The United States equities markets welcomed the debt ceiling deal and the May nonfarm payrolls data on June 2 with strong rallies. The S&P 500 rose 1.8% during the week while the tech-heavy Nasdaq was up 2%. This was the sixth successive week of gains for the Nasdaq, the first such occasion since January 2020.

In addition to the above, the expectation of the Federal Reserve remaining in a pause mode during the next meeting may have acted as a catalyst for the rally. CME’s FedWatch Tool is showing a 75% probability of a pause, with the remaining 25% expecting a 25 basis points hike in the June 14 meeting.

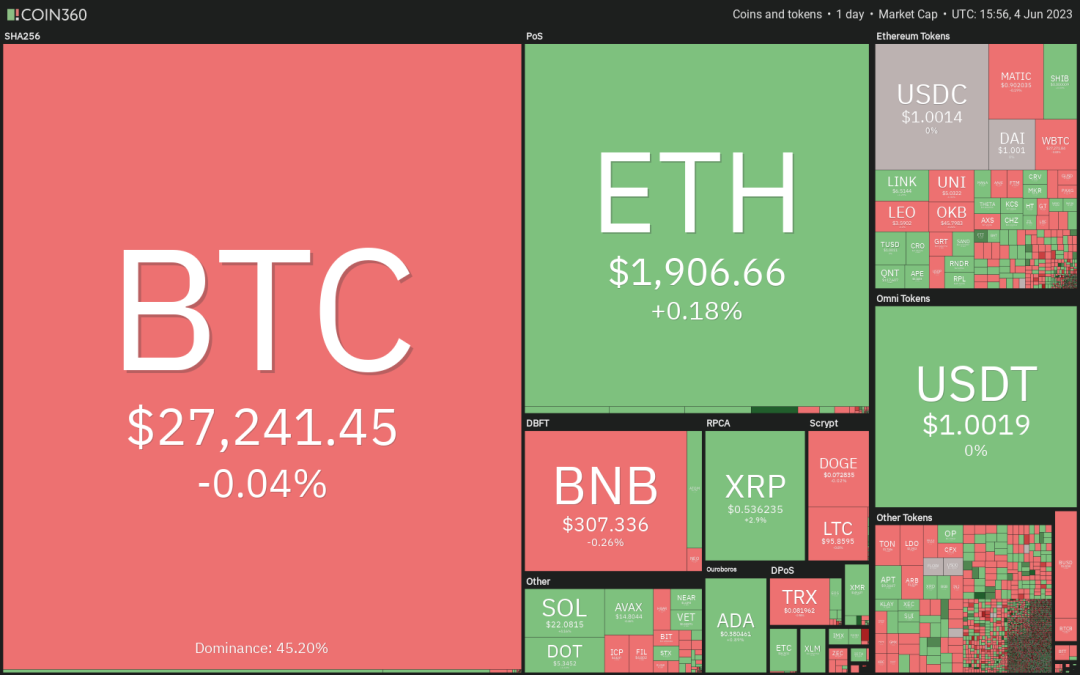

Rallies in the equities markets failed to trigger a similar performance in Bitcoin (BTC) and the altcoins. However, a minor positive is that several major cryptocurrencies have stopped falling and are trying to start a recovery.

Could bulls maintain the momentum and surmount the respective overhead resistance levels? If they do, which are the top five cryptocurrencies that may lead the rally?

Bitcoin price analysis

Bitcoin has been trading close to the 20-day exponential moving average ($27,233) for the past three days. This suggests that the bulls are buying the dip near $26,500.

The 20-day EMA has flattened out and the relative strength index (RSI) is just below the midpoint, indicating a balance between supply and demand. This balance will tilt in favor of the buyers if they drive the price above the resistance line of the descending channel pattern. That may start a northward march toward $31,000.

If the price turns down from the resistance line, it will suggest that the BTC/USDT pair may spend some more time inside the channel. The critical level to watch on the downside is $25,250. A break and close below this support may intensify selling and tug the price toward $20,000.

The 4-hour chart shows that the bears are guarding the immediate resistance of $27,350. On the downside, the pair has been forming higher lows in the near term, indicating demand at lower levels. This enhances the prospects of a rally above the overhead resistance. If that happens, the pair may soar to the resistance line of the descending channel.

If bears want to gain the upper hand, they will have to quickly sink the price below the nearest support at $26,505. The next stop on the downside could be $26,360 and then $25,800.

Cardano price analysis

Cardano (ADA) has been repeatedly finding support at the uptrend line but the bulls have failed to kick the price above the 50-day simple moving average ($0.38).

A breakout from this tight range trading is likely to happen within the next few days. If bulls shove and sustain the price above the 50-day SMA, it will clear the path for a possible rally to $0.42 and then to $0.44.

Alternatively, if the price turns down from the 50-day SMA and dips below the uptrend line, it will suggest the start of a deeper correction. The ADA/USDT pair could then plunge to the strong support at $0.30.

The 4-hour chart shows that the $0.38 level is behaving as a strong obstacle. However, the rising moving averages and the RSI in the positive zone indicate that the bulls have the upper hand. If buyers thrust the price above $0.38, the pair could climb to $0.40 and thereafter to $0.42.

If the price turns down sharply from the current level and breaks below the 50-SMA, it will suggest that bears have seized control in the near term. The pair may then collapse to $0.36 and later to $0.35.

Quant price analysis

After staying below the downtrend line for several days, Quant (QNT) turned around and started a recovery on May 26. The bulls continued their purchase and pushed the price above the moving averages on May 29, indicating a potential trend change.

The moving averages have completed a bullish crossover and the RSI is in the positive territory, indicating that the path of least resistance is to the upside. There is a barrier at $120 but if bulls overcome it, the QNT/USDT pair could rise to $128 and subsequently to $135.

Contrary to this assumption, if the price turns down sharply from $120, the bears will try to yank the price to the 20-day EMA ($110). This remains the key level to keep an eye on because a break below it will indicate that bears are back in control.

The 4-hour chart shows that the price is stuck inside a trading range between $114.50 and $120. The 20-EMA is flattish but the RSI is in the positive territory, indicating that the momentum remains bullish. If bulls clear the hurdle at $120, the pair is likely to start the next leg of the up-move.

Conversely, if the price turns down and plummets below $114.50, it will suggest that bears have a slight edge. The pair may then slump to $110 and later to $102. The deeper the fall, the greater the time needed for the recovery to resume.

Related: Cryptocurrency markets’ low volatility: A curse or an opportunity?

Render Token price analysis

While most major cryptocurrencies are struggling to start a recovery in a downtrend, Render Token (RNDR) has started a new upward move.

The RNDR/USDT pair dipped to the 20-day EMA ($2.48) on May 31 but the bulls successfully defended the level. This shows a positive sentiment where traders are buying the dips to strong support levels. The pair could retest the 52-week high of $2.95. If this resistance is overcome, the pair may soar to $3.75.

The first sign of weakness will be a break and close below the 20-day EMA. Such a move will indicate aggressive profit-booking by the short-term bulls. That may open the doors for a possible drop to the 50-day SMA ($2.20).

The moving averages have completed a bullish crossover and the RSI is in positive territory, indicating that bulls have the upper hand. Buyers will try to push the price above the overhead resistance zone between $2.90 and $2.95. If they succeed, the pair may start a new uptrend.

On the contrary, if the price turns down from the current level or the overhead resistance and breaks below the moving averages, it will suggest that the bears are on a comeback. A break and close below $2.42 will indicate the start of a downward move toward $2.25.

Rocket Pool price analysis

Rocket Pool (RPL) has been trading inside an ascending channel pattern for the past several days. A positive sign in the short term is that the bulls have kept the price above the moving averages. This indicates a change in sentiment from selling on rallies to buying on dips.

The RPL/USDT pair has been trading inside a tight range for the past few days. This suggests that a range expansion could be around the corner. If the price breaks and closes above $50.50, it will suggest the start of an up-move to the resistance line of the channel. The bears are expected to defend this level with all their might.

This positive view will invalidate in the near term if the price turns down from the current level and breaks below the moving averages. The pair could then plummet to the support line of the channel.

The 4-hour chart shows that the bulls are sustaining the price above the moving averages but they have failed to clear the overhead hurdle at $50.37. This suggests that bears continue to sell on minor rallies.

If the price turns down and breaks below the 50-SMA, it will indicate that the bulls have given up. The pair may then plummet to the support line near $46.

Contrarily, if buyers propel and sustain the price above $50.50, the bullish momentum may pick up and the pair could rally to $53.50.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.