Clinton began his second term as President of the United States. Titanic dominated the box office. Hanson’s “MMMBop” stormed music charts. The year, 1997, also turned out to be when two cranks, fringe thinkers, wrote The Sovereign Individual: Mastering the Transition to the Information Age (TSI), published by Simon & Schuster. Catastrophic impresarios James Dale Davidson and Lord William Rees-Mogg wrote a curiosity: a history book focused upon the coming future. Humanity, they urged, was involved in a great transition. Audacious, weird, and at times just plain creepy, the duo managed to hammer out what amounts to cryptocurrency in eerie exactness to its real-life form, bitcoin, a full ten years before anyone, including Satoshi Nakamoto.

Also read: New Wallet from Opendime, the Coinkite Coldcard, is Cypherpunk Cool

Bitcoin’s Prescient Fathers

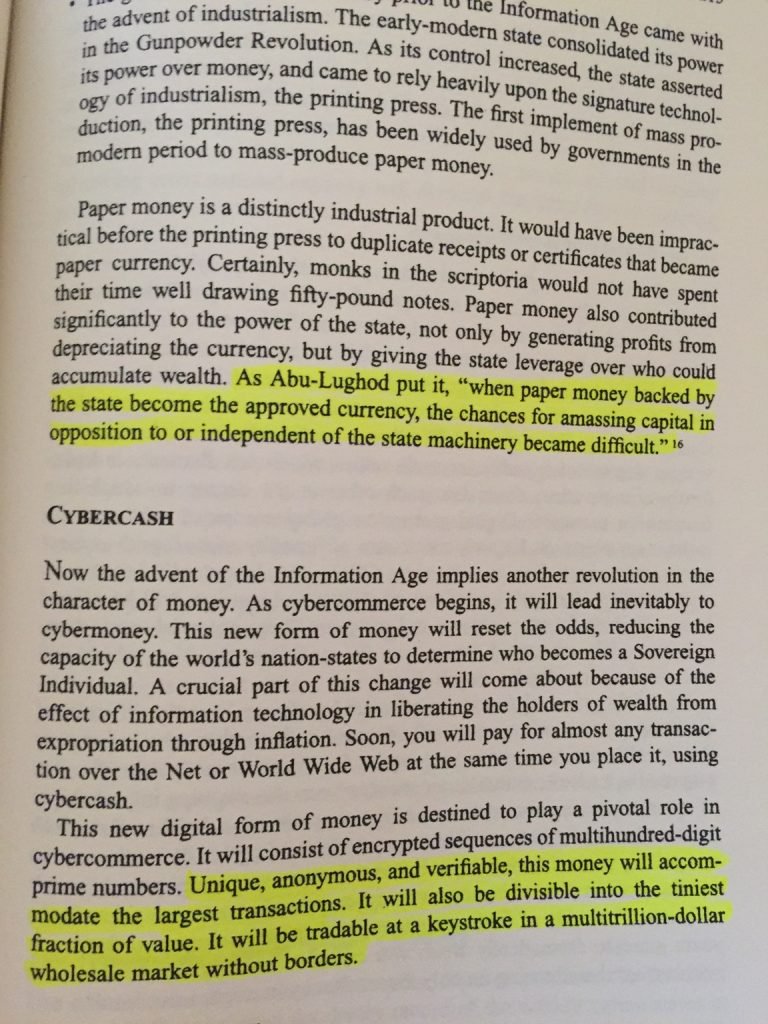

“Now the advent of the Information Age implies another revolution in the character of money,” a subsection at almost the exact middle of TSI, written in the late 1990s, starts. “As cybercommerce begins, it will lead inevitably to cybermoney. This new form of money will reset the odds, reducing the capacity of the world’s nationstates to determine who becomes a Sovereign Individual. A crucial part of this change will come about because of the effect of information technology in liberating the holders of wealth from expropriation through inflation,” they write.

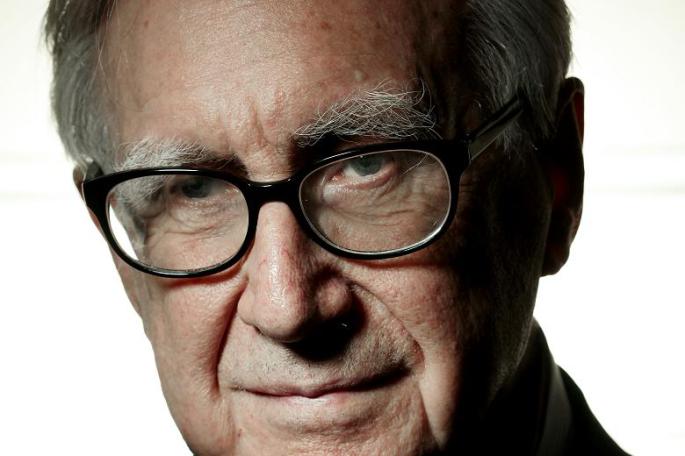

Lord William Rees-Mogg died in 2013 at the age of 84. He was a man of letters, having spent a notable stint as editor at the venerable Times of London, the youngest to have ever held the job. He was known throughout his life for adhering to the pinstripe suit long after everyone else had gone casual. He wrote by hand, even with the ubiquity of computers and word processors. He even refused to drive a car.

His editorials were filled with gems. When polite British society, of which he was surely a member, tutted at 60s boy band The Rolling Stones for their drug usage, and cheered their potential caging, his Lordship castigated, “If we are going to make any case a symbol of the conflict between the sound traditional values of Britain and the new hedonism, then we must be sure that the sound traditional values include those of tolerance and equity,” he wrote, defending the then-lads. The title of that defense bears reprinting, “Who Breaks a Butterfly on a Wheel?” He also wrote a great deal about economics, and was a fan of the gold standard.

He was around 67 years old when he and his co-author, Mr. Davidson, continued in TSI during the late 1990s, “Soon, you will pay for almost any transaction over the Net or World Wide Web at the same time you place it, using cybercash. This new digital form of money is destined to play a pivotal role in cybercommerce. It will consist of encrypted sequences of multi-hundred-digit prime numbers. Unique, anonymous, and verifiable, this money will accommodate the largest transactions. It will also be divisible into the tiniest fraction of value. It will be tradable at a keystroke in a multi-trillion-dollar wholesale market without borders,” they predict.

Crazy Exact Detail

James Dale Davidson, an American and a much younger man, is renown for making predictions, not all of which came about. He’s famously a Bill Clinton hater, but Mr. Davidson is best known for making the consistent prediction of the US economy being just this close to disaster. In 2008, of course, he was right. He’s a founder of the National Taxpayers Union, and is a frequent contributor to Newsmax.

Mr. Davidson met Lord Rees-Mogg while at Oxford nearly forty years ago. A chance encounter over antiquarian book searches ended up in a friendship and a working relationship lasting decades. It first evolved into newsletters, which then became books such as Blood in the Streets, The Great Reckoning, and, of course, The Sovereign Individual, the subject to which we return.

“Inevitably, this new cybermoney will be denationalized. When Sovereign Individuals can deal across borders in a realm with no physical reality, they will no longer need to tolerate the long-rehearsed practice of governments degrading the value of their money through inflation. Why should they? Control over money will migrate from the halls of power to the global marketplace,” the claim, again twenty years ago.

The Sovereign Individual is an argument, and a great deal of it presupposes an inchoate sense of American libertarianism upon the rest of the world. That’s problematic for a host of reasons, not least of which is, well, most of the world worships governance at various forms of state levels. Talk is incessant about what government should be doing, not how less of it should exist, and this has been a trend for as long as anyone can remember.

Free Money, Free People

That aside, Mr. Davidson and Lord Rees-Mogg believe a kind of 21st century clash of Western Civilization to be coming. Governments are inherently parasitical, taking from the productive classes and redistributing based upon favored groups. Governments are able to be this perverse middle-person, picking winners and losers, because of the power of its purse. A kind of borderless, untethered digital currency would be, if popularly adopted, its sure demise. The Atlas shrugging, if you will, of the world will begin as more of the productive sectors take their lives online, the book insists, and away from landed government.

All of human life will radically change under the rubric of encrypted technologies. Free from governmentalism, state nannies, and minders, the productive will be free to streamline goods and services and labor in ways previously not considered. Even government’s main reason for existence, the monopoly on violence, will be virtually done away with as a result.

Mr. Davidson and Lord Rees-Mogg make no bones about what might happen in the wake of government services, the welfare and warfare states, being diminished. It will not be pretty. At least the engine of society, its movers and shakers, the natural aristocracy, will be able to start civilization anew, going where they’re appreciated rather than being chained to ethnic or political country-persons.

Freeing money means freeing people. They explain, “Each transaction will involve the transfer of encrypted multi-hundred-digit prime number sequences. Unlike the paper-money receipts issued by governments during the gold-standard era, which could be duplicated at will, the new digital gold standard or its barter equivalents will be almost impossible to counterfeit for the fundamental mathematical reason that it is all but impossible to unravel the product of multi-hundred-digit prime numbers. All receipts will be verifiably unique,” which is so exactly spot-on it can take a reader’s breath.

“The verifiability of the digital receipts rules out this classic expedient for expropriating wealth through inflation. The new digital money of the Information Age will return control over the medium of exchange to the owners of wealth, who wish to preserve it, rather than to nation-states that wish to spirit it away.”

Plausibility

“Use of this new cybermoney will substantially free you from the power of the state,” becomes their almost anarchic thesis, though they do allow for government in pockets.

Bitcoin doesn’t require all of the above to work. It works on several levels, as governments could just as easily adopt a version and restrict pathways and physical transacting in any number of procedures. I do not believe it will snuff out fiat currency nor bring down governments. So on that score, I disagree with TSI, though I root for much of its conclusions.

Governments are unnecessary as they are evil, and they exist solely on their ability to bully and cajole. Try leaving. Try not paying taxes. Try to live just a tad outside of its vast laws. You’ll find quaint notions like consent of the governed to be a grave myth right up there with Santa Claus.

Bitcoin can a be a way to escape some of government’s machinations, for sure. However, governments are proficient in exactly two areas: expropriation and killing. The latter enforces the former. That a great many, perhaps the vast majority, of humans believe their very lives are the result of government policies also does not bode well for predicting its demise. Whatever the case, TSI borders on the brilliant, and as a thought experiment is well worth your time.

Do you think they predicted bitcoin? Let us know in the comments section below.

Images courtesy of Pixabay.

Need to know the price of bitcoin? Check this chart.

Disclaimer: This is an Op-ed article. The opinions expressed in this article are the author’s own. Bitcoin.com does not endorse nor support views, opinions or conclusions drawn in this post. Bitcoin.com is not responsible for or liable for any content, accuracy or quality within the Op-ed article. Readers should do their own due diligence before taking any actions related to the content. Bitcoin.com is not responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any information in this Op-ed article.

The post Twenty Years Ago, Two Men Predicted Bitcoin appeared first on Bitcoin News.