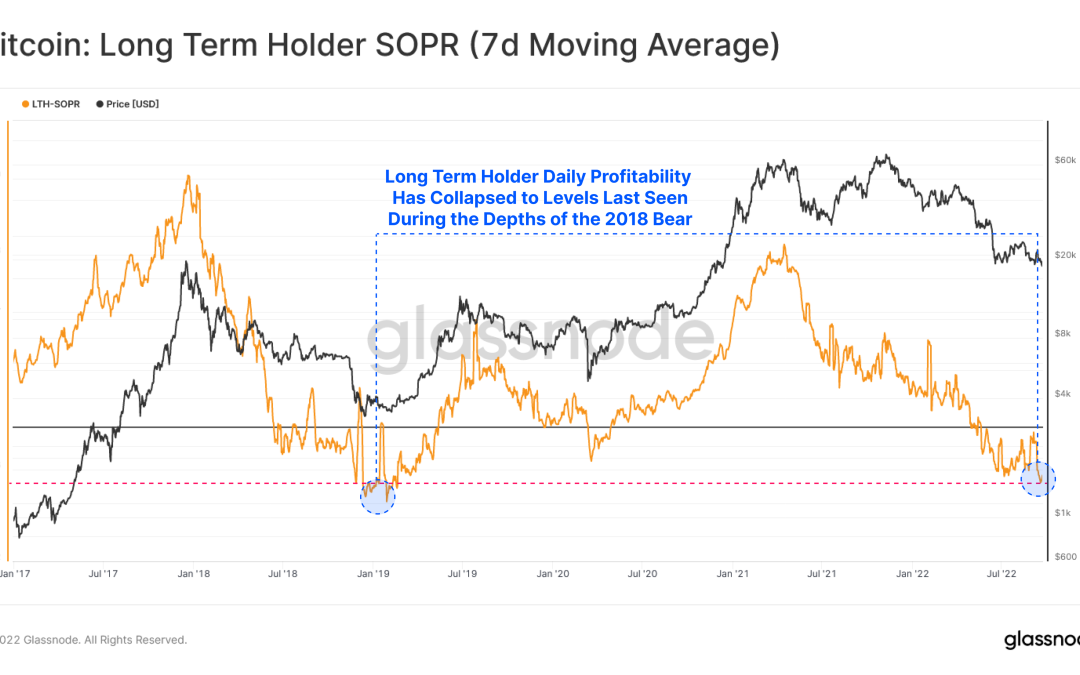

Bitcoin’s (BTC) long-term profitability has declined to levels last seen during the previous bear market in December 2018. According to data shared by crypto analytic firm Glassnode, BTC holders are selling their tokens at an average loss of 42%.

The Glassnode data indicate that long-term holders of the top cryptocurrency selling their tokens have a cost basis of $32,000, meaning the average buying price for these holders selling their stack is above $30,000.

The current market downturn added to the declining profitability can be attributed to several macroeconomic factors. The BTC market still has a heavy correlation with the stock market, especially tech stocks, which are currently seeing an even bigger downtrend than crypto.

The rising inflation added to central banks’ failure to control it has also added to the pain of BTC investors. With much less to invest at their hands, traders and long-term holders are shifting to short-term profitability and less risky assets.

This was evident from the BTC miner sell-offs as well, BTC miners have historically been long-term holders in anticipation of a higher profit. However, the rise in energy costs, added to growing mining difficulty, has narrowed the profit margins of these miners, forcing them to settle for short-term profits.

Related: US Treasury yields are soaring, but what does it mean for markets and crypto?

Bitcoin miner balance has seen large outflows since prices were rejected from the local high of $24.5k, suggesting aggregate miner profitability is still under a degree of stress. While the miner outflow has ranged between 3k BTC – 8k BTC, however, market data indicate that a price decline to $18,000 could lead to a monthly outflow of 8K BTC.

Bitcoin, the top cryptocurrency, is currently trading in the $19,000-$20,000 range, struggling to conquer the $20,000 resistance despite multiple breakouts above it in the month of September.

The long-term holder profitability added with miner profitability has reached a multi-year low. However, the levels are quite similar to when the crypto market bottomed out during previous cycles.

Bitcoin is currently trading in the $19,000-$20,000 range, struggling to conquer the $20,000 resistance despite multiple breakouts above it in the month of September. The top cryptocurrency is currently trading at a 70% discount from its market top of $68,789 posted in November last year.