The U.S. government may expand its efforts to study and regulate the roughly $2 trillion digital asset sector.

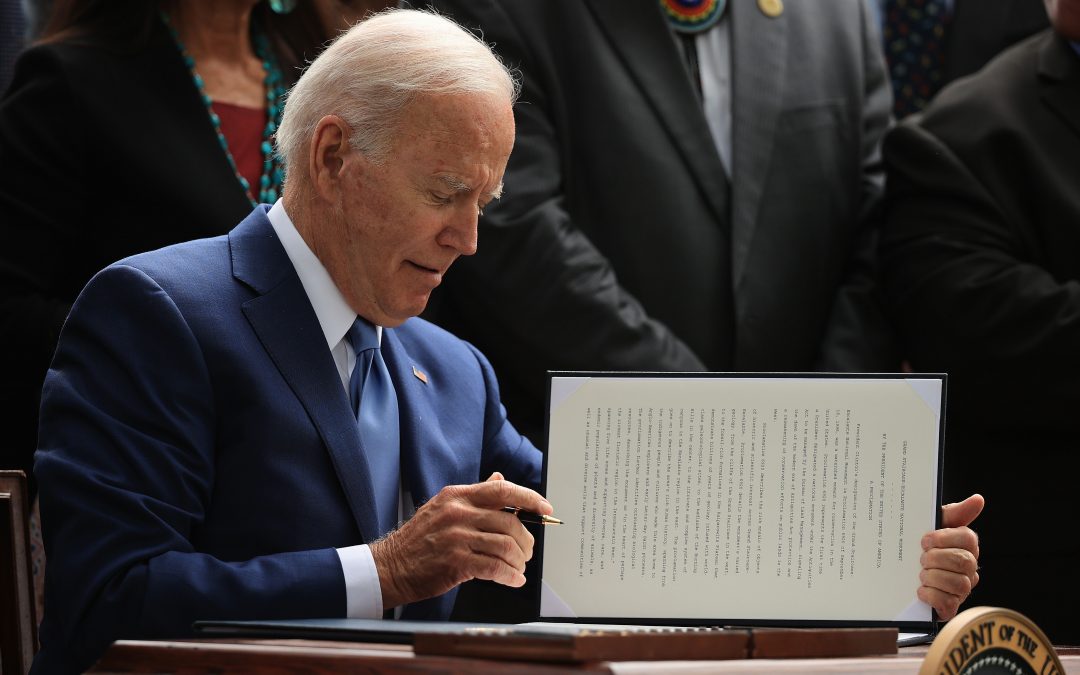

The Biden administration is considering an executive order for federal agencies, which would require them to study the crypto industry and provide recommendations on their oversight, Bloomberg reported Friday, citing unnamed sources.

According to the report, the order would include the Treasury Department, Commerce Department, National Science Foundation and national security agencies. In addition to asking agencies to study different aspects of the industry, the order “would clarify the responsibilities” different agencies have around crypto and blockchain.

Requests for comment sent to the White House, Treasury Department, CFTC and SEC were not immediately returned.

Federal agencies have already been studying or providing regulatory guidance around the digital asset sector for years. The Office of the Comptroller of the Currency (OCC), Securities and Exchange Commission (SEC) and Commodity Futures Trading Commission (CFTC) have issued guidance letters, informal statements and public rulemaking efforts to direct how different aspects of the crypto industry should comply with federal law.

The OCC, FDIC and Federal Reserve – three federal bank regulators – formed a “sprint team” to coordinate their work around crypto earlier this year.

According to Bloomberg’s report, one of the executive order’s provisions would coordinate this effort.

The Biden administration has ramped up the U.S. government’s work around crypto in recent months. In September, the Treasury Department’s Office of Foreign Asset Control sanctioned a crypto exchange in a first as part of its response to a spate of ransomware attacks.

The President’s Working Group on Financial Markets is also set to consider a report that would recommend Congress enact legislation to create a special purpose charter for stablecoin issuers, treating these entities akin to banks.

The Federal Reserve, the U.S.’s central bank, is also set to issue reports on stablecoins – digital asset tokens whose values are pegged to another asset, such as U.S. dollars – and central bank digital currencies.