Bitcoin fell for a second day, touching its lowest price in nearly two weeks, as a barrage of bearish factors hit cryptocurrencies along with risky traditional-market assets like stocks.

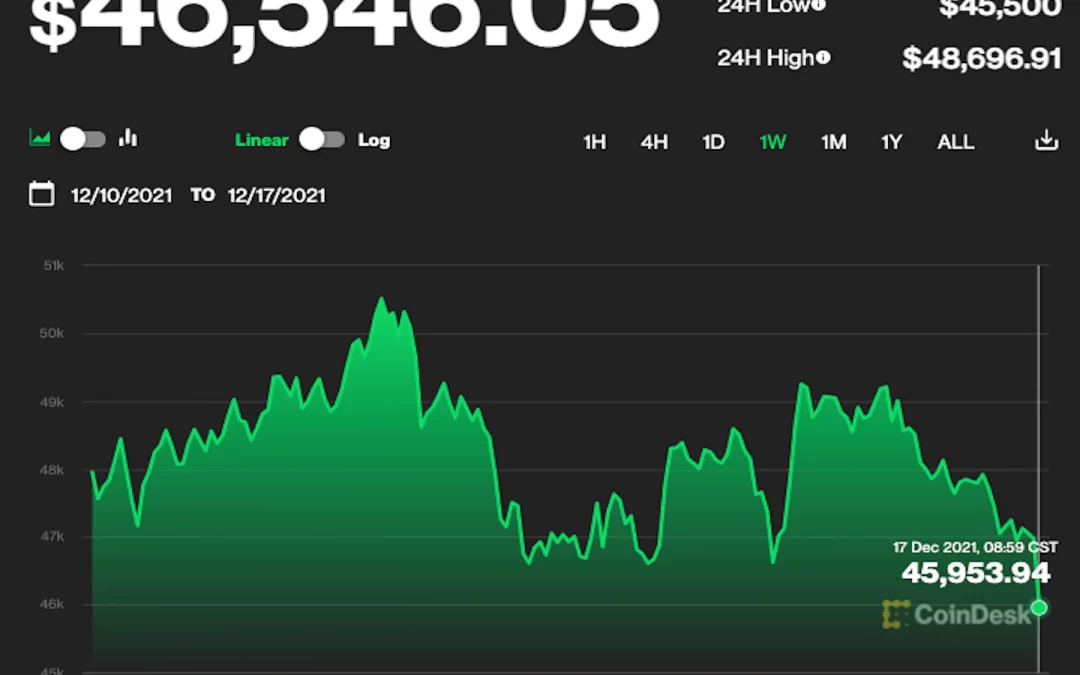

The bitcoin price (BTC) was changing hands around $46,000 at press time. Earlier the largest cryptocurrency’s price slipped as low as $45,479 on the Bitstamp exchange, the lowest since Dec. 4.

Cryptocurrency analysts said a new sense of bearishness may have crept into the market after this week’s announcement by the Federal Reserve that it will accelerate the withdrawal of monetary stimulus. Many investors say the U.S. central bank’s money-printing over the past couple years has bolstered the cryptocurrency’s appeal as an inflation hedge. So a faster withdrawal might put downward pressure on the price.

“The sell wall at $49,200 has muted all attempts to push higher and get the market believing again,” Matt Blom, head of sales and trading at the digital-asset firm Eqonex, wrote Thursday in a newsletter. “Hopes and dreams of BTC north of $100,000 have been shattered.”

Just last month, bitcoin hit an all-time high around $69,000.

According to Bloomberg News, stocks fell on Friday due to concerns that rising coronavirus cases might hit the economy, propelled by the spread of the omicron variant, while some tech-focused investors took profits.

Bitcoin’s recent price slide has trimmed the cryptocurrency’s year-to-date return to 60%. That compares with 24% for the Standard & Poor’s 500 Index of large U.S. stocks.