Bitcoin (BTC) briefly broke above $32,000 on May 31, but the excitement lasted less than four hours after the resistance level proved to be tougher than expected. The $32,300 level represented a 20% increase from the May 12 swing low at $27,000 and it provided the necessary hope for bulls to buy some $34,000 and higher call options.

The fleeting optimism reverted to a sellers’ market on June 1 after BTC dumped 7.6% in less than six hours and pinned the price below $30,000. The negative move coincided with the United States Federal Reserve starting the process of scaling down its $9 trillion balance sheet.

On June 2, former BitMEX exchange CEO Arthur Hayes argued that the Bitcoin bottom in May could have been a strong signal. Using on-chain data, Hayes predicts strong support at $25,000, given that $69,000 marked this cycle’s all-time high, a 64% drawdown.

Even though analysts might issue rosy price predictions, the threat of regulation continues to cap investor optimism and another blow came on June 2 when the U.S. Commodity Futures Trading Commission (CFTC) filed suit against Gemini Trust Co for alleged misleading statements in 2017 regarding the self-certification evaluation of a Bitcoin futures contract.

On June 7, a bill to ban digital assets as payment was introduced in the Russian parliament. The bill loosely defines digital financial assets as “electronic platforms,” which can be recognized as the subjects of the national payment system and obliged to submit to the central bank registry.

Bulls placed their bets at $32,000 and above

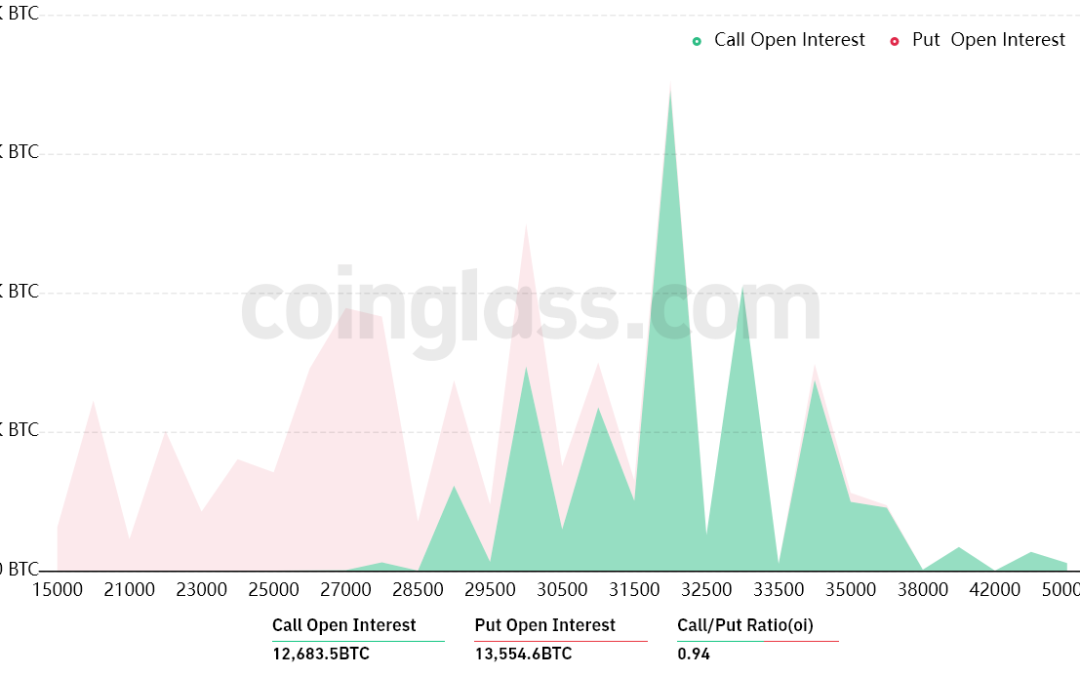

The open interest for the June 10 options expiry is $800 million but the actual figure will be much lower since bulls were overly-optimistic. These traders might have been fooled by the short-lived pump to $32,000 on May 31 because their bets for Friday’s options expiry extend up to $50,000.

The 0.94 call-to-put ratio shows the balance between the $390 million call (buy) open interest and the $410 million put (sell) options. Currently, Bitcoin stands near $30,000, meaning most bullish bets are likely to become worthless.

If Bitcoin’s price moves below $30,000 at 8:00 am UTC on June 10, only $20 million worth of these call (buy) options will be available. This difference happens because a right to buy Bitcoin at $30,000 is useless if BTC trades below that level on expiry.

Bears aim for sub-$29,000 to profit $205 million

Below are the four most likely scenarios based on the current price action. The number of options contracts available on June 10 for call (bull) and put (bear) instruments varies, depending on the expiry price. The imbalance favoring each side constitutes the theoretical profit:

- Between $28,000 and $29,000: 50 calls vs. 7,400 puts. The net result favors the put (bear) instruments by $205 million.

- Between $29,000 and $30,000: 700 calls vs. 5,500 puts. The net result favors bears by $140 million.

- Between $30,000 and $32,000: 3,700 calls vs. 3,400 puts. The net result is balanced between bulls and bears.

- Between $32,000 and $33,000: 7,700 calls vs. 750 puts. The net result favors the call (bull) instruments by $220 million.

This crude estimate considers the put options used in bearish bets and the call options exclusively in neutral-to-bullish trades. Even so, this oversimplification disregards more complex investment strategies.

For example, a trader could have sold a put option, effectively gaining positive exposure to Bitcoin above a specific price, but unfortunately, there’s no easy way to estimate this effect.

Related: ‘Can it get any easier?’ Bitcoin whales dictate when to buy and sell BTC

Bulls will try to pin BTC above $30,000

Bitcoin bulls need to push the price above $30,000 on June 10 to avoid a $140 million loss. On the other hand, the bears’ best case scenario requires a pressure below $29,000 to maximize their gains.

Bitcoin bulls just had $200 million leverage long positions liquidated on June 6, so they should have less margin required to drive the price higher. With this said, bears will undoubtedly try to suppress BTC below $30,000 ahead of the June 10 options expiry.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.