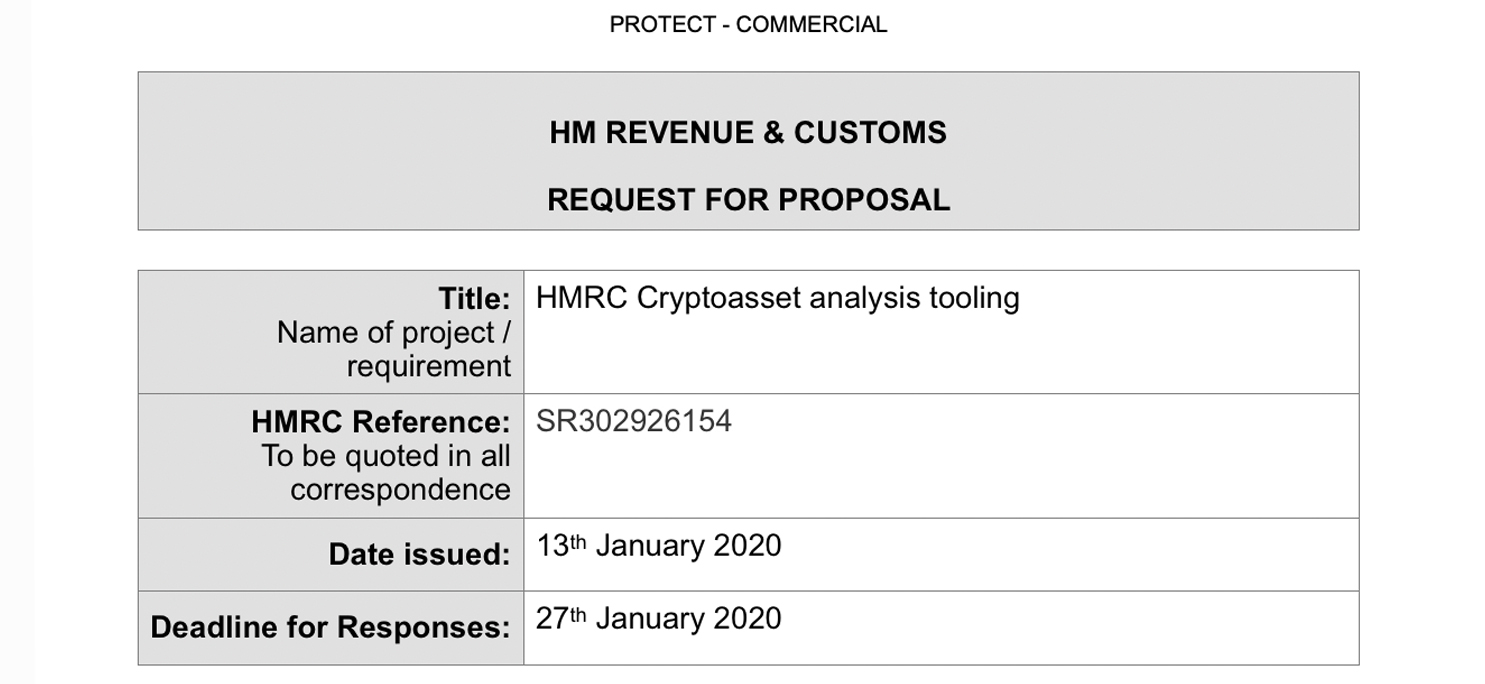

On January 17, the UK tax agency Her Majesty’s Revenue and Customs (HMRC) published a job opportunity for a private contractor to design a cryptocurrency blockchain analysis tool. According to the listing, the contract is for one year and HMRC will pay the contractor $100,000 for software that can “identify and cluster crypto asset transactions.”

Also read: Britain’s Tax Authority Updates Crypto Guidelines

HMRC Wants a Blockchain Analysis Tool and Is Willing to Pay $100,000

Governments worldwide have been cracking down on cryptocurrency holders in order to make sure they are paying taxes. In the U.S., the country’s tax agency the IRS has initiated a broad stroke of tax enforcement against people who may own or at one time possessed cryptos. In the United Kingdom, HMRC has been following a similar path as the tax entity issued guidance for individual cryptocurrency holders in 2018 and then published more guidelines for businesses on November 1, 2019. HMRC’s updated crypto rules highlight the fact that they believe “individuals residing in the UK should file their tax obligations.” Despite the new guidelines toward cryptocurrency use, the tax authority’s rules are still not clearly defined and people still don’t understand their tax obligations. Nevertheless, just like the IRS and its confusing guidelines, HMRC plans to crackdown on tax evaders anyway.

On Friday, a representative from England published an advertisement for HMRC looking for a software engineer to build a blockchain surveillance tool. According to the employment listing, the contractor can work from “any region” remotely. The contract runs from January 2020 to February 2021 and the value of the contract is $100,000. However, a group of voluntary, community and social enterprise (VCSE) contractors cannot apply. Small to medium enterprises (SME) are allowed to apply for the position to build the official HMRC blockchain analysis tool. HMRC’s description states:

Provision of a tool that will support intelligence-gathering methods to identify and cluster Crypto asset transactions into linked transactions and identify those linked to Crypto asset service providers.

Governments Worldwide Aim to Combat Crypto Tax Evasion and Money Laundering

The tool must also de-anonymize blockchain activities by cluster analysis and identify confidence ratings in clusters. The tool needs to provide an “attribution of a cluster/address to a known commercial entity (exchange) or a known service provider (mixing service, gambling service, dark market, etc).” The platform must be web-based and offer a visualization of blockchain analytics in order to identify crypto-using suspects and build intelligence. At minimum, the tool needs to support blockchains such as BTC, BCH, ETH, ETC, XRP, USDT, and LTC. HMRC’s job application emphasizes that the tax agency would love for the tool to analyze monero, dash, and zcash as well. The contractor must also provide secondary training so other government employees can learn how to utilize the blockchain analysis tool. The crypto contractor will be paid via HMRC’s dedicated payment portal Ariba.

Additionally, the contractor applying for HMRC’s job has to fill out a lengthy security questionnaire as part of the blockchain tool proposal response. HMRC’s job application proposal cites that crypto assets are being used for “tax evasion and money laundering.” U.S. regulators, specifically Homeland Security Investigations (HSI), have been working with the IRS to tackle money laundering and tax evaders as well. In 2016, an affadavit revealed that HSI created a special task force to identify unlicensed bitcoin exchangers. Two years later, HSI published its 2019 fiscal year pre-solicitation documents which show the agency asked for money for blockchain analysis tools.

“This proposal seeks applications of blockchain forensic analytics for newer cryptocurrencies, such as zcash and monero,” the solicitation letter explains. “Blockchain forensic analytics for the homeland security enterprise can help the DHS law enforcement and security operations across components as well as state and local law enforcement operations,” states page 21 of the DHS solicitation letter. “Private financial institutions can likewise benefit from such capabilities in enforcing “know your customer” and anti-money laundering compliance.”

HMRC’s newly updated tax guidelines toward crypto-related activities note that most crypto asset operations are “taxable economic activity.” This includes cryptocurrency mining as well as buying, selling, and exchanging a digital asset for another type. Individuals and SMEs interested in HMRC’s blockchain analysis tool contract have until January 27 to submit a proposal alongside the security questionnaire. The UK tax agency’s employment listing shows that governments are actively searching for ways to de-anonymize crypto transactions. HMRC’s crypto analysis tool application underscores that the tax agency is there to make sure the collection of money pays for the UK’s public services. The contract proposal notes that the agency wants to “make it hard for the dishonest minority to cheat the system.”

What do you think about Her Majesty’s Revenue and Customs job listing looking for a contractor to build a blockchain surveillance tool? Let us know what you think about this topic in the comments section below.

Image credits: Shutterstock, HMRC application, Fair Use, Wiki Commons, and Pixabay.

Do you need a reliable bitcoin mobile wallet to send, receive, and store your coins? Download one for free from us and then head to our Purchase Bitcoin page where you can quickly buy bitcoin with a credit card.

The post UK Tax Agency to Pay $100K for Blockchain Surveillance Software appeared first on Bitcoin News.