Bitcoin (BTC) bulls have little reason to celebrate the 25% rally over the past nine days. After testing the $31,000 support on June 8, top traders’ optimism faded, and even the recent $41,000 high was unable to boost their expectations.

Contrary to market sentiment, the United Kingdom’s Financial Conduct Authority has indicated a significant increase in cryptocurrency ownership in the country. A consumer survey found that 2.3 million adults in the U.K. now hold crypto assets, which is up from 1.9 million last year.

Another theory that has been proven wrong is the supposition that whales have been selling, causing the Bitcoin price to remain below $47,000 for 31 days. Counter to this narrative, data from Santiment shows that addresses holding between 100 and 10,000 BTC increased their positions by $367 billion during that period.

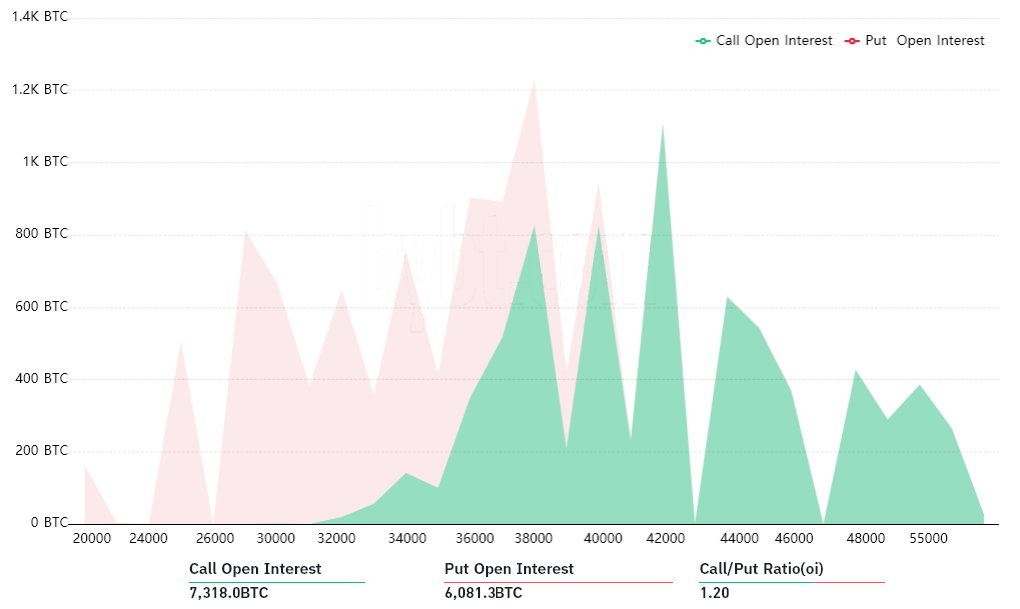

Regardless of investors’ long-term bullishness, there is $520 million worth of BTC options set to expire at 8:00 am UTC on June 18. While the initial screening shows the neutral-to-bullish call options with a 20% lead, a more granular view provides a different picture.

The neutral-to-bullish call (buy) option provides upside price protection to buyers, while the opposite occurs when holding the protective put (sell) options. By measuring each price level’s risk exposure, traders can gain insight into how bullish or bearish traders are positioned.

The total number of contracts set to expire on June 18 is 13,400, or $520 million at Bitcoin’s current $39,000 price. Bulls lead with 1,240 contracts, equivalent to $48 million, but it depends on what price Bitcoin will stand on Friday morning.

Bulls have a $60 million lead above $38,000

While the initial picture seems bullish, one must consider that the $44,000 call (buy) options are almost worthless, with less than sixteen hours left before expiry. A more balanced situation emerges when those bullish contracts are disregarded.

Less than 2,200 call options have been placed at $38,000 or below, an $84 million open interest. At $40,000, another 1,000 neutral-to-bullish options become active, raising the open interest to $128 million.

On the other hand, the protective put options at $38,000 and higher amount to 750 contracts are worth $28 million. This gives bulls a comfortable $60 million lead and an incentive to move the price above $40,000, increasing the difference to $120 million. In this case, 99% of the protective put options will become worthless.

Related: Traders look for Bitcoin price daily close at $41K to confirm bullish reversal

Bears need to wait for until last minute to salvage their position

Options contracts at Deribit, OKEx, and Bit.com happen exactly at 8:00 am, so there is no benefit in trying to manipulate the price ahead of that event. However, bears may have thrown the towel, concentrating efforts on the monthly expiry on June 25. Bulls, on the other hand, have strong incentives to boost their profits on June 17.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.