A group of U.S. regulators urged lawmakers to subject stablecoin issuers to the same strict federal oversight as banks, in a highly anticipated report released Monday.

Congress should also require custodial wallet providers to be regulated by a federal agency and limit stablecoin issuers’ interactions with non-financial companies such as tech or telecom providers, the President’s Working Group for Financial Markets said. The latter recommendation appeared to be aimed squarely at Diem, formerly Libra, the controversial stablecoin project created by Meta, the social media giant previously known as Facebook.

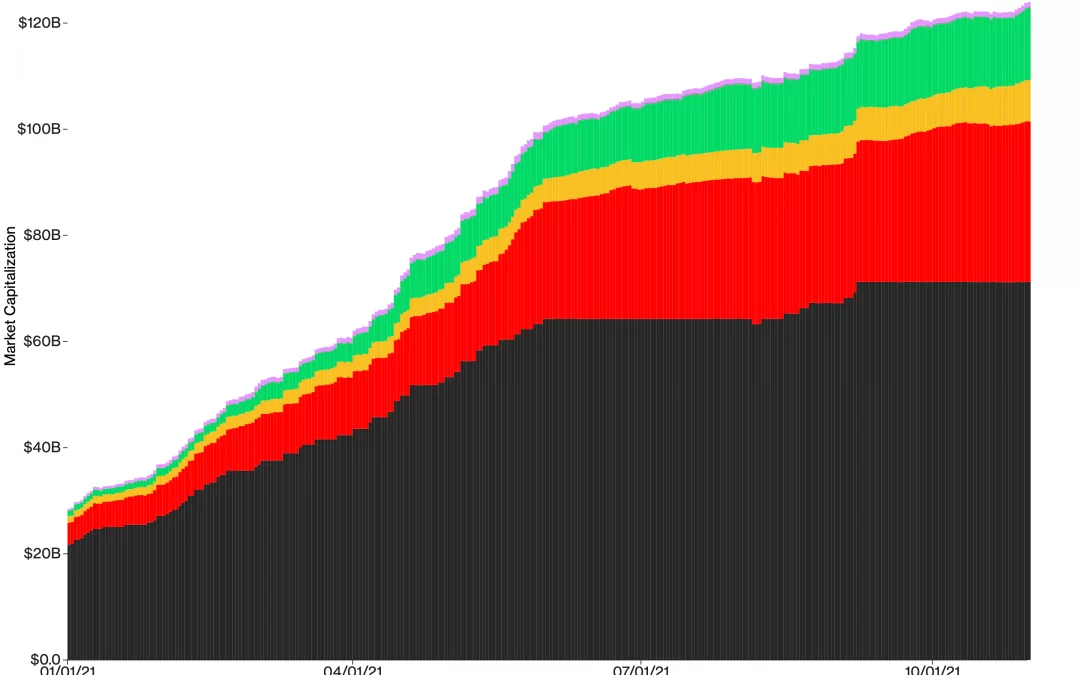

The report is part of an escalating effort by policymakers to rein in this $138 billion segment of the broader crypto market to mitigate the risks they believe stablecoins pose to consumers, markets and the financial system. Stablecoins, or cryptocurrencies pegged to the value of another asset such as the U.S. dollar, have seen explosive growth over the last two years despite lingering questions about their backing.

“Without the safeguards, I think the industry and regulators alike think we might miss out on some potential benefits of financial innovation,” Treasury Under Secretary for Domestic Finance Nellie Liang told CoinDesk. “So I think there’s a common appreciation of needing a framework that isn’t too onerous, provides protections and can keep the innovation moving forward.”

If Congress fails to pass such laws, the regulatory agencies have the authority to take their own measures. However, the group gave the impression it would prefer that it doesn’t happen.

“We believe legislation is important,” Liang said. “This is a new technology, a new innovation. It shouldn’t be surprising that the current regulatory framework isn’t set up to address some of the new kinds of risks that this could pose.”

Congress may be willing to get involved. Members of both the Democratic and Republican parties have been engaged in discussions around regulating cryptocurrencies at large and stablecoins in particular, Liang said.

The working group is nominally composed of Treasury Secretary Janet Yellen, Federal Reserve Chair Jerome Powell, Securities and Exchange Commission Chair Gary Gensler and Acting Commodity Futures Trading Commission Chair Rostin Behnam. Each of these individuals could designate a representative to participate in the group.

Other bank regulators, including the Office of the Comptroller of the Currency and the Federal Deposit Insurance Corporation, were also represented in the group.

A footnote to the report notes that stablecoins are used for trading, lending and borrowing, but the report added that these tokens may eventually become a means of payment for businesses and households.

Another footnote specified that the report is not addressing any potential stablecoin issues under federal securities or commodities laws, but the report itself did acknowledge the SEC and CFTC’s authority to oversee stablecoins that meet the provisions of these laws.

The legislation would apply to stablecoin issuers that are headquartered in the U.S., operate stablecoins that people in the U.S. can access or otherwise have a strong tie to the U.S.

Congressional entreaties

The group’s chief recommendation is that Congress draft and pass legislation that would ensure a federal regulator can oversee the stablecoin industry.

“To address the prudential risks of payment stablecoins, the President’s Working Group on Financial Markets … recommend[s] that Congress act promptly to enact legislation to ensure that payment stablecoins and payment stablecoin arrangements are subject to a federal prudential framework on a consistent and comprehensive basis,” the report said.

Treating stablecoin issuers like other federally regulated insured depository institutions would address risk concerns, the report said, going so far as to say that these types of institutions should be the only entities able to issue stablecoins.

“In particular, with respect to stablecoin issuers, legislation should provide for supervision on a consolidated basis; prudential standards; and, potentially, access to appropriate components of the federal safety net,” the report said. “The legislation would prohibit other entities from issuing payment stablecoins. Legislation should also ensure that supervisors have authority to implement standards to promote interoperability among stablecoins.”

The report notes that a single entity might not be responsible for all parts of a stablecoin’s operations. It broke the stablecoin process down to three components: the token’s issuance, how it’s exchanged and how it’s stored.

Legislation should address all three components and allow each part to continue to be conducted by a different entity, the report said.

To that end, the report also recommends that Congress specifically address custodial wallet providers, placing them under a federal regulator as well. At the moment this recommendation is limited to wallet providers that specifically offer stablecoin services, a senior administration official told CoinDesk. Custody of non-stablecoin digital assets and custodial wallets that don’t offer stablecoin services are not covered by this recommendation.

At the moment, Anchorage, Paxos and Protego are the only crypto companies overseen by a federal regulator. All three companies have conditional trust charters through the OCC. Exchanges and other stablecoin issuers are otherwise overseen at the state level in the U.S., with companies like Gemini issuing stablecoins under the supervision of the New York Department of Financial Services.

Tether (USDT) and USD coin (USDC), the top two stablecoins by market capitalization, are not issued by federally regulated companies, although Coinbase and Circle (the companies behind USDC) are regulated by the New York Department of Financial Services.

USDT, issued by a company incorporated in Hong Kong that has settled two different investigations by U.S. agencies, makes up half of the overall stablecoin market, with $71 billion of tokens in circulation at press time. USDC brings another $33 billion to the sector, according to CoinGecko.

In contrast, the Binance and Paxos dollars, both of which are issued by Paxos, account for about $14 billion, or around 1/10th of the overall stablecoin market.

Other stablecoin issuers remain largely outside the supervision of any U.S.-based regulators.

“Because payment stablecoins are an emerging and rapidly developing type of financial asset, legislation should provide regulators flexibility to respond to future developments and adequately address risks across a variety of organizational structures,” the report said.

Despite the central role stablecoins play in decentralized finance (DeFi) borrowing and lending, the report does not address these projects specifically. While DeFi is mentioned in the document, it is “not the subject of the recommendations in this report.”

Still, the report details how stablecoins fit into DeFi, including through automated market makers.

Carrot and stick

The stablecoin report goes to great pains to emphasize that Congress should enact legislation giving a federal regulator the authority to oversee stablecoins.

Should Congress not act, the Financial Stability Oversight Council (FSOC) could designate some stablecoin activities as being “systemically important payment, clearing and settlement activities” (PCS activities), which would give federal agencies the authority to draft their own regulations around stablecoins. The council, created in the wake of the 2008 global financial crisis, is made up of financial regulators from different agencies and chaired by the Treasury secretary.

“Financial institutions that engage in designated PCS activities also would be subject to an examination and enforcement framework. Any designation would follow a transparent process,” the report said.

Even before this happens, agencies like the SEC and CFTC as well as the Consumer Financial Protection Bureau (CFPB) could take advantage of a number of consumer finance or financial regulation laws to enforce risk protection rules against issuers.

The report also notes that stablecoin transactions could fall under the aegis of “money transmission services,” subjecting these entities to anti-money-laundering and Bank Secrecy Act regulations.

While the report seems to threaten that FSOC or other federal agencies can take independent action, the authors indicate that this is a contingency plan if Congress does not act on its own to enact legislation in line with its recommendations.

“The rapid growth of stablecoins increases the urgency of this work. Failure to act risks growth of payment stablecoins without adequate protection for users, the financial system, and the broader economy. In contrast, a regulatory framework that supports confidence in payment stablecoins, in normal times and in periods of stress, could increase the likelihood of stablecoins supporting beneficial payments options,” the report said.

Risks

The group’s recommendations are borne out of three main risks identified by the report, ranging from the personal to the systemic.

The report identified what it described as “key gaps” in how regulators could oversee stablecoins, particularly with regard to banking regulations.

“These prudential recommendations apply to ‘payment stablecoins,’ defined as those stablecoins that are designed to maintain a stable value relative to a fiat currency and, therefore, have the potential to be used as a widespread means of payment,” the report said. “These stablecoins are often, although not always, characterized by a promise or expectation that the stablecoin can be redeemed on a one-to-one basis for fiat currency.”

According to the document, stablecoins pose risks to users through the possibility that they may break their peg, which could lead to a run on the stablecoin, which could further harm any investors who expect the token to maintain price parity with the fiat currency to which it’s pegged. The document cited concerns such as the possibility that stablecoins are backed by commercial paper and other risky securities rather than cash.

“If stablecoin issuers do not honor a request to redeem a stablecoin, or if users lose confidence in a stablecoin issuer’s ability to honor such a request, runs on the arrangement could occur that may result in harm to users and the broader financial system,” the report said.

There are also payment system risks, including credit, liquidity, operational, governance and settlement risks. These issues could appear as financial shocks or reliability concerns for individuals using stablecoins as a means of payment.

Stablecoins could one day pose a systemic risk to the U.S. financial system as well, the report said.

“The failure or distress of that entity could adversely affect financial stability and the real economy,” the document said.

A stablecoin issuer and wallet provider working with a commercial entity could amass outsized economic power, a scenario the report likened to mixing of banking and commerce interests, which U.S. law has largely forbidden since the 1930s.

This type of union could let a party use information like credit ratings or other data to restrict how a customer could access goods and services.

“This combination could have detrimental effects on competition and lead to market concentration in sectors of the real economy,” the report said.

A long time coming

The working group announced in July it was examining stablecoins and their potential risks to the financial sector with an eye to mitigating any potential financial stability risks.

It’s not a new concern. The group met under former President Donald Trump at the end of 2020, announcing concerns about the scale of stablecoin payments and the potential risks they posed.

In preparing the report, members of the group spoke to representatives from stablecoin issuers including Tether, Paxos, Gemini, Coinbase, Circle and the Diem Association, the document said.

Digital asset custody providers like Anchorage and payment providers like Visa, Mastercard, Square and Stripe also provided input, as did trade associations, third-party experts, academics and banking organizations.

Some industry participants have had only a limited voice in this process, complained Sen. Pat Toomey (R-Pa.), who drafted an open letter to Treasury Secretary Yellen last month asking for greater consultation with the sector.

The administration official told CoinDesk that the group held a handful of roundtable discussions with industry participants and the other experts tapped.

Stablecoins have been on the regulatory radar for over two years now, but attention to this segment of the crypto industry has ramped up in recent months as regulators around the world began publishing their conclusions.

Last month, the Financial Stability Board, an international body, published a report finding that some nearly 50 different nations have “gaps” in their regulatory framework for stablecoins, which could allow entities to engage in “regulatory arbitrage,” referring to businesses that jump from a jurisdiction with a stringent regulatory framework to one with fewer rules.

Similarly, the Bank for International Settlements, a central bank for central banks, argued that countries should require stablecoin issuers to comply with existing international payment, clearing and settlement rules.

Reading the fine print

Monday’s report is specific to stablecoins and how they might fare if they are treated like banks. However, the footnotes hint that more may be to come from the Biden administration.

One such note said the administration will continue evaluating cryptocurrencies and distributed ledger technology at large, emphasizing how today’s document is restricted to stablecoins.

And while the report did mention DeFi and non-bank regulators, it hinted that there may be more specific proposals or suggestions around these aspects of the crypto market and regulation as well.

“While the scope of this report is limited to stablecoins, work on digital assets and other innovations related to cryptographic and distributed ledger technology is ongoing throughout the Administration,” the document said.