Illinois Representative Marie Newman has disclosed she purchased up to $50,000 in exposure to crypto through shares of Grayscale Bitcoin Trust.

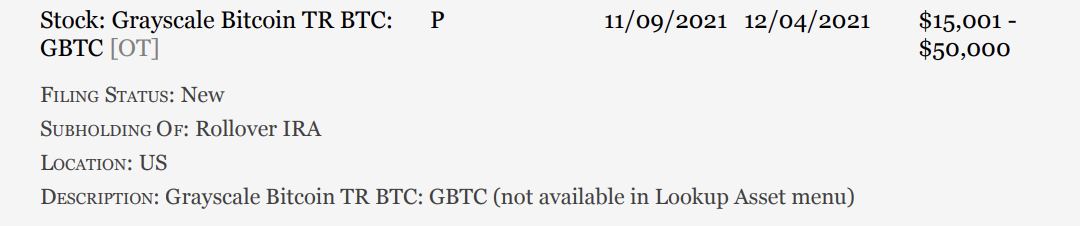

According to a financial disclosure report filed with the U.S. House of Representatives on Dec. 8, Congressperson Newman bought between $15,001 and $50,000 of GBTC between Nov. 9 and Dec. 4. In addition, she conducted four separate purchases of shares of Coinbase Global’s Class A stock between November and December, up to $215,000.

Members of the U.S. House of Representatives and Senate are permitted to buy, sell and trade stocks and other investments while in office but required to report such transactions of more than $1,000 within 30 to 45 days. This reporting is in accordance with the Stop Trading on Congressional Knowledge Act, or STOCK Act, passed in 2012 under President Barack Obama with nearly unanimous approval in both chambers of Congress.

According to data gathered from financial disclosure reports by Bitcoinpoliticians.org, six other members of Congress currently hold cryptocurrency or some exposure to crypto assets, including Wyoming Senator Cynthia Lummis, Texas Representative Michael McCaul, Pennsylvania Representative Pat Toomey, Alabama Representative Barry Moore, New Jersey Representative Jefferson Van Drew, and Florida Representative Michael Waltz. However, many federal judges and lawmakers have reportedly flouted the STOCK Act by not disclosing certain investments.

Related: Pro-crypto senator Cynthia Lummis discloses up-to-$100K BTC purchase

The disclosure report from Newman comes following members of Congress questioning CEOs of major stablecoin issuers and crypto firms in a hearing to better understand the technology and where a regulatory path may lead. Progressive lawmaker Alexandria Ocasio-Cortez also recently spoke out on social media, saying it was inappropriate for her to hold Bitcoin (BTC) or other digital assets because lawmakers have access to “sensitive information and upcoming policy” and such investments could affect their impartiality.