Warren Buffett moving into cash suggests he’s bracing for a possible collapse in risk-on asset prices. With Bitcoin (BTC) up 70% year-to-date and correlated with equities, should BTC investors also prepare for a potential stock market crash?

Buffett says “incredible period” is over

Buffett’s Berkshire Hathaway dumped $13.30 billion worth of equities and increased exposure in cash and United States Treasurys in Q1, its latest quarterly earnings report shows. Meanwhile, it channeled $4.4 billion toward purchasing its own stock and $2.9 billion on the shares of other publicly-traded companies.

The market considers Berkshire Hathaway’s performance as a key indicator to gauge the U.S. economy’s health, given the firm’s holdings range from American railroad to electric utilities and retail businesses.

But the 92-year-old investor, who has credited the U.S. economy’s growth for the success of Berkshire Hathaway in the past, is no longer optimistic.

“The majority of our businesses will report lower earnings this year than last year,” Buffett said last weekend at an event. The “incredible period” for the U.S. economy has been coming to an end over the past six months, he added.

Berkshire raised its cash reserves by $2 billion to $130.60 billion in Q1 2023, the highest level since the end of 2021 when equities entered a bear cycle. Moreover, the firm holds a vast amount of its cash in short-term Treasury bills and bank deposits, thanks to higher interest rates near 5%.

In other words, Buffett is preparing for a potential stock market crash, particularly as the U.S. banking crisis unfolds, with shares of many banks, such as PacWest Bancorp and Western Alliance Bancorp, sinking.

Bitcoin price stays correlated with Nasdaq

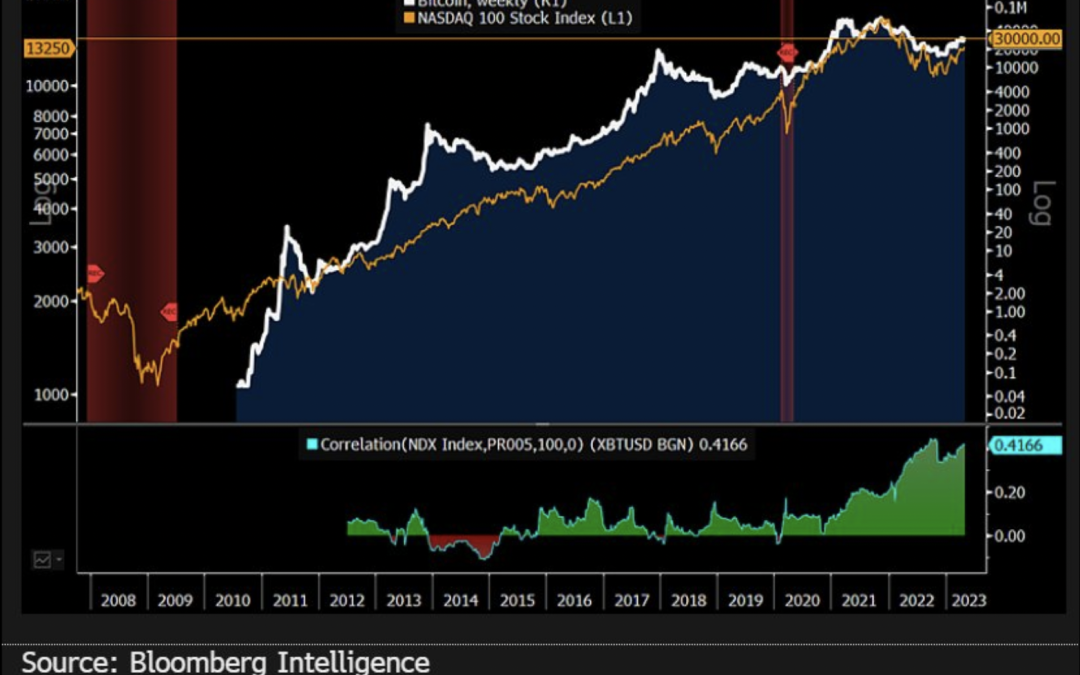

The increasing possibility of a global recession also risks putting downside pressure on Bitcoin, with its 100-week correlation with the Nasdaq reaching its highest level of about 0.42%.

Moreover, Bloomberg Intelligence analyst Mike McGlone expects that BTC price would likely be the leading indicator for a stock crash.

“Bitcoin could pace declines for risk assets — If the worst isn’t over for risk assets, Bitcoin may lead the way lower,” commented McGlone, adding:

“Bitcoin is up about 70% in 2023 to May 2 vs. 20% for the stock index, and those are maybe bounces within broader bear markets. The Fed [is] still tightening in May, and [is] more inclined to stay the course unless risk assets fall to ease inflation, may portend a lose-lose.“

In the short term, there are little expectations from the U.S. Consumer Price Index report on May 10 about easing inflation in April. According to Bloomberg’s survey, economists expect core CPI to remain unchanged at around 5%, suggesting more rate hikes are ahead.

On the other hand, a significant drop in inflation will likely prompt the Fed to consider pausing or even slashing interest rates in an extreme case scenario.

Currently, Fed funds futures’ data suggests that at least five rate cuts between May 2023 and January 2024 are likely, which may pour cold water on Buffett’s risk-off strategy.

Could Bitcoin price fall below $25K again?

Bitcoin’s price has declined roughly 6% over the past week, trading for as low as $27,350 on May 9.

Notably, this has pulled BTC’s price below its 50-day exponential moving average (50-day EMA; the red wave), near $27,950.

Bitcoin bears are now eyeing $27,000 as the next downside target based on the level’s recent history.

A decisive break below the $27,000 support, primarily in the event of further rate hikes, could then pull BTC/USD down to its 200-day EMA (the blue wave) near $24,600. In other words, a 10% drop by June.

Conversely, a rebound from $27,000 increases the possibility of BTC price retesting $30,000 as resistance and resuming the uptrend of the last few months.

Related: Analysts at odds over Fed, US debt ceiling impact on Bitcoin price

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.