The question of how to scale Bitcoin is not a new one. But as transaction volumes are expected to increase in the years ahead, questions about the cryptocurrency’s future composition must, in the eyes of those who favor change, be answered sooner rather than later: Whom does it serve? How should it look? What makes it unique?

What are blocks?

Blocks are batches of transactions that are confirmed and subsequently recorded on bitcoin’s public ledger, the blockchain.

During the digital currency’s early days, these blocks could carry up to 36MB of transaction data apiece. However, in 2010, Bitcoin’s creator Satoshi Nakamoto decided to reduce them to 1MB to reduce the threat of spam and potential denial-of-service attacks on the network.

This limit remains in place today. But as transactions increase, Bitcoin’s blocks are filling up fast – edging further towards this 1MB limit. Miners have a financial incentive to fill blocks regardless of how many transactions occur. With more network users come more transactions, introducing more pressure to increase the block size. So far, there is no indication the developers will increase the block size directly, though.

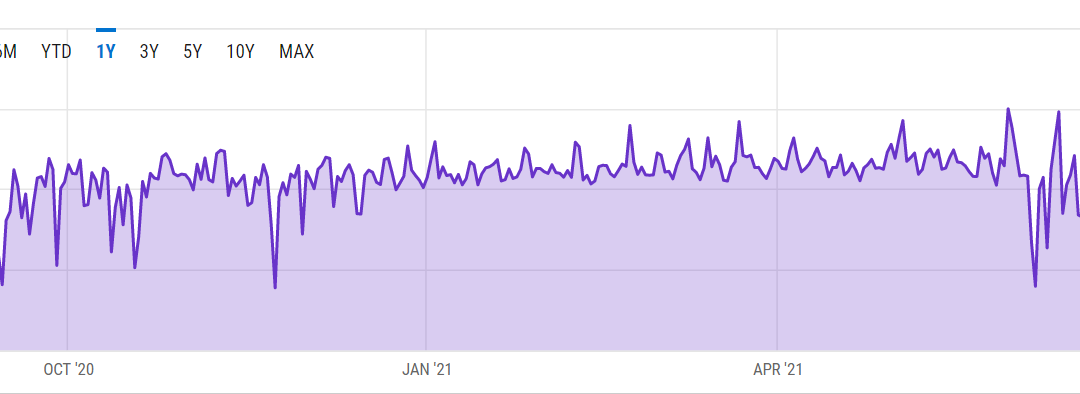

Data released by Ycharts confirms the average block size is now 0.7928MB. That may seem high, yet it is a 39.71% decrease compared to a year ago.

The implementation of Segregated Witness (SegWit) – an upgrade that removes signature data from the main block and stores it off-chain – brought about two major changes on the Bitcoin network:

- Signature data, which normally accounts for 65% of the data stored in a block, is removed from the main “base” block and stored in a separate block. This allows for more transactions to fit in each base block.

- SegWit also introduced “block weight,” which technically increases Bitcoin blocks from 1 MB to 4 MB; consisting of 3 MB of signature data and 1 MB of transaction data.

What was particularly clever about the new block weight was because the base block still only stored 1 MB of transactions, it meant SegWit was compatible without all bitcoin users needing to upgrade to support it.

Average Bitcoin block size in the past year – Source: Ycharts

Today, there are several Bitcoin blocks that are 1MB in size or even bigger. That can be attributed to Segregated Witness, which allows for a theoretical block size of up to 4MB. Over 77% of network blocks make use of SegWit already.

Bitcoin miners aren’t obliged to fill blocks all the way up. They are able to ‘tailor’ mined blocks anywhere from 0 to 1MB, while the standard Bitcoin client has a default setting of around 732KB.

Pros and Cons For Increasing The Block Size

The debate as to whether Bitcoin needs bigger blocks has raged on for years. Several arguments can be made as to why developers should or shouldn’t explore this option.

Potential benefits include:

- Lower transaction fees

- More transaction capacity to rival other payment systems

- A boost for using Bitcoin for micropayments

However, the counterarguments should not be overlooked either:

- Becoming a full node becomes more expensive due to larger blocks

- More centralization concerns if the outline above comes true

- Security issues due to grouped full nodes, which create single points of failure.

As no one is officially “in charge” of Bitcoin, achieving consensus on this topic has proven incredibly challenging. There will always be winners, losers, and those who do not care.

Different proposals to change the block size

Increasing the limit on the size of blocks is one option. That’s the thinking behind Gavin Andresen’s BIP 101 “bigger blocks” proposal, first pitched in May 2015 and eventually tested live as the Bitcoin XT client. BIP 101 was eventually removed from Bitcoin XT and replaced with a one-time block size increase to 2MB. However, the Bitcoin XT client is no longer in use in any significant manner.

The former lead developer and current chief scientist for the Bitcoin Foundation proposed raising the limit to 8MB, which would increase an additional 40% every two years until 2036 to accommodate future growth in CPU power, storage and bandwidth.

Originally, Andresen had sought a 20MB hard limit, but many Chinese miners, who account for more than 50% of the network’s hashing power, expressed concerns over such a drastic change due to the country’s limited bandwidth.

Other proposals for the Bitcoin Core team include Pieter Wuille’s annual 17.7% block size increase and Jeff Garzik’s 2MB “emergency” proposal. However, these and other ideas have not achieved broad support among Bitcoin Core developers, and the debate seems to have calmed down since Segregated Witness has become the default transaction type on the network. As of August 2021, more than 77% of all bitcoin transactions use SegWit.

Problem solved, right?

As developer Peter Todd points out, blockchains – owing to their design – do not scale. Even Andresen, the mastermind behind the “bigger blocks” proposal as well as a driving force behind Bitcoin XT, concedes that raising the block size limit is akin to “kick[ing] the can down the road.”

Others have expressed concern that raising the block size limit will mean fewer full nodes – nodes that store the entire blockchain on a hard drive, rather than a slimmed-down version – due to the increased data storage costs involved. This could dissuade users to operate full nodes and centralize the system around entities capable of handing bigger blocks. This, some opponents of bigger blocks say, would go against Bitcoin’s distributed, censorship-resistant nature.

Richard Gendal Brown, formerly with IBM UK and now with R3, has attributed this way of thinking, in part, to the security engineering mindset – “how can I break this?” – a fear of technical failure that would put this decision off. On the flip side, those who see the larger problem as a more immediate danger are driven by a fear of practical failure that will drive away users.

As Bitcoin blocks can now – theoretically – be up to 4MB in size, there is no immediate reason to increase it further. That topic may be revisited in the future, depending on how widespread Bitcoin is used as a payments network.

So, what other future options are there?

Other solutions include various mechanisms that push the many tiny transactions on the Bitcoin network – such as those from gambling sites and faucets – “off-chain.” One, known as the Lightning Network, is a kind of “hub and spoke” solution that lets two parties transact in private, then puts their data back on the blockchain at an agreed time. The Lightning Network is available on the Bitcoin blockchain today, though adoption is still in its early stages.

Sidechains, spearheaded by $299 million-backed company Blockstream, has been mentioned in the context of the scalability discussion. However, some of the team behind the concept, which allows developers to experiment on separate chains pegged to the Bitcoin blockchain, say their focus isn’t scalability.

Luke Jr, one of several Core developers involved with Blockstream, commented on Reddit:

“Sidechains aren’t about scaling, they’re about improving bitcoin’s functionality. Some of those features may be useful to improve scaling, but sidechains themselves don’t do it.”

As it has unfolded, the block size debate has touched on many pain points for the currency as it seeks to grow. Bitcoin is many things to many types of people – anarchists, speculators, entrepreneurs – which, until now, hasn’t been much of a problem.

Despite Segregated Witness offering a temporary solution to the block size debate, the question of the currency’s future remains. Will it compete with the likes of Visa as a cheap, fast payment channel? Or should it remain an ultra-secure, premium – and scarce – store of value to which other services can be pegged?