The New York Times: “Reality Intrudes on a Utopian Crypto Vision.” Bloomberg: “The Next Crypto Bust May Be Spelled D-A-O.” The Guardian: “Are blockchain-based DAOs really a utopian revolution in the making?”

Seemingly every week, another old-guard media outlet echoes the talking points of defenders of the status quo financial system who fear and distrust the economic opportunities that will be unlocked through the power of decentralized autonomous organizations (DAOs). While publications are right to recognize the unsurprising early growing pains of DAOs, this sort of hand-wringing misses the forest for the trees when it comes to the impact of DAOs.

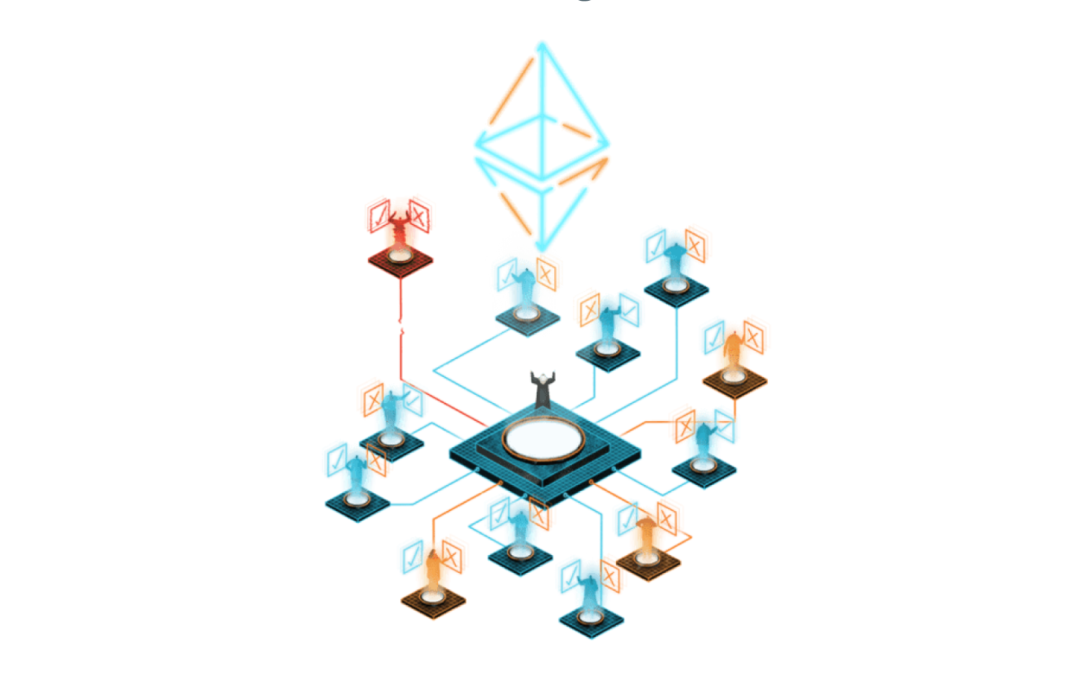

Rather than simply being a “utopian” experiment, DAOs are a crucial tool in the development of a new decentralized financial (DeFi) system that has the potential to reach the 1.7 billion people globally who currently have no access to the traditional financial system. DeFi promises to provide individuals everywhere with access to a reliable and transparent financial system with clear rules of the road.

The potential of DAOs

Further, while we’ve only scratched the surface of the potential DAOs have to create a radically more transparent and equitable financial system, we’ve already seen projects emerge that are delivering real value to real people in the real world today.

One example is the war in Ukraine, where UkraineDAO, set up by Russian art collective Pussy Riot and Trippy Labs, raised over $6.75 million worth of Ether (ETH) donated directly to Ukrainian defense efforts against Russia. While this amount may not shift the balance of the war, the rapid creation and scaling-up of UkraineDAO demonstrate the power of decentralized financial technologies to coordinate a disparate global group of individuals around a single cause to deliver tangible results.

Related: Every Bitcoin helps: Crypto-fueled relief aid for Ukraine

But, the value of DAOs goes beyond just raising funds for noble causes under duress. In fact, many DAOs are already providing sustainable value to participants across the world and even harnessing blockchain technology to take on some of the most pressing challenges of our time such as climate change.

DAOs are being used today to support charitable endeavors, remove barriers to crowd-source fundraising, give donors more control over the spending of funds, enable low-cost borrowing and support artists and musicians. All of this is designed to be governed by transparent smart contracts that give users control of the organization’s direction and governance.

Other DAOs are leveraging new technologies to confront man-made climate change directly. KlimaDAO, a subDAO of Olympus DAO, which I contribute to, has come up with an innovative mechanism to pull carbon credits out of the Voluntary Carbon Market and into the DAO’s Treasury, effectively driving up the cost of carbon offsets and making it more expensive to build carbon-intensive businesses.

Related: The pandemic year ends with a tokenized carbon cap-and-trade solution

Already, KlimaDAO has locked up over 17 million tons of tokenized carbon credits, surpassing the annual CO2 emissions of Croatia. This sort of project is actualizing the promise of DeFi technology and pioneering a new way to do climate activism that bakes environmental concerns into the very fabric of economic activity.

As with any revolutionary new technology, DAOs provide boundless opportunities for innovators to solve problems in new ways but have also drawn the attention of scammers looking for a quick buck. Scams like rug pulls, where a developer absconds with funds invested into a project, are real problems in the DeFi ecosystem that need to be addressed. We are committed to strengthening the regulatory requirements that ensure DAOs are safe and secure to protect consumers.

Related: How to spot a rug pull in DeFi: 6 tips from Cointelegraph

But, we can’t let a few bad actors distract from the truth that DAOs and the entire DeFi ecosystem are driving a much-needed disruption of the traditional financial systems that have been predatory and exclusionary for our most vulnerable populations and harmful to our planet. It’s time for establishment media to look under the hood at DAOs and emerge with a more true and nuanced picture, reflecting what those of us involved in DeFi know: that the efforts we’re leading today will pay dividends for generations to come.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

The views, thoughts and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.