The demand for bitcoin puts appears to have waned in the lead up to a U.S. inflation report that could strengthen the case for faster liquidity withdrawal by the Federal Reserve, indicating that investors are less inclined to seek protection against a decline in the cryptocurrency.

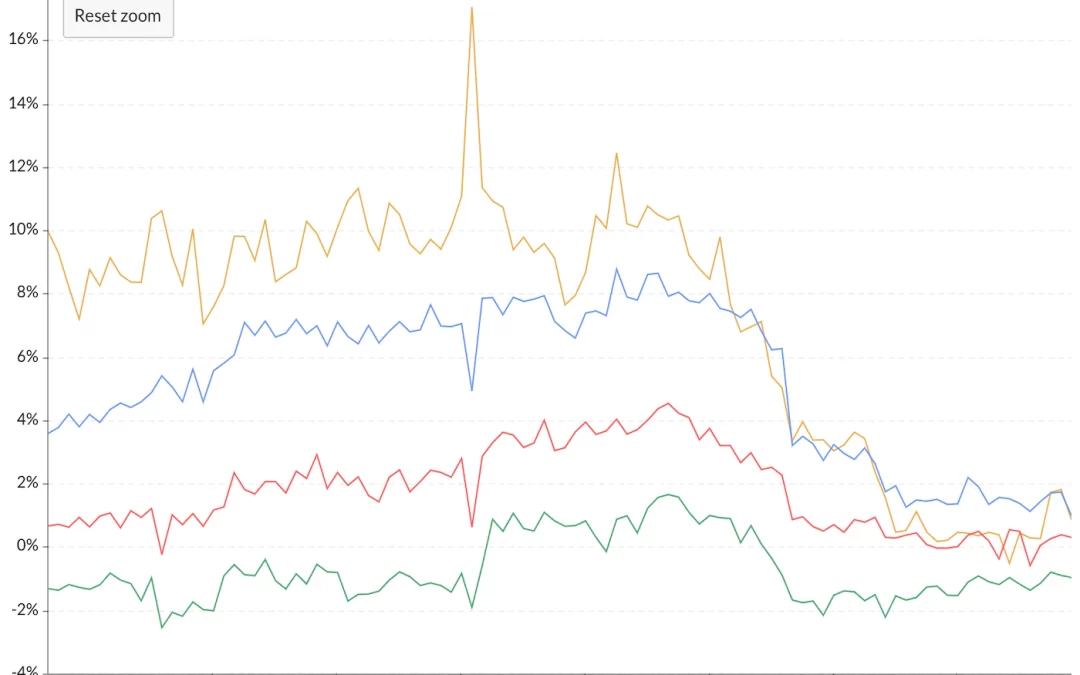

The one-week put-call skew, which measures the cost of puts – or bearish bets – relative to calls, has come off sharply from 17% to nearly 0% since late Monday, according to data provided by the crypto derivatives research firm Skew.

The one- and three-month put-call skews have seen a similar weakening of put bias, with some investors snapping up call options.

“After a quiet start to the year with options open interest coming off significantly from December, volumes started to pick up last night with several large short-dated options trading overnight,” Patrick Chu, director of institutional sales and trading at over-the-counter tech platform Paradigm, told CoinDesk in a Telegram chat. “Over Paradigm, we saw several large interests trading with the end of January topside [Jan expiry calls] in demand.”

Positive options market flows perhaps indicate that sophisticated investors foresee bitcoin withstanding U.S. consumer price index (CPI) data due at 13:30 UTC, which is expected to show the cost of living rose to a four-decade high of 7.1% in December.

That’s quite possible as inflation concerns and the Fed’s hawkish pivot look to have done the damage already. Bitcoin has crashed nearly 40% in the past two months, with the Fed shifting focus to inflation control and signaling three rate increases this year and an end to its asset-purchase program in March.

“Gun to my head, inflation # (830AM EST) comes in line, and the crypto reversal continues. BTC sellers re-engage around $46,000, altcoins enjoy further upside,” trader and analyst Alex Kruger tweeted. “Too much inflation talk. Even my barber mentioned it. Only a large CPI upside surprise would see prices crash.”

Bitcoin was last trading near $42,800 alongside gains of less than 0.3% in S&P 500 futures. Sentiment improved on Tuesday after Fed’s Chairman Jerome Powell said the central bank may shrink its balance sheet later this year, easing fears of quicker tightening.