Bitcoin traders have been betting for years the largest cryptocurrency by market cap could serve as an effective hedge against inflation. That’s why they’ll be watching Wednesday as the U.S. Labor Department publishes its Consumer Price Index (CPI) report for December.

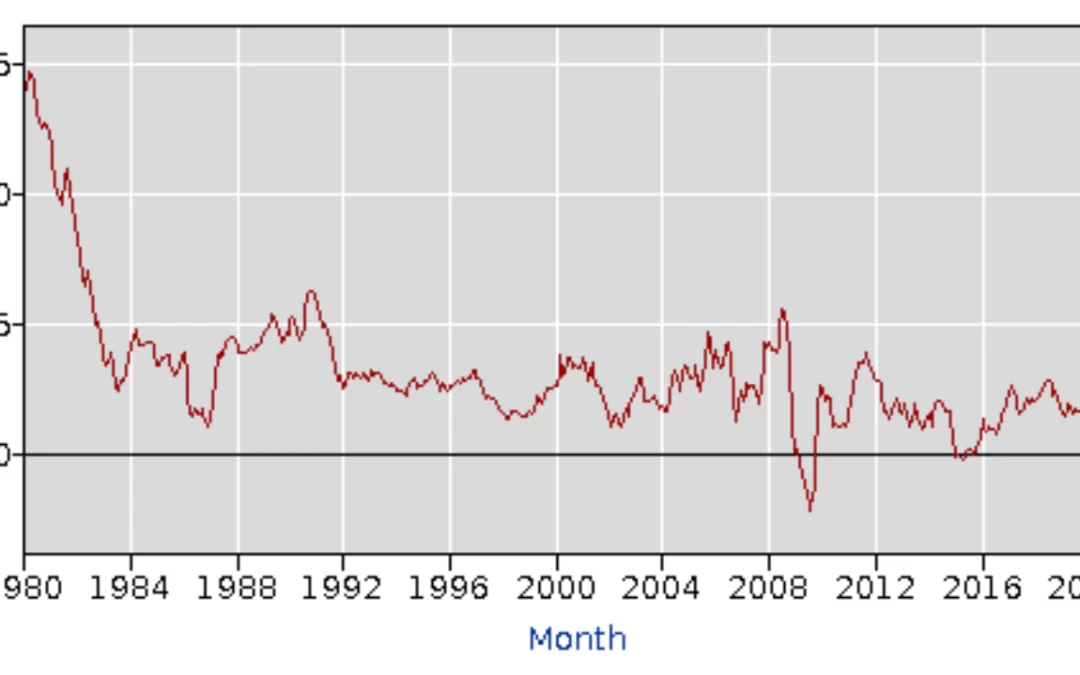

The widely followed CPI, scheduled for release at 8:30 a.m. ET (13:30 UTC), is expected to show an acceleration in inflation, already at the highest point in 39 years, from the prior month.

A faster-than-expected uptick in prices could spur the Federal Reserve to tighten monetary policy aggressively over the next few months. That, in turn, could put more downward pressure on risky assets from stocks to bitcoin (BTC) and other cryptocurrencies.

The CPI is estimated to have risen 7.1% in the 12 months through December, according to data from FactSet. On a month-to-month, seasonally adjusted basis, the headline index probably rose 0.4%.

The core CPI, which excludes food and energy movements, is forecast to rise 0.5% month over month.

The report will be of special interest for the cryptocurrency investors who look at bitcoin as a hedge against inflation. The U.S. inflation rate surged to 6.8% in November, the highest since 1982.

Bitcoin prices quadrupled in 2020 and rose about 60% last year when traders said the Fed’s loose monetary policies could ultimately lead to a fast climb in consumer prices.

But as inflation ticked up, and Fed officials signaled they would move aggressively to tackle inflation, the price trend has reversed: Bitcoin is down more than 13% over the past 30 days.

Here is what some experts expect from Wednesday’s report:

- Daniel Bachman, U.S. economic forecaster at Deloitte Insights, told CoinDesk: “I would expect the December CPI to remain fairly high. … But what’s more important is that these supply chain pressures are temporary and are already showing a few signs of easing. … By the middle of 2022 I expect CPI inflation to be in the 2.0% to 2.5% range.”

- Craig Erlam, senior market analyst at Oanda, in a market update: “I’m not sure the inflation data tomorrow is going to put investors’ minds at ease, with CPI seen hitting a multi-decade high above 7%. A higher reading could spook investors once again just as equity markets appear to be stabilizing.”

What this could mean for bitcoin:

- Yuya Hasegawa, crypto market analyst at bitbank: “According to the CME’s FedWatch, almost 70% of the market participants are expecting the March rate hike, so bitcoin may be able to defend $40K in case of another sell-off, but it certainly is not the time for optimism in the short run.”

- Scott Bauer, chief executive officer at Prosper Trading Academy: “With regards to BTC, the risk-off overhang is front and center. It does appear as if institutions are ready to pounce as leverage has been getting slowly flushed out of the system, even with outflows the last few weeks of institutional funds being fairly large. The downward move in BTC over the last few weeks has happened on low volume, which could lead to the possibility of a huge short covering event.”

“The key thing in reading tomorrow’s release is to understand the underlying causes of the current inflation, rather than focusing on the actual number,” Erlam said.