Art trumps money. Always. It is important to remember this amid the current crypto art hype. Nonfungible tokens have given digital art the benefit of provable ownership, scarcity and programmability, allowing digital creators to promote and sell their work in ways never before possible.

With the blockchain industry growing and markets becoming more liquid, crypto art has seen a flurry of incredible primary market sales. The ICO-like fear of missing out has inspired collectors and artists to chase scarcity, and even destroy art in the process, as was the case with the creation and auction of the Banksy print NFT.

Still, what may seem like a marketing ploy may be one of the greatest actionist performances the art world has seen to date.

Chasing scarcity

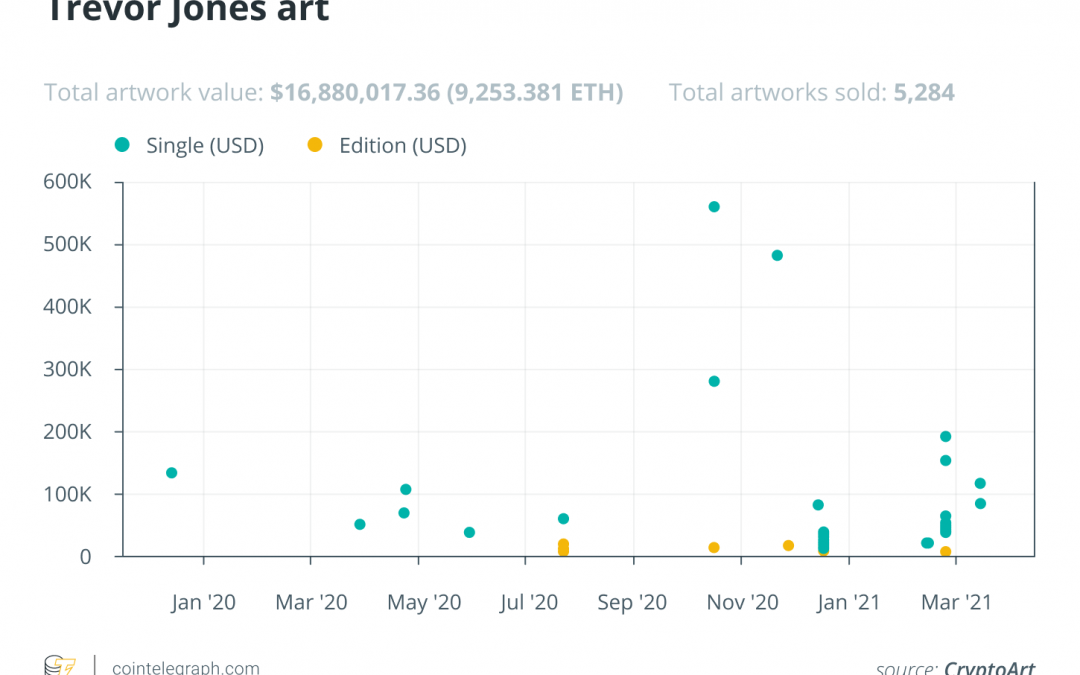

The rarer something is, the more it is coveted. That seems to be the basic principle of any collectible items and applies to crypto art as well. A quick look at single vs. multiple-edition sales shows that the market favors uniqueness.

This chase for scarcity has taken on many forms, from limiting the number of editions of a particular art piece to finding “firsts” in a sea of things — as was the case with Jack Dorsey’s tweet.

Major stars from the art world and music industry have started to experiment with NFTs, making six-figure drops a seemingly commonplace occurrence. From Paris Hilton’s $17,000 picture of a cat to Grime’s $389,000 Death of the Old to Beeple’s landmark Christie’s auction, sales and awareness are on the rise.

The allure of mega sales

Despite the incredible primary market sales, the secondary market, for the most part, has been relatively quiet. Looking at data from SuperRare, we can see that secondary market sales counts are a fraction of the number of primary items sold.

The fact that artists’ royalties are dealt with differently on different platforms and rarely function cross-platform further forces both creators and collectors to focus on initial sales for near-term success.

Bridging the gap

The blockchain industry has seen and continues to see many attempts to bridge the physical and digital worlds. With respect to art, the initial attempts were focused on tokenization of physical art and pieces by famous painters, with price tags that made them highly illiquid. The hope was that fractionalizing the expensive pieces through tokenization would lead to greater engagement from people who were previously priced out of the high-end art market. This would make the paintings more liquid investment vehicles.

To this point, the attempts have had very limited success. This may be due in part to the mismatch in audiences: Traditional collectors don’t operate crypto wallets, and digital natives feel less attached to physical items held by a centralized party.

However, what if someone could take a physical art piece and make it digital? The Injective Protocol team has tried to do just that. It acquired a Banksy screenprint “Morons (White),” only to burn the physical artwork (while streaming the event) and minting the image as an NFT.

The seemingly barbaric ritual was supposed to ascend the Banksy screen print to a blockchain and earn the team a tidy sum in the process. The second goal was clearly achieved. The original piece was acquired for $95,000 and auctioned off on OpenSea for around $400,000. However, it can be argued that what happened was a transfer from the physical to the digital world.

Rather, the Injective Protocol team destroyed a Banksy screenprint and created an entirely different work of art.

Vandals or actionists?

It is easy to write off the burning of the Banksy NFT as a successful marketing ploy, but on closer inspection, there is so much more there.

On the surface, there is a tip of the hat to the original artist, who himself has destroyed his own piece at an auction for the sake of creating new art. However, that is just the beginning.

Consider that art has a rich tradition of actionist events where an art installation was damaged for the sake of a statement, effectively creating a new piece of art. The most comparable example is probably that of Alexander Brener, who painted a green dollar sign on Kazimir Malevich’s white cross at a museum exhibition.

Brener was making a statement against “corruption and commercialism in the art world.” Now look closer at the Banksy screenprint and read what it says: “I can’t believe you morons actually buy this shit.” That cannot be an accident.

At a time when a Beeple work sold for $6.6 million, while a Vincent van Gogh (albeit a disputed van Gogh) went for $650,000, the Injective Protocol team made a statement by burning this particular Banksy piece and selling the NFT, which no longer represents a physical artwork but the memory of that artwork, at an auction.

To top it all off, the team streamed the burning of the piece… in true performance art fashion.

Did the market miss the point?

While the market has been debating whether the merits of the destruction of art, the nature of scarcity and the price mechanics of crypto art, the Injective Protocol team may have pulled off one of the most spectacular actionist art statements in history.

This was a performance art piece, a vandalistic ritual and an ironic auction all in one.

The market may be chasing scarcity for the sake of scarcity, without even pausing to consider what just happened. It may even be that the Injective Protocol team did not intend for all of the hidden meanings to be there. However, that is the power of art.

Years from now, after the FOMOs and FUDs settle their scores, we will be looking at this not as another six-figure NFT auction, but as perhaps the first instance of actionist art in the crypto space.

The views, thoughts and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.