Ponzi lending smart bot scam Bitconnect finally did what most sane observers predicted long, long ago. It went splat. And it didn’t collapse due to government pressure, nor flurries of bad press, and certainly not from DDoS hacking attacks. The story is more of a ballad, a great object lesson, and it is the lie proving a greater truth: coin centralization and ”governance” end in fiery crashes and hellish burns.

Also read: Ditch University and High Transaction Fees!

Changes Coming for the Bitconnect System

“Ubitex, MyBitcoin, Bitcoin7, Bitscalper, Bitcoin Savings & Trust, Bitcoin Rain, Gbl Basic-Mining, Butterfly Labs, MintPal, Gemcoin, GAW Miners / Paycoin,” well known developer Jameson Lopp listed, including the latest, “Bitconnect. Scammers have wanted your BTC ever since it had an exchange rate. Learn from history. Don’t be greedy. Don’t be a victim,” he tweeted.

The third week of 2018 brought an announcement, Changes coming for the Bitconnect system – Halt of lending and exchange platform, posted by the anonymous outfit 15 January. “We are closing the lending operation immediately with the release of all outstanding loans,” they claimed.

“In short, we are closing lending service and exchange service while Bitconnect.co website will operate for wallet service, news and educational purposes.” Among the reasons for an abrupt change included “continuous bad press,” “two Cease and Desist letters,” and “DDoS attacks,” according to the scheme’s unnamed authors.

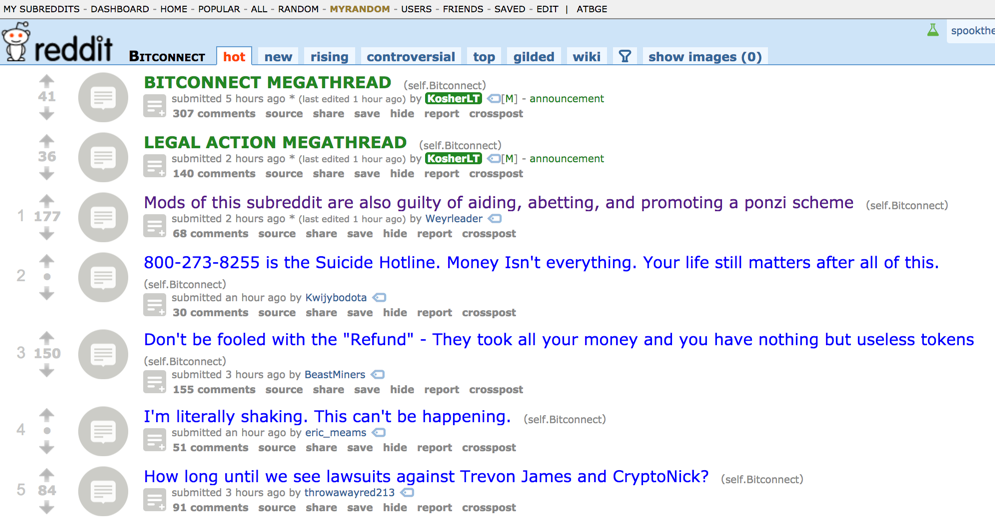

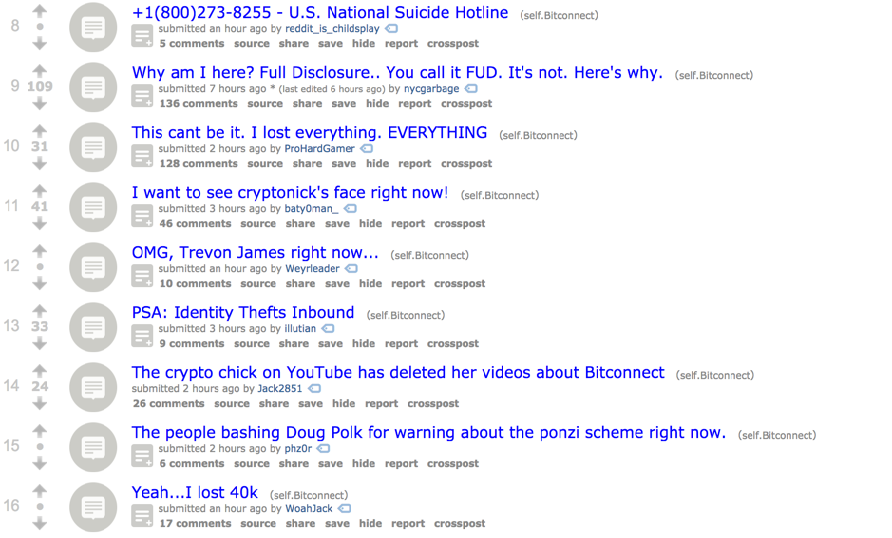

Former believers posting on the subreddit, /r/bitconnect, went apoplectic, as one might imagine (see insets). Their concern now is not with mechanics or figuring what might’ve gone wrong, but is instead purely practical: how to get out. Sober analysis is still important, and maybe it’s a perfect opportunity to pass along an ugly lesson to crytpo’s newcomers in hopes of helping them avoid future tragedy.

Centralization and Governance are Antithetical to Crypto

Putting aside outright scam (which Bitconnect is), a test going forward filtering all coins is their acceptance of centralization and, always with it, governance. To put the formula in basic terms: if there is a “someone” or a “headquarters” to sue, to shakedown, to roust and cajole, then that coin or team isn’t decentralized.

While projects such as IOTA, Ripple, Decred etc. are not scams in the Bitconnect sense, they’re currently embracing centralization and the cocaine of the industry at present, governance. Boards. These are all trappings leading to the rise of the bitcoin ethos in the first place. Crypto was created to fight them. A careful look at once-lauded concepts such as Tezos, and its foundation embroiled in lawsuit after lawsuit, should give pause to anyone long on cryptocurrency. Understanding just why cryptocurrencies matter and how they’re different can better inform new investors.

Bitconnect lost from the start in terms of its basic concept, built on the sturdy credulity of countries not yet familiar with Ponzi. In the west, as Andreas Antonopoulos explains, we’ve had at least a century to be fooled, to have felt the sting of our stupidity. The great thing about bitcoin and crypto is that it’s bringing-in emerging markets, people who’ve in many ways been left out of traditional capital arrangements – and it has done this precisely because it is decentralized and lacking formal governance. In countries with a history of command economics, the age-old lesson of Ponzi appears to be something they’re going to have to learn anew.

Bitconnect failed the Ponzi filter, but it also, and more importantly, failed the decentralization test: it could be given letters of cease and desist. It could be hectored. And because it was centralized, it lacked a robust segment of its team to shake it out of its scam properties. A perfect storm. This isn’t to exactly absolve Bitconnect’s religious believers. They’re guilty too, and as of this writing they’re busy trying to resurrect the dead, pumping their coin (which they insist doesn’t exist) back up even if ever so slightly. If only they knew about feathercoin, and a string of other failed altcoins that are dead, dying, or on life support. The patient cannot be saved.

What do you think about bitconnect going under? Let us know in the comments section below.

Images courtesy of Pixabay, Reddit.

Not up to date on the news? Listen to This Week in Bitcoin, a podcast updated each Friday.

The post Autopsy of the Bitconnect Implosion: Ponzi, Centralization, Governance appeared first on Bitcoin News.