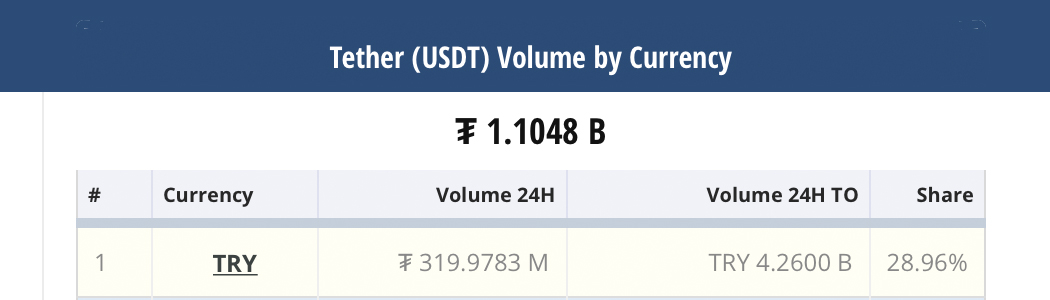

The Republic of Turkey’s economy and the country’s native fiat currency the Turkish lira continue to experience turmoil as inflation has risen to 36%. Since this time last year, the lira has lost 44% of its value against the U.S. dollar. Meanwhile, the use of stablecoins in Turkey has skyrocketed and today, 28.96% of all trades with tether are paired against the Turkish lira.

Inflation in Turkey Rises to the Highest Level in 19 Years, TRY Is Tether’s Top Pair Capturing 29% of All Trades, TRY Commands 7.20% of BUSD Trades

- Reports from the Turkish Statistical Institute on Monday detail that inflation in Turkey has soared to 36%, which is the highest rate it’s been in 19 years. Reuters explains that during the month of December a basket of consumer prices shot up to 13.58%.

- During the last 12 months, the Turkish lira has lost 44% of its value against the USD. The current inflation has never been higher during Tayyip Erdoğan’s rule. Just recently the nation’s central bank introduced a concept that encourages people to convert gold into lira time deposits.

- Turkey’s central bank has slashed the country’s benchmark interest rate down four months in a row. The rate cut in mid-December dropped the Turkish lira to a record low of 15.5 against the USD.

- 2021 has shown that demand for bitcoin (BTC) in Turkey has risen a great deal. At the time of writing, TRY represents 0.69% of all BTC trades and 0.72% of all ETH swaps.

- Turkey’s demand for stablecoins is much larger than the traditional crypto assets like BTC and ETH. Data shows on January 3, 2021, that the stablecoin tether’s (USDT) largest fiat trading pair is TRY with 29.42% of USDT swaps.

- The stablecoin issued by Binance BUSD has recorded 7.20% of all trades with the Turkish lira today and TRY is BUSD’s second-most traded pair. Turkey doesn’t use USDC much, as TRY only represents 0.36% of all USDC swaps today.

- Reports have shown that the lira’s sluggish year has contributed to a great deal of crypto-asset trades with the fiat currency. Turkish President Recep Tayyip Erdoğan, however, has clarified Turkey’s stance on cryptocurrencies and said “we have a separate war, a separate struggle against them.”

- Metrics indicate that the Turkish inflation is due to a number of factors including the cost of transportation, food and beverage costs, and household items “skyrocketing” in comparison to a year ago today.

- In addition to the gold conversion ploy, Erdoğan has urged Turkish businesses and high net worth individuals to help protect the country’s native currency. “As long as we don’t take our own money as a benchmark, we are doomed to sink. The Turkish lira, our money, that is what we will go forward with. Not with foreign currency,” Erdoğan stated on Friday.

What do you think about Turkey’s inflation soaring to 36% and the country’s demand for stablecoins? Let us know what you think about this subject in the comments section below.