Developers are now allowed to fork Uniswap v3 protocol as its Business Source License (BSL) expired on April 1, shows protocol documentation. The expiration was a much-anticipated event within the decentralized finance (DeFi) ecosystem, enabling developers to deploy their own decentralized exchange (DEX).

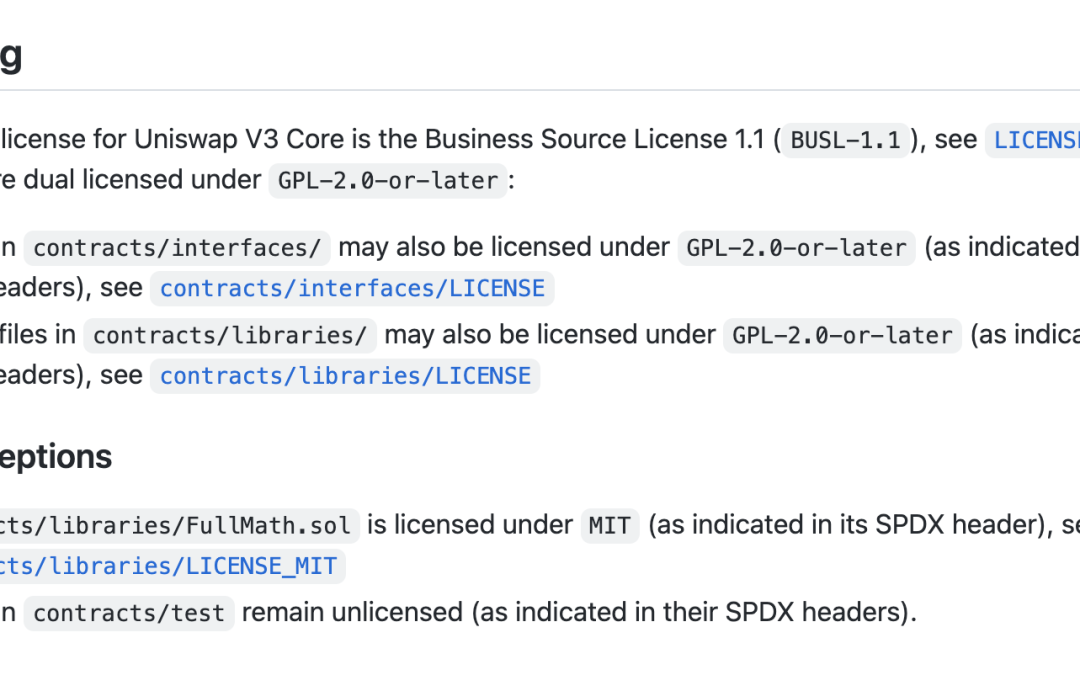

The BSL license lasts for a limited period before becoming completely open source. The purpose is to protect the author’s right to profit from their creations. Uniswap v3’s license was released in 2021 for two years, preventing its code from commercial use. A new license called a “General Public License” now applies to the protocol.

To fork the code, developers will be required to use an “Additional Use Grant” — a production exemption meant to accommodate both the needs of open-source and commercial developers.

Uniswap is a widely utilized decentralized exchange — considered the biggest automated market maker in DeFi space — providing a platform where token creators, traders and liquidity providers swap tokens. Its native Uniswap (UNI) token is a popular way for investors to gain exposure to the DeFi market.

In May 2021, shortly after being launched, Uniswap v3 surpassed Bitcoin in terms of daily fee generation, Cointelegraph reported. Data from Cryptofees showed that Uniswap v3 was generating $4.5 million in daily fees at that time, while Bitcoin generated $3.7 million.

Earlier this month, Unisawp officially went live on the BNB Chain — Binance’s smart contract blockchain — after more than 55 million UNI tokenholders voted in favor of a governance proposal by 0x Plasma Labs to deploy the protocol on the BNB Chain. Through the move, Uniswap users can access BNB Chain’s ecosystem for trading and swapping tokens. The integration also allowed Uniswap to tap into a liquidity pool with BNB Chain’s DeFi developer community.

Magazine: DeFi abandons Ponzi farms for ‘real yield’