There is an old saying on Wall Street: buy the rumor, sell the news. The adage is based on the belief that market participants, being forward-looking, tend to buy an asset when expecting positive information and take profit, driving the market lower on confirmation of the news.

Bitcoin has rallied over 40% this month on expectations that the U.S. Securities and Exchange Commission (SEC) would approve an exchange-traded fund investing in futures contracts tied to the cryptocurrency. With ProShares’ product set to go live on the New York Stock Exchange on Tuesday, there is a lot of noise in the market about the possibility of a sell-the-fact pullback in bitcoin. Analysts, however, stand divided on the issue.

“Will someone please remind [me] the day before the bitcoin ETF officially launches? I might want to take some chips off the table,” Dan Morehead, CEO & co-chief investment officer of Pantera Capital, wrote in his newsletter earlier this month. “On Wall Street, there’s a saying, “Buy the rumor, sell the fact. [ITs] Definitely working in our space.”

Bitcoin had surged by over 2,000% in about six weeks leading up to the launch of futures contracts on the Chicago Mercantile Exchange (CME) on Dec. 17, 2017. The cryptocurrency peaked near $20,000 on the same day and entered a year-long bear market.

Similar price action was seen earlier this year as bitcoin topped out at $64,801 with crypto exchange Coinbase’s debut on Nasdaq on April 14. The cryptocurrency fell to $30,000 the following month.

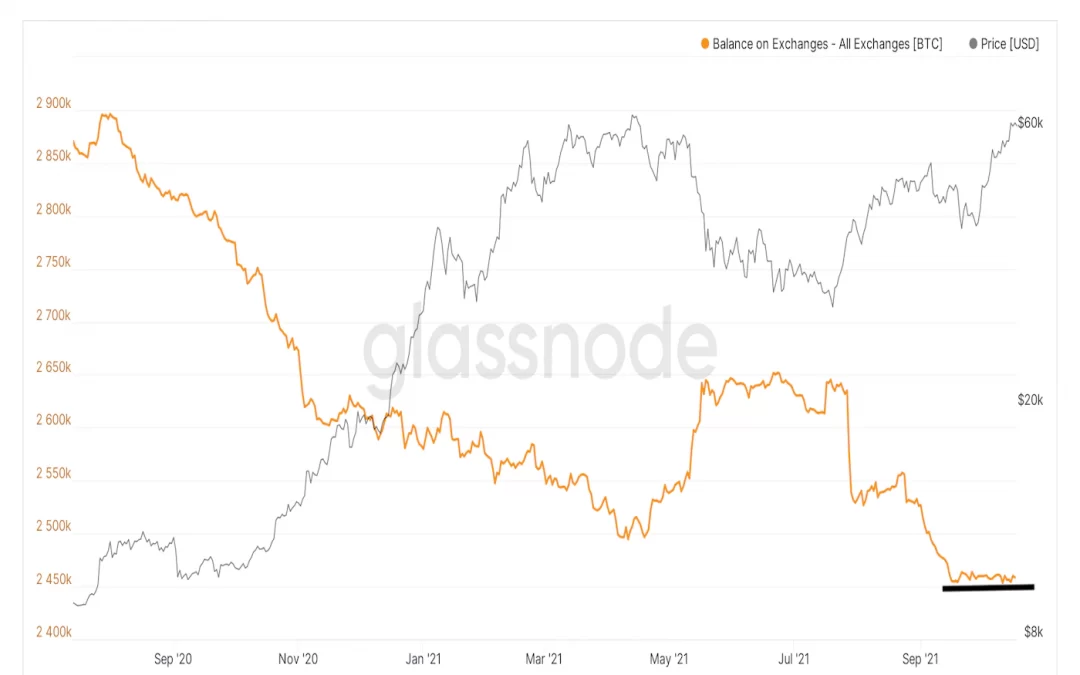

Blockchain data supports the case for a sell-the-fact action after ETF listing, as discussed in Monday’s First Mover newsletter. The exodus of coins from centralized cryptocurrency exchanges has stalled in recent weeks, contrary to the steady decline in exchange balances observed during the bull run from $10,000 to over $64,000.

“This goes in line with the expectation that once trading goes live for a Bitcoin ETF, we will likely see a sell-off event,” Nick Mancini, research analyst at Trade The Chain, said in a Twitter response. “The reason you keep crypto on exchanges is because you plan to make use of that liquidity. Keep a lookout for a major selling event this week.”

Some selling may be seen if the uptake for the newly launched product is weak.

“Disappointment from the BTC futures ETF listing could provoke a correction – after other seminal BTC market moments such as the listing of BTC futures on the CME in December 2017 and the listing of Coinbase on Nasdaq in April 2021, the market fell sharply,” said Noelle Acheson, head of market insights Genesis Global Trading, Inc. “However, even if there is some sell-off, it is unlikely to be as deep or lasting as the previous examples because of where we are in the market cycle. In both previous cases, the market was already frothy and showing signs of exhaustion – that is not the case this time around,” Acheson said.

Pankaj Balani, CEO of Delta Exchange and Patrick Heusser, head of trading at Swiss-based Crypto Finance AG, also ruled out a big pullback, saying the focus will be on the first-day trading volume of the ProShares futures ETF.

Meanwhile, Stack Funds’ COO and co-founder Matthew Dibb doesn’t foresee a significant price drop. “BTC funding rates are mostly flat, indicating little leverage in the market. The structure of Bitcoin futures is indicating a substantial premium for long-dated ownership as Sep 22 is trading at $68880,” Dibb told CoinDesk in WhatsApp chat. “We see no warning signs that the market is overheated in the short term.”

Calculated every eight hours, the funding rate refers to the cost of holding long positions in the perpetual futures [futures without expiry] market. A very high funding rate is widely taken to represent excess bullish positioning and often precedes price pullbacks.

Data from Glassnode shows, the average funding rate has receded to 0.01% from 0.024% seen over the weekend.

The options market is showing no signs of nervousness with one-week, one-, three- and six-month put-call skews signaling a call or bullish bias with negative values.

Put-call skews measure the cost of puts or bearish bets relative to calls or bullish bets. A negative value implies calls are drawing greater demand than puts.

“The favoured options contracts appear to be call options with strike prices above $100,000, with a typical open interest of $250 million to $350 million for call options expiring at the end of the year. The open interest in call options dwarfs that in put options, aligning with the overall bullish market sentiment,” Glassnode said in its weekly report published Monday.