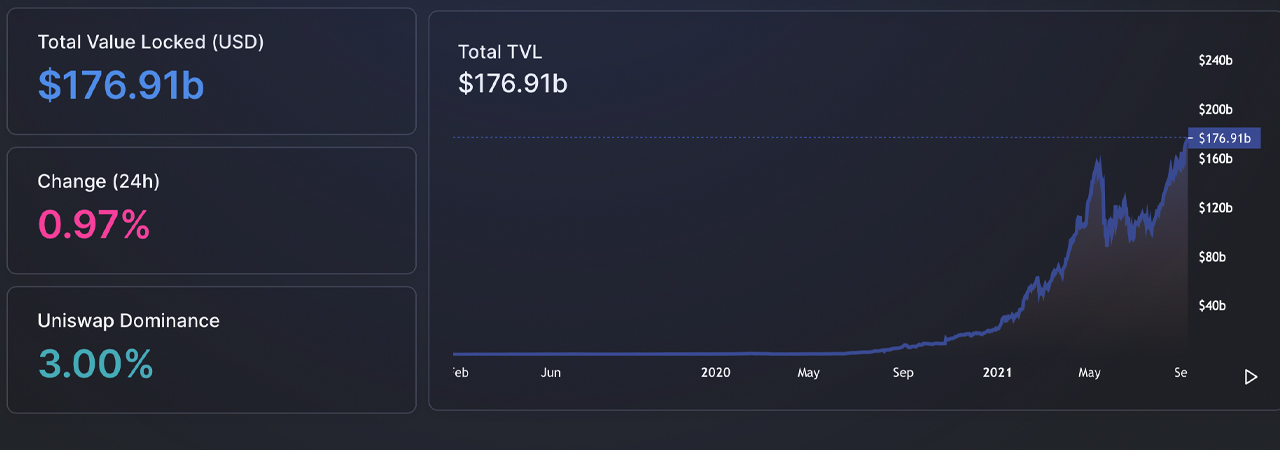

At the time of writing, the total value locked (TVL) in decentralized finance (defi) is around $176 billion across various blockchains like Ethereum, Binance, Terra, Polygon, Solana, and Avalanche. While Ethereum commands $130 billion of the aggregate total locked, a myriad of other defi-fueled blockchains continue to see TVLs steadily rise.

Total Value Locked Across All Defi Compatible Blockchains

The total value locked (TVL) in defi today has risen to $176.9 billion with a change of 1.07% during the last 24 hours, according to defillama.com statistics. The TVL has been steadily nearing the $200 billion zone and today Uniswap commands 3% dominance among the variety of defi applications. The defi application Aave commands $16.04 billion and Curve captures $13.92 billion today as most of the TVL is locked into application bolstered by the Ethereum chain.

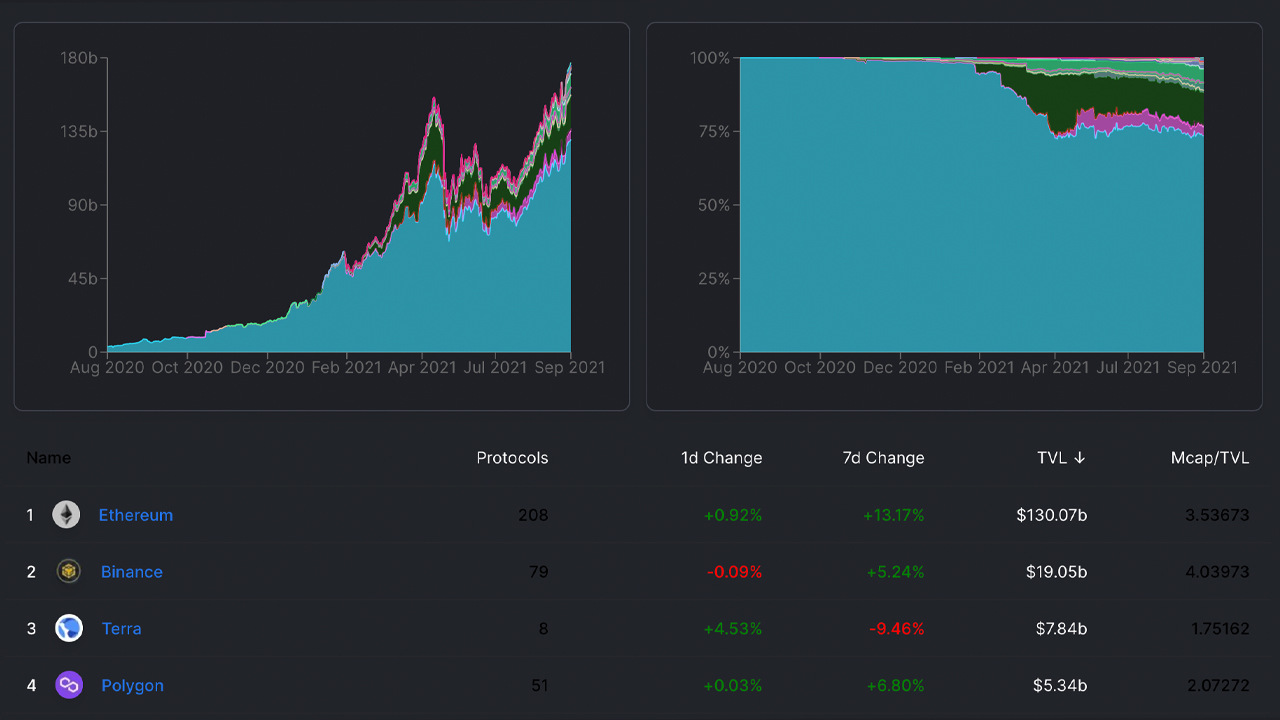

A number of other chains, however, have been contributing billions to the overall defi TVL. While Ethereum (ETH) has around $130.07 billion on Sunday, the Binance Smart Chain (BSC) has around $19.05 billion TVL. This is followed by Terra ($7.84B), Polygon ($5.34B), Solana ($4.3B), Avalanche ($2.36B) and Klaytn ($1.29B). The latest launch of the Arbitrum mainnet scaling solution for Ethereum has approximately $2,343,531 TVL on Sunday.

As far as decentralized exchange (dex) platforms are concerned, Curve has the most TVL today with $13.92 billion followed by the BSC-powered Pancakeswap with $5.94 billion and Uniswap has $5.3 billion TVL. For just the Ethereum chain alone, among 16 different dex platforms, Dune Analytics dex stats show there’s been $19 billion in global swaps during the last seven days. $2.24 billion in 24 hours and Uniswap commands 69.2% of all the dex volume across 16 dex platforms.

if (!window.GrowJs) { (function () { var s = document.createElement(‘script’); s.async = true; s.type=”text/javascript”; s.src=”https://bitcoinads.growadvertising.com/adserve/app”; var n = document.getElementsByTagName(“script”)[0]; n.parentNode.insertBefore(s, n); }()); } var GrowJs = GrowJs || {}; GrowJs.ads = GrowJs.ads || []; GrowJs.ads.push({ node: document.currentScript.parentElement, handler: function (node) { var banner = GrowJs.createBanner(node, 31, [300, 250], null, []); GrowJs.showBanner(banner.index); } });

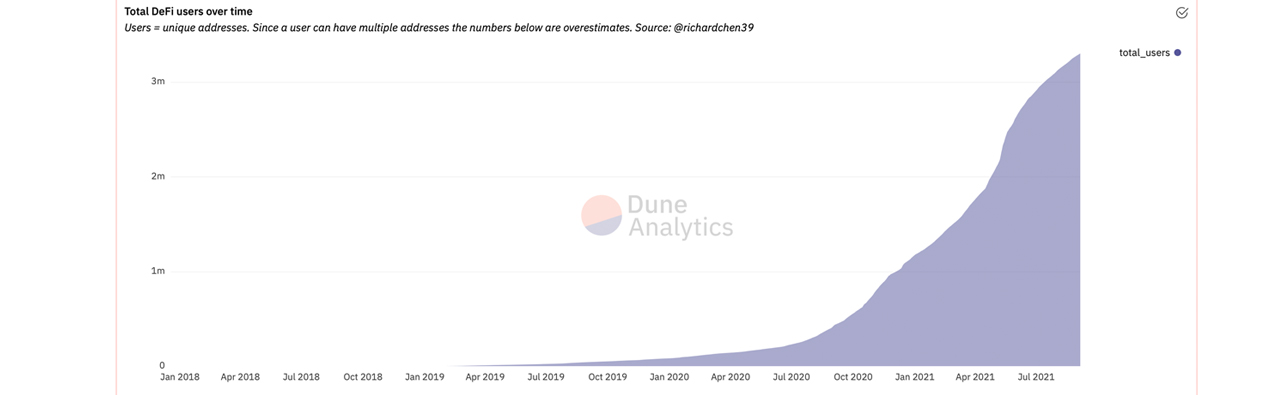

Uniswap Remains Ethereum’s Top Dex, Unique Defi Addresses Rise to 3.3 Million

Seven-day stats show Uniswap exchanged approximately $12,952,621,793 in global trades. 88% of the volume stems directly from dex applications but the rest of the volume (11.7%) are funneled through dex aggregators like 1inch, 0x API, Matcha, and Paraswap. The number of defi users or unique addresses across Ethereum-based defi apps is 3.3 million. The biggest lending apps today include platforms like Aave, Compound, Anchor, Venus, and Cream Finance respectively.

As far as yield-based TVL rankings on defillama.com are concerned, Convex Finance holds the top position on Sunday. This is followed by Yearn Finance, Alpaca Finance, Tranches, and Autofarm. The largest defi asset in terms of TVL is wrapped bitcoin (WBTC) with $10.05 billion locked. The second-largest defi asset is hbtc (HBTC) with $1.74 billion and mirror (MIR) with $1.01 billion.

What do you think about the defi TVL growth across various blockchains? Let us know what you think about this subject in the comments section below.