Last Friday, the U.S. International Trade Commission (ITC) ruled in favor of Suniva and SolarWorld, having found that they suffered injury from the flood of cheap imports. Will this ruling dreadfully affect the U.S. PV market this year?

“There is enough inventory in the channel to keep projects going for a while,” Paula Mints, founder and chief analyst of SPV Market Research, said, implying that the U.S. market will most likely grow, instead of shrink. In fact, the “Global Analysis for the Markets for Solar Products and Five-Year Forecast 2016-20121” published by SPV Market Research shows upward trends in two scenarios.

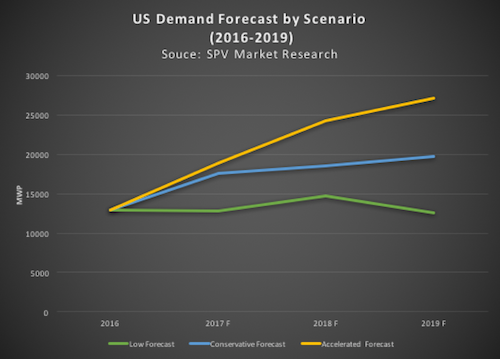

For the Five-Year Forecast, there are three scenarios — low, conservative, and accelerated. According to Mints, for the low forecast, the impact of the decision including a significant increase in module and cell prices and low inventory was weighted more heavily, therefore showing a slight year-over-year decline.

Both conservative and accelerated scenarios for 2017, however, show an annual market growth of 36 percent and 46 percent, respectively. In these scenarios, available inventory in the channel and some panicked buying caused by the “tariff scare” were taken into consideration.

“Right now, there is still inventory in the channel. It will be worked off quickly for smaller participants and more slowly for large project participants,” Mints said.

SPV Research forecasts that 17.6 GW will be installed in 2017 under the conservative scenario and 18.9 MW under the accelerated scenario.

Credit: SPV Market Research

Since the U.S. ITC decided on injury, now the PV industry waits for the ITC hearing on remedy phases and its remedy recommendation to President Trump by November 13.

When Suniva originally filed a petition under Section 201, it requested a $0.78/Wp minimum price on all crystalline module imports and an additional $0.40/Wp tariff on imported crystalline cells.

“No one knows what will happen. All we know is what the worst case is — basically everything they [Suniva and SolarWorld] asked for — and what the best case is — no remedy,” Mints said. “The outcome will be between those two things.”

Tariffs in 2012 and 2014… and 2017

Looking back at recent history, the U.S. market survived and grew over the trade disputes. In 2012, SolarWorld filed trade petitions against cells/modules imported from China. Following an investigation, tariffs were placed on cells and modules imported from China. In 2014, SolarWorld amended its original petition to include cells imported from Taiwan and, again, tariffs were placed. Despite high anxiety over potential price increases, prices did not increase significantly.

If tariffs are placed this time, prices will increase because at this point prices are too low for importers to absorb the tariff in the margin, according to Mints.

“End users (in the residential segment) for the most part are unaware of the tariff,” she said. “In states with strong net metering and while the 30 percent investment tax credit is in effect, and where installers can absorb the minimum price/tariff, it should continue without much disruption. Some (utility-scale) projects in development will drop off and most will continue.”

Lead image credit: depositphotos.com