Uncle Sam dominates the Bitcoin (BTC) trading arena according to a report published by Arcane Research. Bitcoins’ 90-day correlation to the S&P 500 is currently at its highest since October 2020 while the United States trading hours show the most Bitcoin activity.

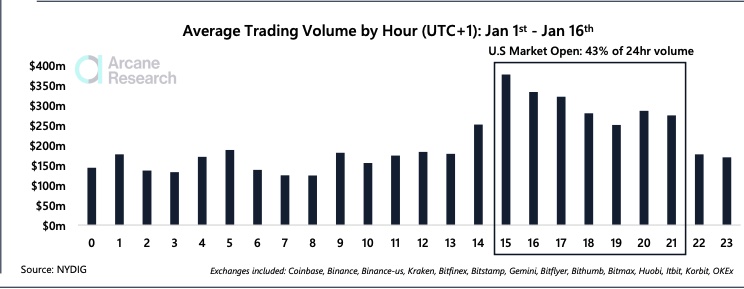

For 2022, the U.S. trading hours show a marked increase in trading volume, making up 43% of the 24-hour volume on average.

Trading volumes have trended up during US market hours since late 2021. The 43% figure is up from 36% from the period from Nov, 1, 2021 to Jan. 16, 2022.

In the graph, the U.S. market open is from 3 p.m. to 9 p.m. UTC+1:

Arcane Research summed up the trend neatly:

Trading activity tends to immediately pick up as the U.S. stock market opens, with Bitcoin performance being tightly correlated to that of the S&P 500.

Interestingly, American traders also kick off the week with gusto. Up to 50% of Bitcoin trading volume occurred on the last three Mondays and Tuesdays of the year, before trending down to the 40% range.

The 40% is still substantial given that the U.S. market hours of 9:30 a.m. to 4 p.m. Eastern Time account for less than 30% of a 24-hour day.

Related: Bitcoin will emerge stronger after stocks dip ’10-20%’ — Bloomberg analyst

The findings illustrate that American traders — or traders wishing to trade during American market hours — take the lion’s share of Bitcoin trading activity, and they do it early on in the week. However, it also shows the considerable impact of the U.S. stock market on the performance of Bitcoin lately.

Given that the “Bitcoin 90-day correlation to the S&P 500 is currently at its highest since October 2020,” and volatility is low, calls for fireworks in the market abound.

As analysts warn that Bitcoin could dip to $38,000 “before an eventual breakout,” in light of the data, the move could happen during U.S. trading hours.