a paper wallet. And much more.