Cryptocurrency exchange Binance implemented its first-ever binance token (BNB) auto-burn program last quarter, removing over 1.6 million BNB tokens worth $750 million from circulation.

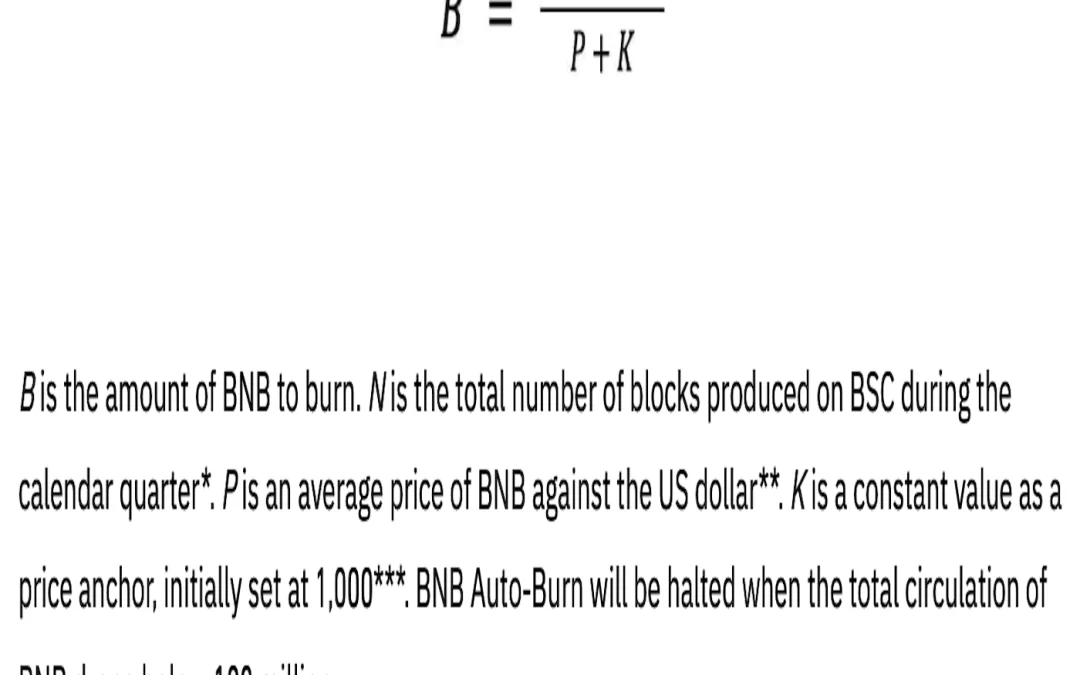

Under the new program, the number of tokens to be burned is arrived at using a formula based on the total number of blocks produced on the Binance Smart Chain, a programmable blockchain powering smart contracts and running parallel to Binance Chain, and BNB’s average dollar-denominated price during the quarter.

The move away from the previous token burn methodology, which was based on revenue generated from the Binance centralized exchange, is expected to make the process more objective and clear to the BNB community.

“The implementation of the BNB auto-burn is a natural next step in BNB’s journey and will help the BNB community grow through providing greater autonomy, transparency, and predictability,” Changpeng Zhao (CZ), co-founder and CEO of Binance, said in an official announcement published on Binance blog.

Binance is committed to destroying 100 million BNB tokens, amounting to 50% of the circulating supply, through quarterly burns. According to data source Coin Tools, the exchange has destroyed nearly 35 million tokens via quarterly burns to date, having begun the program in late 2017.

Token burns are supposedly deflationary and usually meant to bring a store of value appeal to the cryptocurrency. In traditional finance, deflation means a consistent price decline. In crypto, a deflationary token is the one whose circulating supply will decrease over time, thus making it inflation-resistant or store of value asset.

“BNB is deflationary,” Zhao tweeted early Tuesday along with the BNB burn news.

However, the 18th burn, the first-ever automated event, announced on Monday, has failed to put a bid under the cryptocurrency. At press time, BNB was trading flat on the day near $474, having dropped over 4% on Monday.