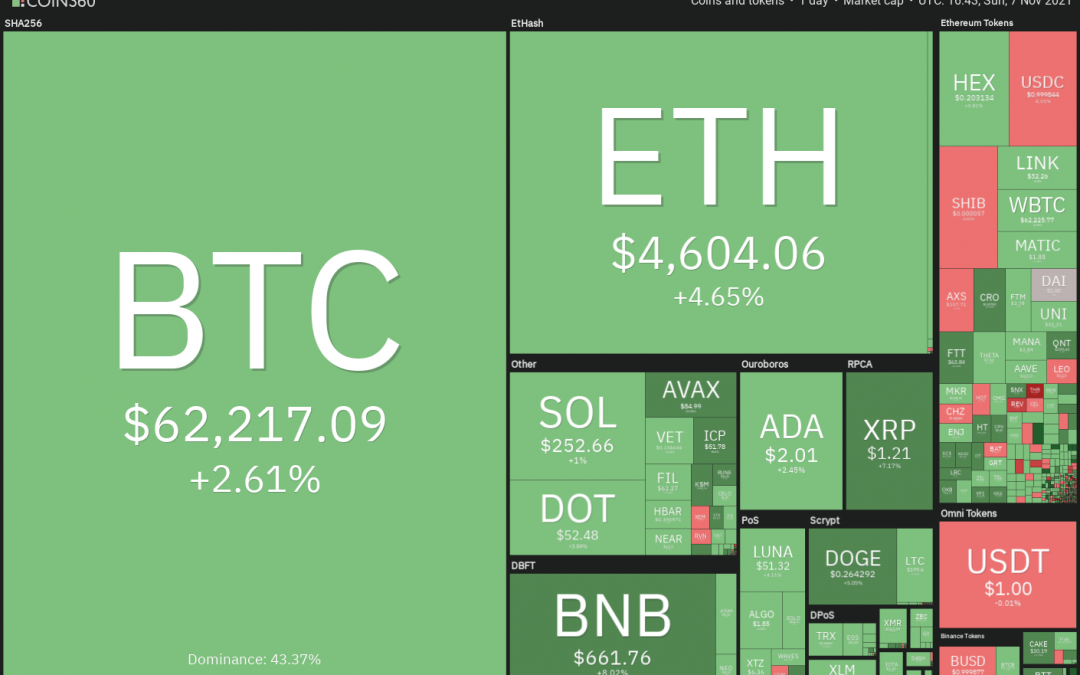

Bitcoin’s (BTC) dominance has dropped from about 48% on Oct. 20 to 42.3% on Nov. 7 while the total crypto market capitalization has continued its northward journey. This indicates that the price action has shifted from Bitcoin to altcoins.

CryptoQuant CEO Ki Young Ju said that Bitcoin whales are selling but this has not resulted in the breach of the strong support at $60,000. He also pointed out that Bitcoin reserves across exchanges have continued to decrease, indicating strong appetite from buyers.

The majority of the market participants remain bullish on Bitcoin and anticipate a rally to $288,000 by the start of 2022, according to a survey conducted by PlanB.

Real Vision founder Raoul Pal also projected a bullish picture for cryptocurrencies in an interview on Nov. 3. He said the current bull run is unlikely to top out in December of this year and may extend to between March and June of the next year. Pal anticipates the possible launch of Ethereum 2.0 and the likelihood of an Ether (ETH) exchange-traded fund being green-lit in the first half of 2022 will attract institutional investors and trigger a massive rally.

In this bullish backdrop, let’s analyze the charts of the top-5 cryptocurrencies that may remain in focus and outperform in the short term.

BTC/USDT

Bitcoin broke above the bullish flag pattern on Nov. 2 but the buyers could not capitalize on this move and push the price above the overhead resistance zone at $64,854 to $67,000. This indicates the bears have not yet given up and are attempting to stall the up-move.

However, a positive sign is that bulls are aggressively defending the 20-day exponential moving average ($60,794). The buyers will make one more attempt to push the price above the overhead resistance zone.

If they can pull it off, the bullish momentum may pick up and the BTC/USDT pair is likely to rally toward the pattern target at $89,476.12.

This bullish view will invalidate if the price breaks and dips back into the flag pattern. The pair may then drop to the 50-day simple moving average ($54,883). The zone between the 50-day SMA and $52,920 is likely to attract strong buying support from the bulls.

The 4-hour chart shows the pair is range-bound between $63,732.39 and $59,500. The flat moving averages and the relative strength index (RSI) just above the midpoint indicate a balance between supply and demand.

If the price rebounds off the moving averages, the bulls will again attempt to propel the price above the overhead resistance zone between $63,732.39 and $64,270. If they manage to do that, the pair may retest the all-time high.

Conversely, a break below the moving averages could pull the pair to the strong support zone at $59,500 to $58,000. The bears will gain the upper hand if this zone is breached. The pair could then correct to $55,267.61.

DOT/USDT

Polkadot (DOT) soared and broke above the overhead resistance at $49.78 on Nov. 1. The RSI broke above the downtrend line, invalidating the negative divergence. This suggests the resumption of the uptrend.

The bears tried to pull the price back below the breakout level on Nov. 6 but the long tail on the candlestick shows that bulls are buying on dips. The rising moving averages and the RSI near the overbought zone indicate the path of least resistance is to the upside.

If bulls thrust the price above $55.09, the DOT/USDT pair could rally to $63.08. The bears may have other plans as they will attempt to sink the price below the breakout level at $49.78. Such a move will suggest a lack of buyers at higher levels.

A break and close below the 20-day EMA ($46.82) will be the first sign that the bulls may be losing their grip. The pair could then drop to the 50-day SMA ($38.54).

The 4-hour chart shows that the pair is rising inside an ascending channel. Although bulls pushed the price above the channel, they have not been able to build upon the advantage. This indicates that the bears are defending this resistance with vigor.

The pair rebounded from the centerline of the channel and the bulls will again try to clear the overhead hurdle. If they succeed, the pair may pick up momentum.

Alternatively, if the price turns down from the current level or the overhead resistance and breaks below the centerline, the pair may drop to the support line. A bounce off this level will keep the uptrend intact but a break below it will signal a possible change in trend.

LUNA/USDT

Terra protocol’s LUNA token broke and closed above the overhead resistance at $49.54 on Nov. 4. The bears tried to pull the price back below the breakout level on Nov. 5 and 6 but could not sustain the lower levels. This suggests that the bulls are buying on dips.

If bulls drive the price above $53.18, the LUNA/USDT pair could rally to the resistance line of the wedge where the bears are expected to mount a stiff resistance. The bullish momentum could pick up if bulls thrust the price above the wedge.

Alternatively, if the price turns down from the current level or the overhead resistance, the pair may drop to the support line of the wedge. A break and close below this support will signal a possible change in trend. The pair could then drop to $35.

The bulls pushed the price above the resistance line of the triangle indicating that they had overcome the resistance from the bears. The sellers tried to pull the price back into the triangle but the bulls defended the breakout level aggressively.

Both moving averages on the 4-hour chart are sloping up and the RSI is in the positive territory, indicating advantage to buyers. If bulls drive the price above $53.18, the pair may rally to the pattern target at $62.59.

Related: Bitcoin consolidates right below Fib level that triggered 2013 all-time highs

AVAX/USDT

After trading near the overhead resistance at $79.80 for the past three days, Avalanche (AVAX) has broken above the barrier. This indicates the possible resumption of the uptrend.

The rising moving averages and the RSI in the overbought territory indicate that bulls are in control. If the price sustains above $79.80, the AVAX/USDT pair could rally to $93.04 and then try to challenge the psychological level at $100.

Contrary to this assumption, if the price turns down from the current level and dips back below $79.80, it will suggest that markets have rejected the higher levels. The pair could then drop to the 20-day EMA ($69.51).

The 4-hour chart shows the formation of a rounding bottom pattern which completed on a breakout and close above $79.80. If bulls sustain the price above $79.80, the pair could start its northward march toward the pattern target at $108.56.

The first important level to watch on the downside is $79.80. A bounce off this level will indicate that bulls are aggressively buying on dips and that will increase the likelihood of the resumption of the uptrend.

Conversely, a break below $79.80 could sink the pair to $72. A break below this support will suggest that bears are back in the game.

EGLD/USDT

Elrond (EGLD) broke above the previous all-time high at $303.03 on Nov. 3, which is a positive sign. The bears tried to pull the price back below the breakout level on Nov. 5 and 6 but failed.

This suggests that bulls are attempting to defend the breakout level and flip it into support. A break and close above $329 will signal the resumption of the uptrend. The rising 20-day EMA ($281) and the RSI near the overbought zone indicate the path of least resistance is to the upside.

Contrary to this assumption, if the EGLD/USDT pair turns down from the current level and breaks below $303.03, the next stop could be the 20-day EMA. A strong rebound off this support will keep the uptrend intact but a break below it could open the doors for a deeper correction to the 50-day SMA ($249).

The 4-hour chart shows the formation of an ascending triangle pattern, which completed on a break and close above $303.03. This positive setup has a pattern target at $427 but the rally may not be linear as the bears are likely to pose a stiff challenge at $355.

A break below the 20-EMA will be the first sign of weakness. That could pull the price down to the breakout level at $303, which is an important support for the bulls to defend. If this support cracks, the pair may drop to the 50-SMA and then to the trendline of the triangle.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk, you should conduct your own research when making a decision.