A number of large companies have been adding significant amounts of bitcoin to their balance sheets, signaling corporate America’s growing confidence in BTC and other digital assets as a potential hedge against the possibility of rising inflation.

At the same time, some of the more forward-looking organizations also see digital adoption as a way of gaining a competitive advantage, whether it’s through utilizing crypto to make secure international transactions or integrating it into their business operations.

El Salvador aside, we might not yet be at the point where the average person routinely buys their morning dose of caffeine with BTC. But as the adoption of digital assets continues at an accelerated pace – and as the infrastructure supporting institutions that are investing in crypto becomes more sophisticated – it looks like a future that might be closer than most think.

In fact, digital asset adoption is happening across the globe: In Australia, a partnership between Coca-Cola and New Zealand-based payments service Centrapay has led to the soft drink giant’s vending machines being able to accept payments in BTC. Samsung is currently working with the central bank of South Korea to develop the transaction infrastructure for the bank’s digital currency, with plans afoot to allow offline transactions to be made using the currency via Galaxy smartphones. Perhaps most intriguingly of all, Mattel has created a series of NFT artworks based on its wildly popular Hot Wheels series.

Traditional Merchant Services vs. Cryptocurrency Payment Services

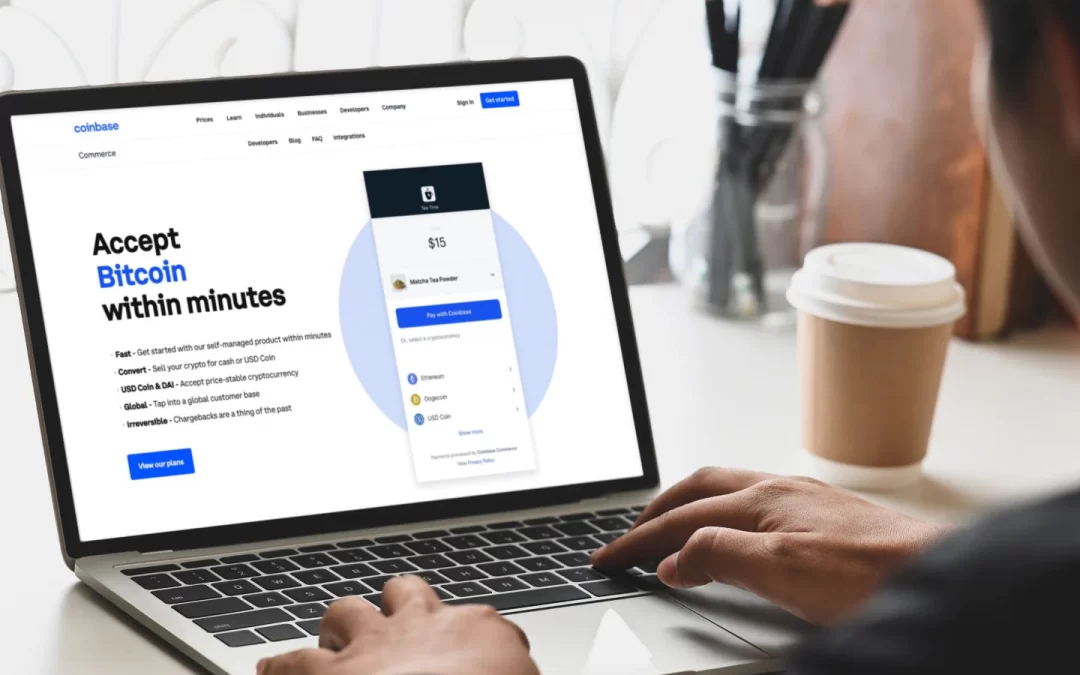

It’s not difficult to see why digital adoption within the commerce space is gathering brisk momentum. With its emphasis on ease of use, the robust infrastructure available to merchants has made digital assets much more accessible as a payment option.

Of course, when comparing digital asset commerce side by side with traditional merchant services, there are few differences worth highlighting.

Cryptocurrency Payment Processing:

● In traditional fiat-based commerce, transactions are a “pull,” with the merchant taking payment from the customer. The client provides credit card information to the merchant, which then uses credit card processing to take payment.

● In digital asset commerce, transactions operate as a “push” from the customer to the merchant. The Coinbase Commerce API creates a unique charge to identify the transaction and wait on payment. The customer then performs the transaction on the blockchain, where it is detected by Coinbase in the merchant address. Coinbase’s turnkey API gives merchants the opportunity to manage their own accounts without the hassle of managing blockchain transactions directly, while also taking advantage of Coinbase’s scale, regulatory expertise, rigorous security infrastructure that helps protect against lost or stolen funds and compliance with AML/KYC regulations. Additionally, the Coinbase Commerce platform is not just limited to API, but also comes with a number of hosted products that make it easy for merchants to accept crypto payments without the technical complexity they might encounter with API-only products.

Verification and Settlement:

● In traditional merchant financial services, payments between merchants and customers are verified and settled using a third-party intermediary, which is typically a credit card company.

● Digital asset payments operate in a similar way to cash payments. Transactions are verified and settled once the full payment is received. This takes time on a blockchain, and so transactions start off as pending until the digital assets are deposited into the merchant address. If the payment is not received, the transaction is cancelled. There are other notable types of transaction statuses unique to cryptocurrency payments due to the peer-to-peer nature of blockchain-based transactions.

Where is Institutional Adoption in Commerce Happening?

What’s most interesting is that digital adoption is occurring across many segments of commerce at a steady, accelerated pace. For example, Sotheby’s, a global art house that has been in business since the mid-18th century, partnered with Coinbase earlier this year to allow digital asset payments to be accepted for the auction of famous street artist Banksy’s piece Love Is in the Air. Two other major auction houses, Phillips and Heather James Fine Art, have also partnered with Coinbase.

But paying with digital assets is not the preserve of auction houses that deal in the avant-garde. For every headline-grabbing use case, there have been several low-key but incrementally important adoptions of digital assets in traditional commerce scenarios. This can especially be seen in the global e-commerce business, where digital assets seem poised for continued growth as an accessible payment form for both Main Street businesses and the average entrepreneur.

For evidence of this, look no further than the relationship between Coinbase Commerce and Shopify. Through Coinbase’s payments integration on Shopify, e-commerce entrepreneurs who use Shopify can access Coinbase Commerce’s APIs to accept digital assets like bitcoin, ethereum and other crypto assets held in the Coinbase wallet for payments.

What’s just as remarkable is how smoothly digital assets can be integrated as a payment method. Merchants on Shopify can adopt the Coinbase Commerce integration with no developer expertise required to get started.

Coinbase Commerce has similar integrations with twelve other e-commerce platforms and tools, including WordPress’s WooCommerce plugin. With Coinbase’s multi-currency solutions, flexible invoicing, customized payment buttons, turnkey API and transaction reporting tools, merchants can easily begin accepting crypto payments.

If we look at the wide variety of merchants that are adopting digital asset commerce solutions, it’s clear that the appetite for digital assets transactions is growing in the market. Over 8,000 merchants have already signed up and are using Coinbase Commerce. With access to advanced crypto transaction capabilities and a partner with robust operational experience, companies can continue to build a competitive edge by meeting the growing customer demand to buy and sell in bitcoin and other cryptocurrencies.