Uphold was founded in 2015. It is a cryptocurrency exchange managed by Uphold Europe Limited, which is registered under the Financial Conduct Authority’s Temporary Registration Regime for crypto asset firms. It is also regulated by the Financial Conduct Authority (FCA) to issue e-money pursuant to the Electronic Money Regulations 2011.

Away from the management and regulation of the exchange, let’s now delve into how it works and its pros and cons.

How it works

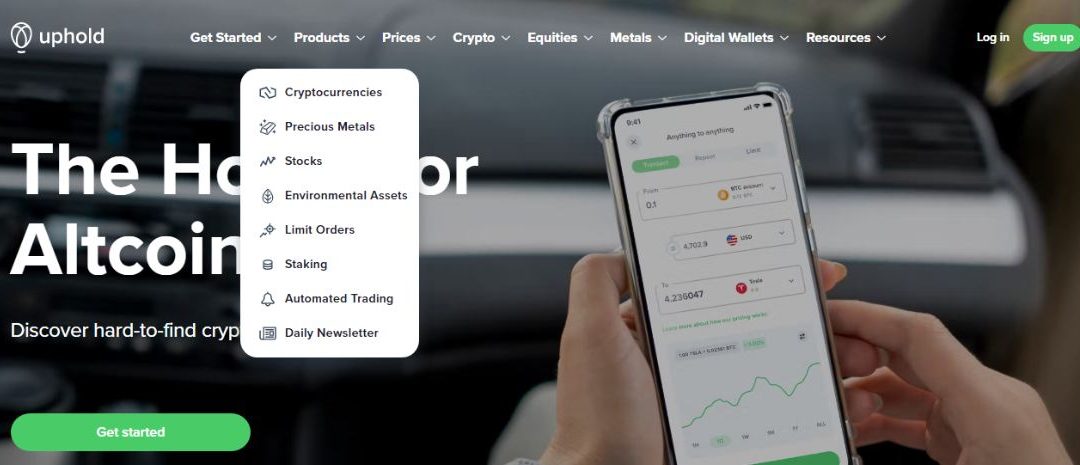

To start with, Uphold is quite a unique trading platform in that in addition to allowing users to buy, sell, and convert cryptocurrencies, it also allows them to trade precious metals, fiat currencies and US equities.

It also allows cross-asset trading; meaning you can trade between any of the assets it offers. You could, for example, choose to trade cryptocurrencies for stocks or a fiat currency for precious metals and so on. You, therefore, do not need different accounts to trade the different trading instruments that Uphold offers.

In addition to trading, Uphold also offers a number of other financial services. It offers a debit card called Uphold Card that allows you to pay using any of the crypto assets that you hold and in return earn rewards for spending. It also allows for instant fee-free payments to friends and family across the globe.

Products offered by Uphold

As an Uphold user, you can also receive payments from an employer in any currency (including a combination of currencies) of your choosing. You can also directly withdraw funds to your bank account or crypto wallets. It allows bank withdrawals in over 30 countries.

Uphold also has a staking program that allows you to stake your crypto assets and in return earn staking rewards.

It also allows for automated trading meaning you can schedule regular transactions using AutoPilot. This allows you to set up a recurring buy or sell order and reduce the impact of price volatility.

Uphold fees

While Uphold offers 0% trading commissions, it charges spread fees on crypto purchases and sales. For popular cryptocurrencies like Bitcoin and Ethereum, the fees can go to as high as 1.2%. The spread fees may also increase when the market volatility increases.

The spread fees for the other financial assets are fixed. For fiat currencies, the spread fee is 0.2%, for US equities it is 1%, and for metals, it is 3%.

On the bright side, Uphold does not charge any deposit and withdrawal fees.

Pros and Cons of Uphold

Pros

Zero deposit and withdrawal fees.

Uphold allows direct bank withdrawals.

It offers a debit card that allows users to directly pay for services using the assets that they hold on Uphold and in return earn rewards for spending.

It allows users to link any Bitcoin, Bitcoin Cash, XRP Ledger, Ethereum and Litecoin wallet.

It allows cross-asset trading; something that is quite unique among crypto exchanges.

It allows crypto staking thus providing users with an opportunity for earning a partial income from their crypto holding.

Cons

One of the main disadvantages of using Uphold is the variable spread fees on crypto purchases and sales which are also affected by market volatility. Those buying and selling popular cryptocurrencies pay the most.

Uphold only offers one order type, which is limit orders. If you are looking for additional or more advanced order types like market orders, you will want to look elsewhere.

Uphold is not optimized specifically for crypto trading and investment and it misses key crypto features like NFTs.

Uphold offers a limited number of cryptocurrencies when compared to other crypto exchanges.

The US equities and precious metals trading as well as the Uphold Card and automated trading are not available in some regions.

Why should you use Uphold?

Uphold is ideal if you are looking for a platform where you can trade a variety of assets. On Uphold, you will be able to trade cryptocurrencies, fiat currencies, US equities and precious metals.

Its user interface is also simple to use meaning you can easily start trading on the platform regardless of your experience level.

Also, Uphold allows you to trade between the various assets that it offers. You can trade fiat currencies for cryptocurrencies Fiat currencies for US equities and so on. This feature makes Uphold stand out among its competitors.

You can also set up automated trades for recurring buys and sells helping you to mitigate the effects of market volatility.

Final Verdict

Uphold is a good platform for those looking to not only do cryptocurrency trading but also trade other financial instruments like precious metals and US equities.

However, users will have to contend with some of the limitations like the lack of more advanced order types since the platform only allows the use of limit orders. Its FCA compliance also makes it quite strict and there have been a number of account lockouts.

The post Uphold Review: all you need to know about this multi-asset digital trading platform appeared first on CoinJournal.