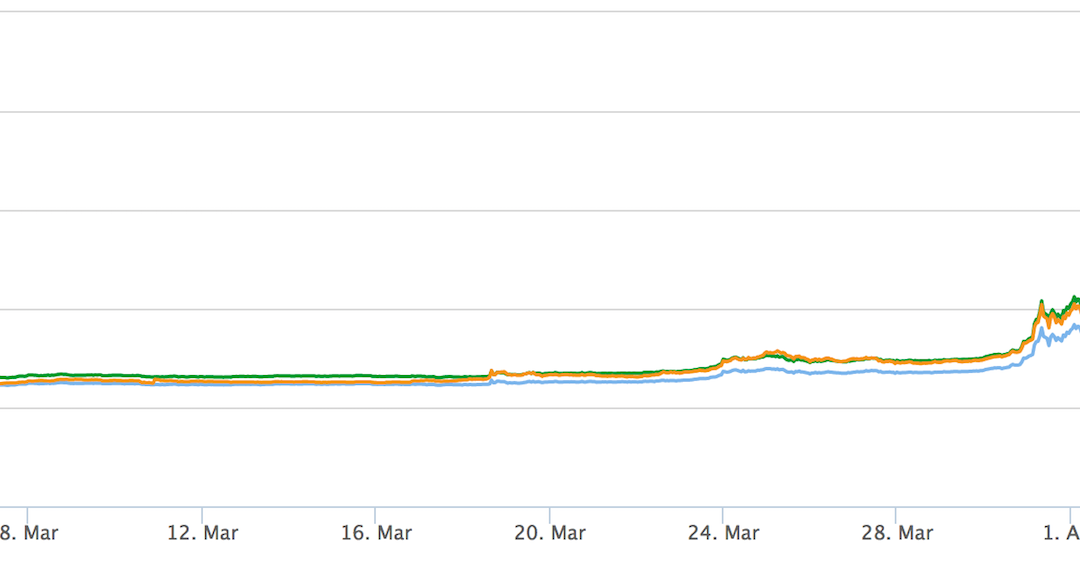

Even by cryptocurrency’s often exaggerated market standards, the price of XRP has been on a tear of late.

The cryptocurrency that powers the distributed Ripple Consensus Ledger, a business-focused distributed ledger technology platform developed by San Francisco startup Ripple, has surged more than 1,000% over the last 30 days, reaching a new all-time high on 2nd April.

But what’s the reason for the sudden surge?

So far, markets have been left to speculate, watching as the wider cryptocurrency markets have seen new volatility. Yet, Ripple is now weighing in on the market activity, arguing that the sharp spikes in value of late are evidence of its progress.

Ripple CEO Brad Garlinghouse told CoinDesk:

“We have had a significant rally in XRP prices, but it is reflective of a lot of work we have done to make Ripple a very compelling solution.”

He emphasized that there have been “huge” network improvements, adding that his company has invested significantly in ensuring that the Ripple Consensus Ledger – along with XRP – truly becomes a leading technology.

Yet, not all market participants agree there’s a direct correlation.

As the price of XRP has experienced sharp volatility of late (rising and falling 10% in some single sessions), some assert the digital currency became the latest victim of ‘pump and dump’ trading activity, several analysts told CoinDesk.

Ripple is certainly not alone in this regard, as several other alternative asset protocols have surged to all-time highs lately and then suffered notable declines.

Scaling and speculation

Another major development that has helped provide tailwinds for XRP prices is bitcoin’s ongoing scaling dilemma, according to Garlinghouse.

The bitcoin community has thus far been unable to form a consensus on how best to address the problem of block size, and that is sparking interest in alternatives, he reasoned.

Because of the technical issue, the average time needed to confirm bitcoin transactions has risen significantly in recent months, reaching 168 minutes on 27th March and 145 minutes on 31st March.

Garlinghouse sought to contrast this performance with Ripple’s, tweeting on 31st March that his network’s confirmations were taking an average of 3.7 seconds, while it costs $0.00031 per transaction compared to $0.48 using bitcoin.

Yet, here too, analysts offered an alternative picture, contending the quick rise in Ripple’s price was more indicative of speculative market activity.

Jacob Eliosoff, a cryptocurrency fund trader, told CoinDesk that XRP is most certainly benefiting from an “altcoin fervor” amongst active traders. As a result, buyers were either swayed by some news, or some large buyer chose this week to spark market activity, he posited.

As for the decline in price that soon followed, analysts said this may have marked a period of “profit taking”, where long-term Ripple holders sold (and bought back at a lower price) to increase their return on their investment.

Growing credibility?

Still, it remains an open question whether this activity amounts to real use for the Ripple platform. As such, the statements above mark a divide between the startup’s view on the market and those of avid traders.

Garlinghouse, for example, suggested that the Ripple network may also be more practical than bitcoin’s, a feature that he argued is attracting users.

“One of the big differences between XRP and many other digital currencies is that we are solving a real-world problems for banks and providing ROI. This has been giving us credibility in the broader cryptocurrency space,” he said.

Some analysts mentioned Ripple’s partnership with Japan’s largest bank, MUFG, as helping bolster XRP’s price. As a result of this partnership, the Asian financial group will become the latest financial institution to get involved in creating and overseeing payment transaction rules and standards for Ripple’s network.

However, such ideas are countered somewhat by the rise in trading activity on markets typically associated with more speculative trading.

For instance, one Ripple gateway operator projected more than three-quarters of XRP’s trading activity is now taking place on Poloniex, an exchange for alternative cryptocurrencies that does not offer trading in fiat currency.

In this light, the recent moves may mark a combination of factors.

Tim Enneking, chairman of cryptocurrency hedge fund Crypto Asset Management, suggested that Ripple’s developing value proposition was perhaps encouraging it to be more aggressively traded.

He concluded:

“On a percentage basis, BTC moves have been getting steadily smaller for years. For those who have grown used to trading in that environment – with the attendant risks and rewards – alts have simply become more interesting.”

Question mark image via Shutterstock