UNI price rose to $34.87, an all-time new high that also saw Uniswap break into the top 10 cryptocurrencies by market cap

Uniswap’s UNI token has reached a new all-time high of $34.87 after rallying 12% in the past 24 hours. This milestone for the DeFi token comes after it surged by over 50% this past week, a feat that saw Uniswap break into the top ten of the largest cryptocurrencies by market capitalisation.

UNI currently ranks as the eighth largest with a market cap of $17.5 billion, ahead of Litecoin (LTC) with $12.4 billion and just behind XRP with $21 billion.

At the time of writing, UNI is trading around $33.70, with bulls likely to retest the all-time high as the market gears up for the launch of Uniswap’s V3 upgrade.

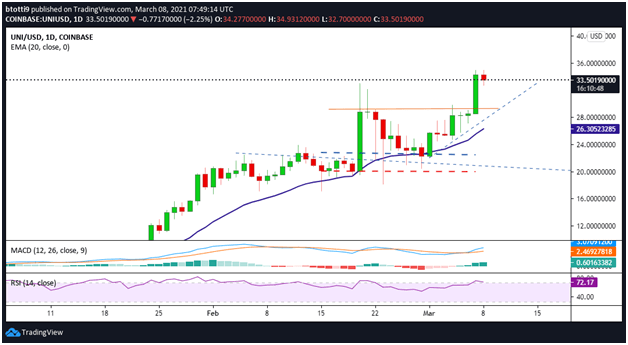

Uniswap price daily chart

UNI/USD rallied to the new all-time high of $34.87 after breaking above overhead resistance near $29. The retreat to lows of $33.30 suggests that the appetite for profit taking has been high in the latter hours of the Asian trading session.

The RSI however remains in the overbought territory despite a slight slope. This indicates bulls hold the advantage and a flip higher would allow for further gains. The MACD meanwhile supports a fresh upside, with the indicator showing a bullish crossover and the histogram printing successive green bars.

If the UNI/USD pair holds above $33, they can swiftly attack barriers at $35 and $38, with the successful breaking of these hurdles allowing for an upside move to $46.

On the downside, increased profit-taking could see prices dip to support at $30. Failure to hold this level could put UNI/USD at risk of further damage, likely towards the 20-day EMA ($26.28). If such a scenario unfolds, sellers may push towards $22 and then $20.

Uniswap price 4-hour chart

The 4-hour chart suggests sellers are intent on keeping prices below $34, with the immediate outlook suggesting a dip to support at $32.92.

Bulls are trying to defend gains just below the upper boundary of an old ascending parallel channel. This negative perspective will strengthen if bears sink UNI/USD below the middle line of the channel, touching support at the 20-day EMA ($30.55).

If this happens, extended selling pressure could push the DeFi token beyond the lower support of the channel. The 50-day EMA ($28.17) would provide the next support zone, with short-term declines likely to extend to $26.

On the contrary, a rebound to the upper boundary of the ascending parallel channel could allow bulls to retest overhead resistance at $35 and potentially target $40.

The post Uniswap price analysis: UNI hits new all-time high above $34 appeared first on Coin Journal.