The bitcoin-ether ratio rallied to the highest level in three months on Monday as adverse macroeconomic conditions unexpectedly took a bigger toll on the native token of Ethereum’s blockchain.

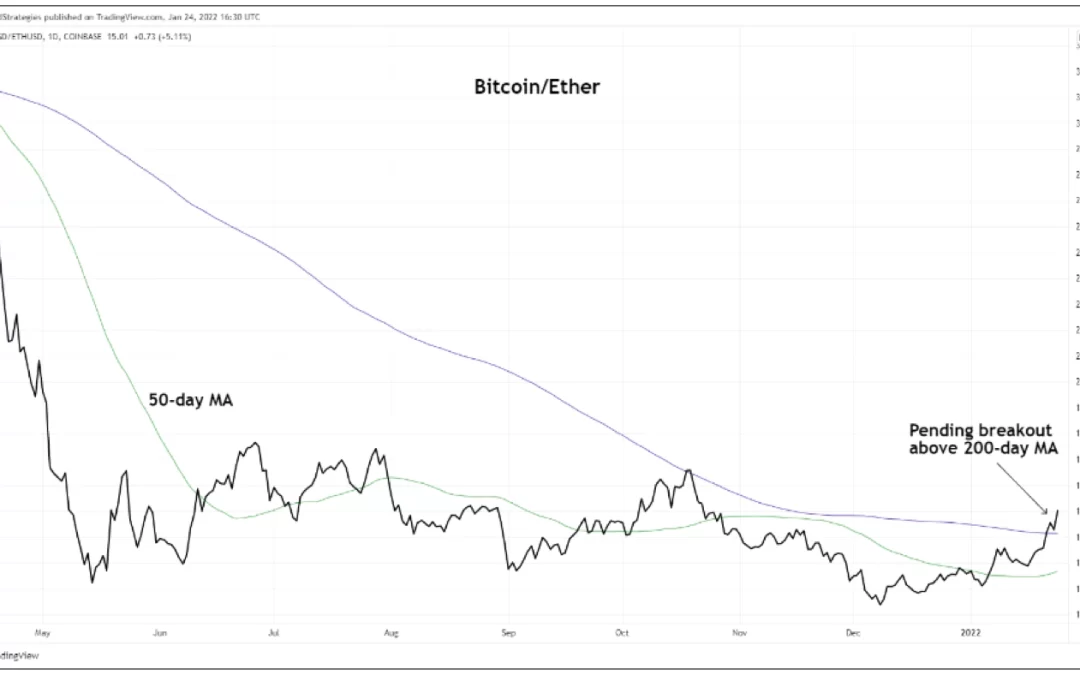

- The ratio climbed to 15 on Monday, hitting the highest since Oct. 25, a chart provided by TradingView shows.

- Bitcoin has consistently outshined ether over the past six weeks, evidenced by the ratio’s 32% increase since Dec. 8.

- While ether has declined 45% since then, amid heightened expectations of a U.S. Federal Reserve interest-rate increase, bitcoin, despite being considered an inflation hedge and more sensitive to changes in borrowing costs in the traditional economy, has seen a more measured drop of 29%.

- The price action counters the narrative that increased institutional participation in bitcoin has made it more vulnerable to macro factors.

- The bitcoin-ether ratio has entered the bullish territory above the 200-day moving average. Should the ratio succeed in establishing a foothold above the critical technical line, it would imply a continued bitcoin outperformance in the near term.

- “Bitcoin has cleared its 200-day MA versus Ether as risk-off conditions persist broadly,” Katie Stockton, founder and managing partner of Fairlead Strategies, said in a weekly research note shared with CoinDesk late Monday.

- “If the ratio confirms the breakout on Friday [UTC close], it would support long-term outperformance by bitcoin, likely associated with additional volatility in the cryptocurrency space,” Stockton added.