UNI/USD price has touched highs of $6.00 as total value locked jumps to $1.40 billion.

UNI/USD has touched highs of $6.08 on Coinbase, despite fears that airdropping over $1,500 worth of UNI tokens to users would see users looking to cash in on the goodies dump prices. Instead, investors are now eyeing higher gains, with analysts forecasting Uniswap’s governance token could be the driving force behind a new DeFi craze.

If dump happens, support lies around $4.20-$4.50 and crucially above $3.00.

UNI/USD price

Looking at the charts, UNI/USD is trending overbought with the RSI still rising to suggest a correction is likely. The MACD is also fully extended, to suggest holding prices above $5.00 could help bulls hold the advantage.

However, if a downward materializes, the critical support zones will be $4.20-$4.50 and below that, $3.00 that forms the entry point on the upswing to $6.00. Many holders are likely not to sell beyond this level.

Uniswap in top 25 by market cap

On September 17th, Uniswap announced it would airdrop 400 UNI tokens for every address that had called the network by September 1st. Immediately, more than 29.9k wallets claimed the new tokens.

At the time, UNI/USD was trading around $3.00. In the past 12 hours, UNI/USD has surged with a series of higher highs and higher lows as more Uniswap users continue to claim their free tokens. Per data on Etherscan, 77,451 addresses have claimed their 400 tokens with total transactions reaching over 336,500 as of writing.

Uniswap is now ranked as the 25th largest cryptocurrency in the market, with a market capitalization of $915 million and over $2.9 billion in intraday trading volume. The token is also listed on major cryptocurrency exchanges, including Coinbase, Binance, Huobi Global, FTX, and WazirX. There are also more than 60 trading pairs.

According to data on CoinMarketCap, UNI/USD changed 215% in the first 24 hours after its launch. The token is trading more than 135% up on the day, jumping to hit highs of $6.00 in the early market sessions on September 18th. The momentum has cooled, but the upside remains and higher gains cannot be ruled out.

Uniswap tops of DeFi

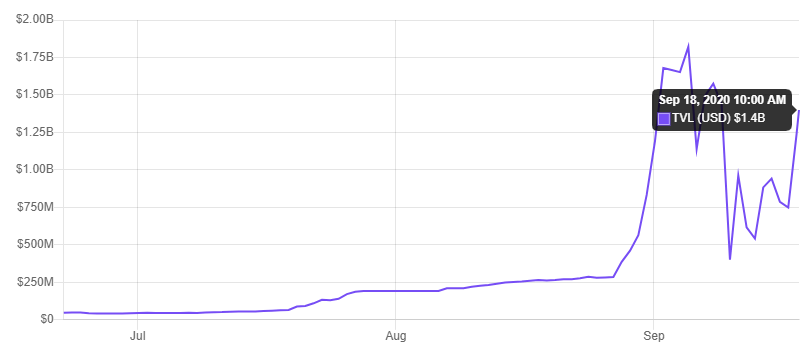

The total value locked in decentralized finance protocols has hit $9.01 billion, with the value of assets locked in Uniswap surging more than 81% in the past 24 hours to account for over 15% and top the leaderboard.

Uniswap has climbed to the top with $1.40 billion in total value locked, ahead of Aave with $1.35 billion and Maker with $1.15 billion according to data from DeFi Pulse.

The post Uniswap (UNI) price jumps 135% to $6.00 highs appeared first on Coin Journal.