Bitcoin (BTC) crashed below $16,000 on Nov. 9, driving the price to its lowest level in two years. The 2-day correction totaled a 27% downtrend and wiped out $352 million worth of leverage long (buy) futures contracts.

To date, Bitcoin price is 65% down for 2022, but it’s essential to compare its price action against the world’s biggest tech companies. For instance, Meta Platforms (META) is down 70% year-to-date, and Snap Inc. (SNAP) has dropped 80%. Furthermore, CloudFare (NET) lost 71% in 2022, followed by Roblox Corporation (RBLX) and Snapchat (SNAP), both down 70%.

Inflationary pressure and fear of a global recession have driven investors away from riskier assets. This protective movement has caused the U.S. Treasuries’ 5-year yield to reach 4.33% earlier in November, its highest level in 15 years. Investors demand a higher premium to hold government debt, signaling a lack of confidence in the Central Bank’s ability to curb inflation.

Contagion risks from FTX and Alameda Research’s insolvency are the most pressing issues. The trading group managed multiple cryptocurrency project funds and was the second-largest trading exchange for Bitcoin derivatives.

Bulls were overly optimistic and will suffer the consequences

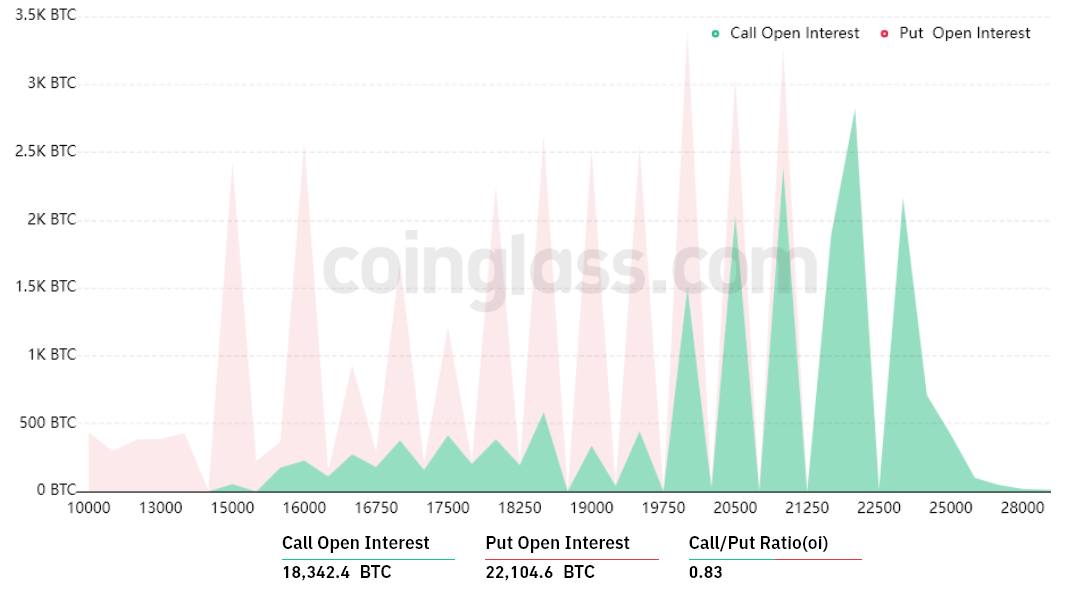

The open interest for the Nov. 11 options expiry is $710 million, but the actual figure will be lower since bulls were ill-prepared for prices below $19,000. These traders were overconfident after Bitcoin sustained above $20,000 for almost two weeks.

The 0.83 call-to-put ratio reflects the imbalance between the $320 million call (buy) open interest and the $390 million put (sell) options. Currently, Bitcoin stands near $17,500, meaning most bullish bets will likely become worthless.

If Bitcoin’s price remains below $18,000 at 8:00 am UTC on Nov. 11, only $45 million worth of these call (buy) options will be available. This difference happens because the right to buy Bitcoin at $18,000 or $19,000 is useless if BTC trades below that level on expiry.

Bears aim for sub-$17k to secure a $200 million profit

Below are the three most likely scenarios based on the current price action. The number of options contracts available on Nov. 11 for call (bull) and put (bear) instruments varies, depending on the expiry price. The imbalance favoring each side constitutes the theoretical profit:

- Between $16,000 and $18,000: 1,300 calls vs. 12,900 puts. Bears dominate, profiting $200 million.

- Between $18,000 and $19,000: 2,500 calls vs. 10,200 puts. The net result favors the put (bear) instruments by $140 million.

- Between $19,000 and $20,000: 3,600 calls vs. 5,900 puts. The net result favors the put (bear) instruments by $40 million.

This crude estimate considers the call options used in bullish bets and the put options exclusively in neutral-to-bearish trades. Even so, this oversimplification disregards more complex investment strategies.

For example, a trader could have sold a call option, effectively gaining negative exposure to Bitcoin above a specific price, but unfortunately, there’s no easy way to estimate this effect.

Related: Grayscale Bitcoin Trust records a 41% discount amid FTX meltdown

Bulls probably have less margin to support the price

Bitcoin bulls need to push the price above $19,000 on Friday to avoid a potential $140 million loss. On the other hand, the bears’ best-case scenario requires a slight push below $17,000 to maximize their gains.

Bitcoin bulls just had $352 million leverage long positions liquidated in two days, so they might have less margin required to support the price. In other words, bears have a head start to pin BTC below $17,000 ahead of the weekly options expiry.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.