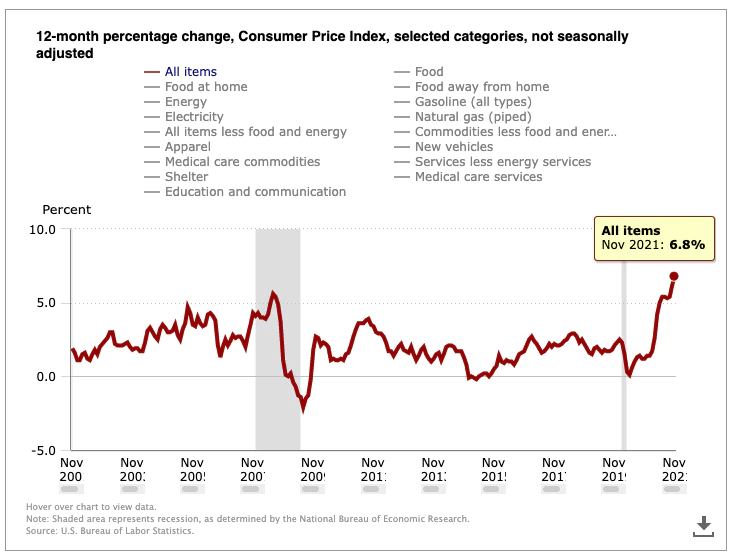

The U.S. Labor Department’s Consumer Price Index (CPI), closely tracked by bitcoin traders due to the cryptocurrency’s use by some investors as a hedge against inflation, has risen to its highest since the early 1980s.

The Consumer Price Index for all items rose 6.8% in the 12 months through November, the highest since May 1982, when it was 6.9%. The cost-of-living increase was in line with the average forecast of economists in a Reuters survey, but it marked a sharp increase from October’s 6.2% print.

Bitcoin, seen by a growing number of investors as a hedge against inflation, rose 2% in the minutes after the CPI data was released, trading around $50,000.

After the release of the October CPI data, bitcoin shot up by almost $3,000 to quickly print a new all-time high of $68,950. But within a few hours, the move reversed completely, and prices fell as more traders shifted to focus on the logical consequence of faster inflation: monetary-policy tightening by the Federal Reserve that might crimp demand for riskier assets from stocks to cryptocurrencies.

The world’s largest cryptocurrency by market capitalization is currently trading at around $49,100, down 27% from the all-time high reached in early November when the last inflation report was released. Bitcoin is still up 69% on the year.