Bitcoin’s price spiked past the $12,480 level as a resurgent crypto market clocked over $380 billion in total market capitalisation for the first time in over a year

After two-weeks of sideways trading placed Bitcoin between $11,000 and $12,000, the market exploded in late trading yesterday to see bulls push the top cryptocurrency to highs of $12,485.

The significant rally not only saw BTC/USD sail past $12,400 but also included its march to a year-to-date high.

Bitcoin’s surge to its 2020 high was accompanied by a swell in volume, with average intraday trade volume rising from $20 billion to $28.5 billion.

According to William Purdy of crypto and financial analysis platform, PurdyAlerts, Bitcoin’s price is likely to test higher levels given the high interest seen in the derivatives market.

In comments shared with Coindesk, the options trader noted that BTC/USD price targets as shown by open interest in Bitcoin derivatives were “$12,000, $13,000, $14,100 and $16,000.”

As such, the areas are likely where bulls will establish support or run into stiff resistance.

BTC/USD strong

BTC/USD is trading at around $12,335 as of writing after a slight retreat during the Asian session. However, bulls still hold the upper hand and could push higher once again during later sessions in today’s trading.

Intraday highs above $12,500 will likely put bulls on course for a crack at the psychological $13,000 level.

The technical picture for Bitcoin is positive, with the RSI and the MACD suggesting a bullish divergence that should see the recent upsurge continue. There’s also a bullish bias for the BTC/USD pair given its trading above the 20-day and 50-day SMA.

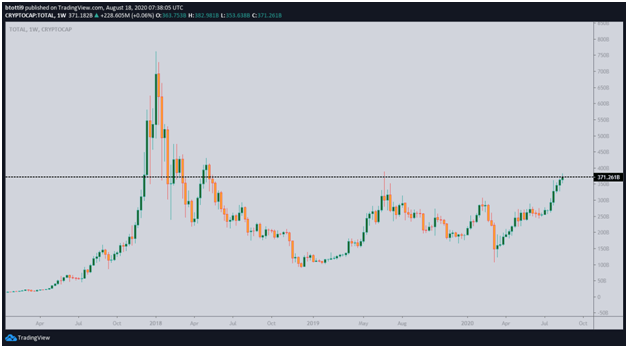

Meanwhile, the total cryptocurrency market value has surged to a 14-month peak, touching highs last seen in June 2019.

According to the above chart, the total market cap for crypto hit $380 billion; a sustained trend above this level will be the first time this has been seen since May 2018.

The post Bitcoin eyeing $13k as total market cap hits $380 billion appeared first on Coin Journal.