The African continent continues to be a fertile ground for the growth and implementation of blockchain technology.

According to the 2022 “African Blockchain Report” by CV VC, blockchain deals in Africa raised a total of $474 million in 2022, representing a 429% increase from the $90 million raised in 2021. This growth in funding far surpassed the global average, which only saw a 4% increase in blockchain funding.

According to the report, African blockchain funding demonstrated a growth rate that was over 12.5x higher than that of general African venture funding on a year-on-year basis. Overall African venture funding saw just a 34% increase, with $3.14 billion raised across 570 deals.

Africa experienced the highest growth rate in funding globally, while the United States remained steady at $15.2 billion in funding and Asia and Europe saw YoY increases of 50% and 35% with $4.74 billion and $4.88 billion in funding, respectively.

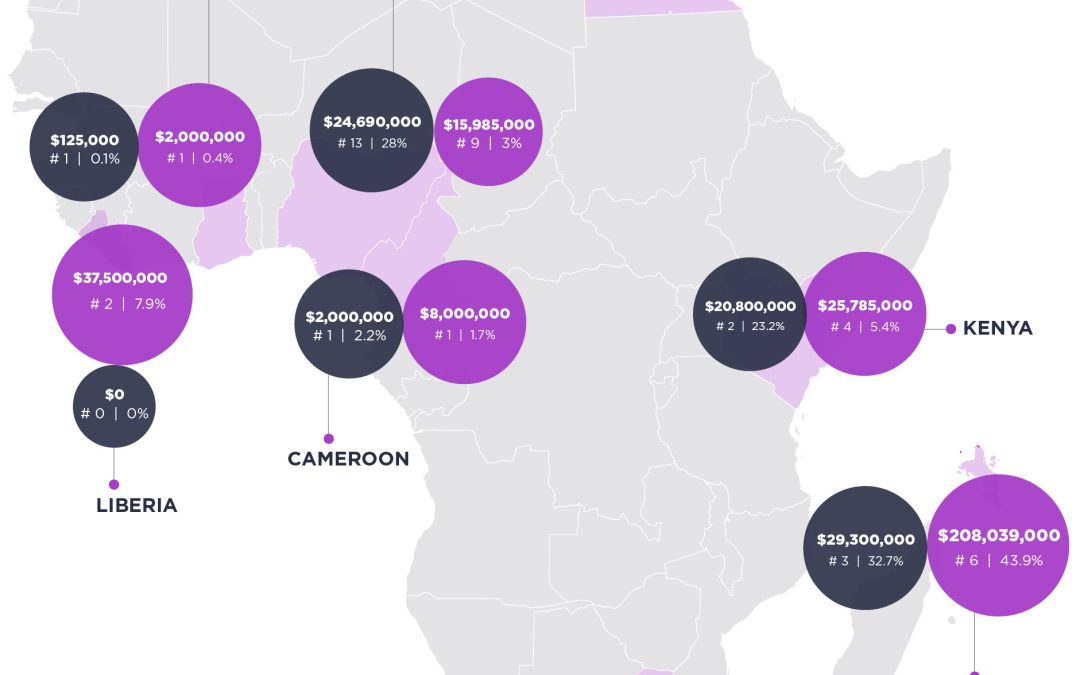

Last year, Seychelles and South Africa were responsible for 81% of the blockchain venture funding in Africa, having raised $208 million and $177 million, respectively. Moreover, the total number of African blockchain deals increased by 12% YoY, from 26 to 29.

African blockchain venture funding made up 1.77% of global blockchain venture funding, which saw an impressive 407% YoY increase, with several countries contributing to the surge. By comparison, the U.S. concluded 137 deals while Asia and Europe had 84 and 78, respectively.

Related: Web3 economy to gain more traction in Africa through DeFi-based financial inclusion

Nigeria was the frontrunner when it comes to the number of blockchain startups receiving funding, followed by South Africa, Seychelles and Kenya. However, despite Nigeria having the highest number of deals on the continent in 2022, it only accounted for 3.4% of all African blockchain venture funding, with an average deal size of $1.25 million.

Taking into account the substantial increase in blockchain funding in Africa and the fact that there was a relatively small increase in the number of blockchain deals shows that the median deal size has significantly risen. This suggests that businesses are securing more substantial funding and investors are becoming more confident in African blockchain ventures.

Magazine: Bitcoin in Senegal: Why is this African country using BTC?