Crypto investors seem to have stepped up bitcoin accumulation, shrugging of prospects of faster interest-rate hikes from the U.S. Federal Reserve (Fed).

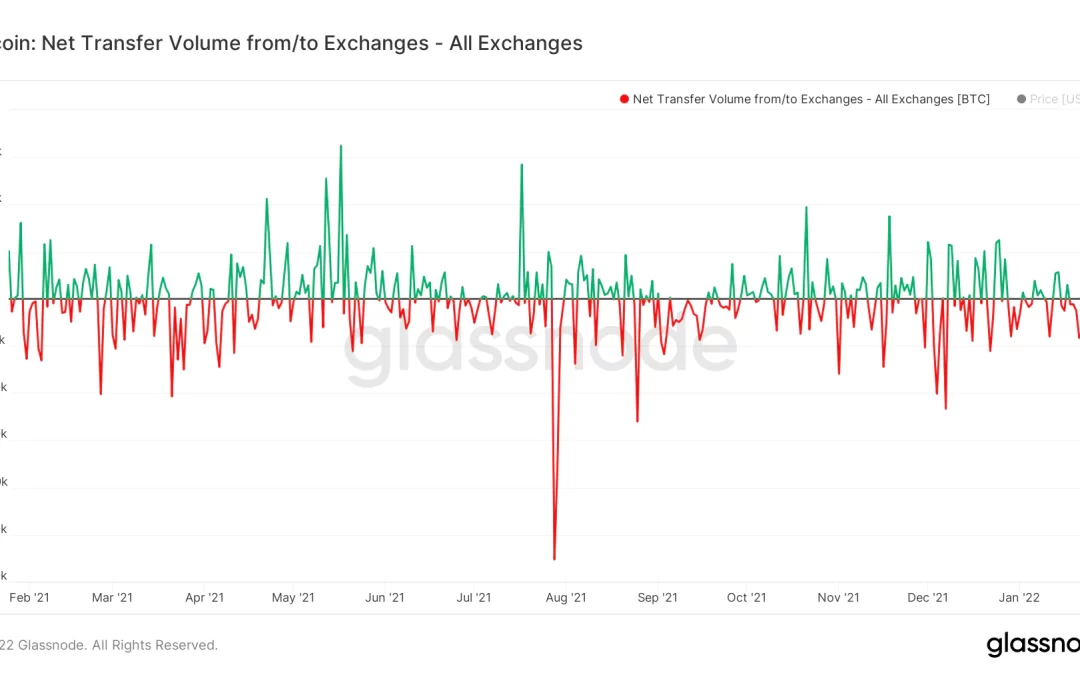

Blockchain data provided by Glassnode shows that more than 18,000 bitcoin worth $670 million left centralized exchanges on Thursday, registering the biggest single-day net outflow in over a month. Crypto exchange BitMEX alone saw net outflow of over 9,500 BTC.

Most investors prefer to have direct custody of coins when they intend to hold them for a longer term. Thus, net outflows are widely taken to represent bullish sentiment.

Outflows do not necessarily imply passive investing and investors often tokenize coins drained from centralized exchanges on the Ethereum blockchain to earn extra yield. The number of wrapped bitcoin (WBTC) has increased by 13,000 this year, extending the year-long rising trend. WBTC is the first ERC20 token backed 1:1 with bitcoin and represents the top cryptocurrency on the Ethereum network.

Whatever the case, increased outflows mean fewer coins available for sale on exchanges and a better chance of the market going up.

On Wednesday, the Fed set the stage for a more aggressive withdrawal of liquidity to tame high inflation. The Fed fund futures have now priced in five rate hikes of 0.25% each for 2022, up from four ahead of Wednesday’s meeting.

Bitcoin and other risk assets with fortunes tied to centralized liquidity are likely to remain under pressure with the Fed focused on fighting inflation; analysts told CoinDesk.

At press time, bitcoin was trading unchanged on the day near $37,000.