The advisors of the Venezuelan government have recommended that the country’s oil-backed cryptocurrency, the petro, be sold in private placements at a discount of up to 60 percent. 38.4 million petros, with a face value of around $2.3 billion, could go on sale starting on February 15.

Also read: South Korea Urges 23 Countries, EU, and IMF to Collaborate on Curbing Crypto Trading

Private Placements of Discounted Petros

The newly-formed advisory group to the Venezuelan government, VIBE, has reportedly provided a recommendation on how to start selling the country’s oil-backed cryptocurrency, the petro. The group consists of crypto experts close to the government, Reuters described. According to a document it reviewed, the news outlet elaborated:

VIBE recommended Venezuela sell 38.4 million petros with a face value of around $2.3 billion in private placements starting on Feb. 15 at a discount of up to 60 percent… Another 44 million petros with a face value of $2.7 billion should be offered to the public a month later.

“The remainder should be shared between the government and VIBE,” Reuters quoted the document. In addition, “the document suggested the government accept tax payments in petros, and that state oil company PDVSA incorporate cryptocurrencies in its dealings with foreign companies.”

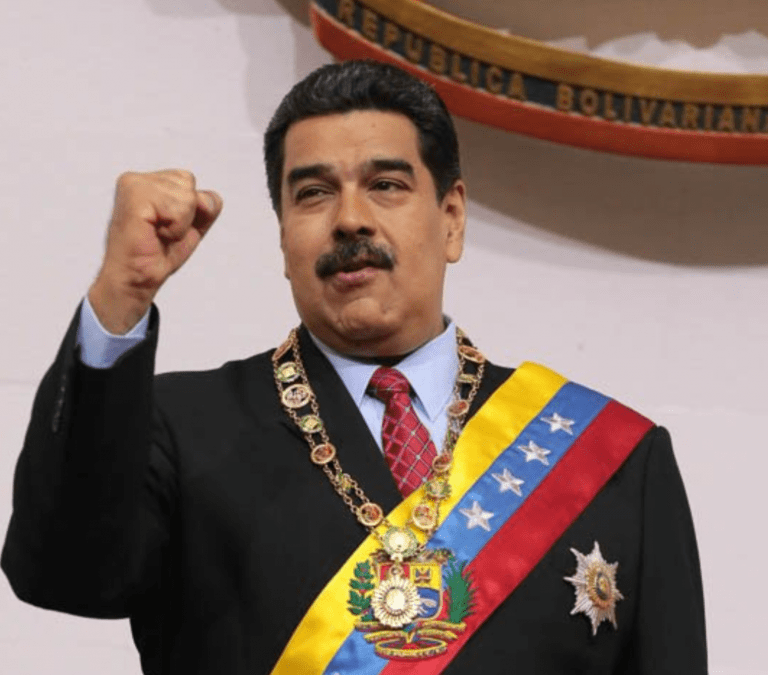

Earlier this month Venezuela’s president Nicolas Maduro assigned 5 billion barrels of crude oil to back the new currency and ordered the issue of 100 million petros.

The publication added that, according to a source familiar with the matter, high-ranking government advisors have discussed the proposal. However, there has not been a confirmation whether it was accepted.

The Petro’s Journey

The creation of Venezuela’s national cryptocurrency was first announced by Maduro in early December, stating that it would be backed by the country’s oil, gold, natural gas, and diamond reserves.

Without providing additional details, he said “the cryptocurrency issuance would take place via online exchanges,” Reuters conveyed and quoted a government advisor explaining that some exchanges would work with bolivars while others would trade the petro for other cryptocurrencies. The news outlet further noted:

Each petro will be backed by one barrel of Venezuelan oil and will be sold at the same price, which last week averaged $60.40 per barrel…That would put the value of the entire petro issuance of 100 million tokens at just over $6 billion.

As Maduro prepared to launch the petro, the country’s opposition-run Congress declared the new currency “an illegal debt issuance by a government,” the publication described. Parliamentarians also declared Maduro’s decree to issue it null, citing “it is illegal to use oil reserves.”

As Maduro prepared to launch the petro, the country’s opposition-run Congress declared the new currency “an illegal debt issuance by a government,” the publication described. Parliamentarians also declared Maduro’s decree to issue it null, citing “it is illegal to use oil reserves.”

Nonetheless, the Superintendent of Cryptocurrencies, Carlos Vargas, proceeded to announce that the petro will be pre-mined. Furthermore, the document Reuters saw “suggested the petro be a token on the Ethereum network.”

A search on popular Ethereum block explorer Etherscan shows a number of ERC20 tokens with the name “Petro” already in existence. One of them (PTO) has a 100-million token issuance. The coins, held in one address, were generated on January 13. However, there is no indication whether the Maduro government is in control of the address.

Forging ahead with the issuance of the petro, Maduro was quoted on Monday proclaiming:

The center of financial policy will be the consolidation of the petro. This cryptocurrency is the future of humanity. Venezuela has entered the future.

Do you think the Venezuelan government will follow VIBE’s advice? Let us know in the comments section below.

Images courtesy of Shutterstock and the Venezuelan government.

Need to calculate your bitcoin holdings? Check our tools section.

The post Venezuela Considers Selling Its ”Oil-Backed” Cryptocurrency With a 60% Discount appeared first on Bitcoin News.