The aggregate total value locked (TVL) in the crypto market measures the amount of funds deposited in smart contracts and this figure declined from $160 billion in mid-April to the current $70 billion, which is the lowest level since March 2021. While this 66% contraction is worrying, a great deal of data suggests that the decentralized finance (DeFi) sector is resilient.

The issue with using TVL as a broad metric is the lack of detail that is not shown. For example, the number of DeFi transactions, growth of layer-2 scaling solutions and venture capital inflows in the ecosystem are not reflected in the metric.

In DappRadar’s July 29 Crypto adoption report, data shows that the DeFi 2Q transaction count closed down by 15% versus the previous quarter. This figure is far less concerning than the devastating TVL decline and is corroborated by a 12% drop in the number of unique active wallets in the same period.

Layer-2 is the path for sustainable DeFi growth

Iakov Levin, CEO and founder of Midas Investments told Cointelegraph that:

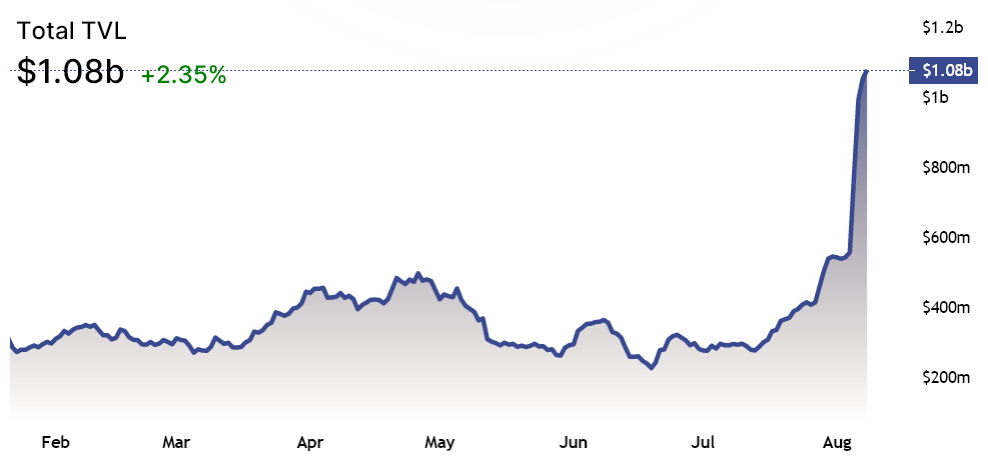

“I am firmly convinced that the current bear market is not the ‘end’ of the DeFi industry. For instance, there is a growing competition amongst decentralized exchanges on layer-2 Ethereum scaling platform Optimism, as Velodrome reached more than $130 million in TVL.”

Optimism is an Ethereum scalability solution using layer-2 to bundle transaction verifications off-chain, reducing the processing and transaction cost for decentralized applications on the network.

Venture capital inflows further support the resilience of DeFi thesis. On July 12, the crypto-centric Multicoin Capital launched a $430 million fund. The investment managing firm was founded in 2017 and aims to focus on developing Web3 infrastructure, DeFi applications and autonomous business models.

On July 28, Variant announced a successful $450 million capital increase to fund, among others, “financial empowerment through DeFi.” The strategy includes the financialization and productivity of NFTs, stablecoins, lending optimizers, DEX aggregators and “products that bridge the legacy financial system with DeFi.”

These significant-size fund raises lead Levin to believe that scaling solutions will take decentralized finance applications to the next level in a way that was not possible during the so-called “DeFi Summer 2.0” in the 3Q of 2021. The average Ethereum network transaction fee during that period stood above $25, making it almost impossible for the applications to gain traction. Midas Investments CEO Levin said:

“Ultimately, I see layer-2 as a potential factor for reviving the sector’s growth. This will be driven by the scalability rise due to the optimistic and zk-Rollups solutions implementation. By providing users with cheaper transaction fees and near-instant semi-confirmations, layer-2 will dramatically improve user experience and will soon have the capacity to onboard a new wave of users.”

Metamask Swap and 1inch Network stand out

The number of active addresses using DeFi applications has held reasonably stable over the past 30 days, according to data from DappRadar.

Data shows an average 2% drop in active addresses, but four out of the top fiv applications presented growth. In addition, DEX aggregators 1inch Network and MetaMask posted considerable user gains, thus invalidating concerns of a “DeFi winter.”

In a nutshell, the decentralized finance industry continues to grow in the number of active addresses, venture capital investments and innovative solutions offering cheaper and faster processing capabilities compared to the last peak in late 2021.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.