Bitcoin has been trading in a narrow 3.4% range for the past three days after successfully defending the $25,500 support on June 10. In this time, investors’ attention has shifted to the macroeconomic area as the United States Federal Reserve will announce its interest rate decision on June 14.

Cryptocurrencies might work independently from the traditional finance markets, but the cost of capital impacts almost every investor. Back in May, the Fed raised its benchmark interest rate to 5–5.25%, the highest since 2007.

All eyes will be on Fed Chair Jerome Powell’s media speech 30 minutes after the rate announcement as markets are pricing in 94% odds of a pause at the June meeting, based on the CME FedWatch tool.

Crypto fears more than just an FOMC meeting

The upcoming Federal Open Market Committee meeting isn’t the only concern for the economy, as the U.S. Treasury is set to issue more than $850 billion in new bills between now and September.

Additional government debt issuance tends to cause higher yields and, thus, higher borrowing costs for companies and families. Considering the already-restrained credit market due to the recent banking crisis, odds are that gross domestic product growth will be severely compromised in the coming months.

According to on-chain analytics firm Glassnode, miners have been selling Bitcoin (BTC) since the start of June, potentially adding further pressure to the price. Among the potential triggers are reduced earnings from a cooldown in Ordinals activity and the mining hash rate reaching an all-time high.

Investors now question whether Bitcoin will test the $25,000 resistance, a level unseen since mid-March, and for this reason, they are closely monitoring Bitcoin futures contract premiums and the costs of hedging using BTC options.

Bitcoin derivatives show modest improvement

Bitcoin quarterly futures are popular among whales and arbitrage desks. However, these fixed-month contracts typically trade at a slight premium to spot markets, indicating that sellers are asking for more money to delay settlement.

As a result, BTC futures contracts in healthy markets should trade at a 5 to 10% annualized premium — a situation known as contango, which is not unique to crypto markets.

The demand for leveraged BTC longs has slightly increased, as the futures contract premium increased to 3% from 1.7% on June 10, although it is still far from the neutral 5% threshold.

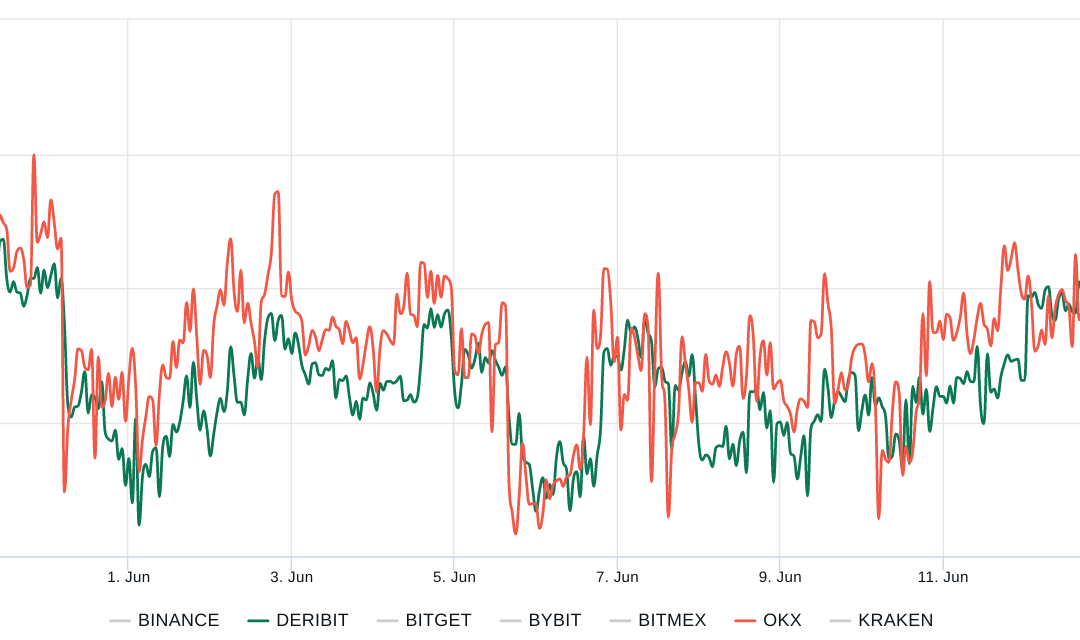

Traders should also analyze options markets to understand whether the recent correction has caused investors to become more optimistic. The 25% delta skew is a telling sign of when arbitrage desks and market makers overcharge for upside or downside protection.

In short, if traders anticipate a Bitcoin price drop, the skew metric will rise above 7%, and phases of excitement tend to have a negative 7% skew.

Related: Crypto fund outflows reach $417M over 8 weeks as investor caution persists

The 25% delta skew metric entered “fear” mode on June 10 as Bitcoin’s price faced a 4.5% correction. Currently at 4%, the indicator displays balanced pricing between protective puts and neutral-to-bullish call options.

The crypto bear trend looks set to continue

Normally, a 3% futures basis and a 6% delta skew would be considered bearish indicators, but that is not the case given the extreme amount of uncertainty regarding the economic conditions and the recent charges against Binance and Coinbase. The Securities and Exchange Commission (SEC) alleges those exchanges held unregistered offerings and sales of tokens and failed to register as brokers.

U.S. lawmakers have criticized the SEC for its heavy-handed approach to crypto enforcement. On June 12, Rep. Warren Davidson proposed a bill aimed at restructuring the SEC by firing Chair Gary Gensler and redistributing power between the commissioners.

The uncertain crypto regulatory environment remains a hurdle to attracting institutional investors. Furthermore, the recession risk for the U.S. economy limits the demand for risk-on assets such as Bitcoin, increasing the odds of the $25,000 support being tested.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.