It was the best of times, it was the worst of times. From the hubris and excess of the North American Bitcoin Conference to the gloominess of the crypto markets, it’s been a feel-o-coaster of a week. Fear, uncertainty and doubt were the overarching emotions amidst a turbulent seven days, but there was also space for cheer, schadenfreude and disbelief. Welcome to another week in bitcoin.

Also read: Blockchain Rolls Out Trading Feature for 22 States in the U.S.

High Drama Amidst Low Prices

This week in bitcoin managed to cram in more drama than a Mexican telenovela, with major market drama, regulatory drama, and Ponzi drama to name but three. Things started smoothly enough, with our leading story, as Monday broke, addressing the fact that 80% of all bitcoins have now been mined. Traditional media picked that one up and ran with it. Appreciation of bitcoin’s scarcity failed to stop the rot though, as bitcoin started to slide, taking the rest of the cryptocurrency market down with it.

This week in bitcoin managed to cram in more drama than a Mexican telenovela, with major market drama, regulatory drama, and Ponzi drama to name but three. Things started smoothly enough, with our leading story, as Monday broke, addressing the fact that 80% of all bitcoins have now been mined. Traditional media picked that one up and ran with it. Appreciation of bitcoin’s scarcity failed to stop the rot though, as bitcoin started to slide, taking the rest of the cryptocurrency market down with it.

Everyone had a theory behind the slump that saw bitcoin drop below the champagne threshold of $10k for the first time since early December. It was a price bracket that many thought we’d never see again. Theories postulated included threats to ban crypto in South Korea, threats of China cracking down further on bitcoin mining, historical data which shows bitcoin always performs badly in January, or the fact that bitcoin was “overbought” in the run-up to CME and Cboe futures launching last month, and thus a correction was necessary. Some people even chose to blame falling markets on the cycles of the moon, which seems as good a theory as any.

It Came From Korea

It’s impossible to review a week in bitcoin without acknowledging Korea, so here goes: our most popular story concerned government officials profiting on advance knowledge of regulatory action. That’s right, insider trading. Everyone seems to be at it, though it doesn’t require a man on the inside – simply the ability to sense a storm coming, as futures traders appear to have done, according to Eric Wall. He notes “there was an unusual increase in short positions around January 11. At the same time, the price was just bouncing around in the 12800-14200 range.” In other words, the markets looked normal, but futures traders had an inkling that something was brewing.

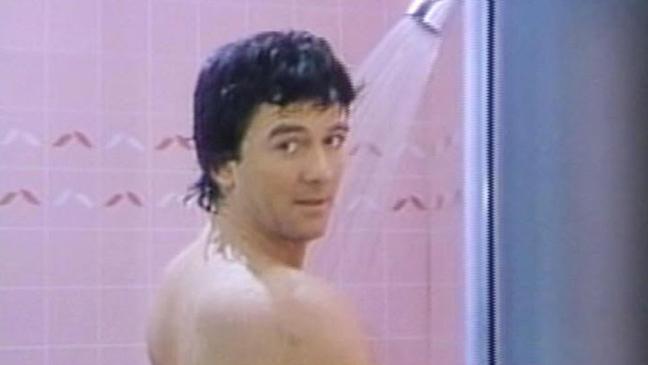

On Wednesday, every asset in the cryptocurrency top 100 was in the red. 24 hours later and we were back to fields of green. It was a non sequitur the likes of which hasn’t been since 1986 when Dallas’ Bobby Ewing reappeared in the shower after having been killed off in the previous season. In the words of Biggie Smalls, it was all a dream. The dreaming didn’t last for long unfortunately, as by the weekend the market revival had died out and we were back in the low eleven-hundreds. Quick, someone order more tethers.

Bitcoin Gets a Haircut, Bitconnect Gets Scalped

If bitcoiners thought they had it bad, they should spare a thought for bitconnectors. All those with their wealth locked up in the Church of Ponzi had their assets savagely crushed from $290 a token to $18. It would be heartening to say that everyone who got duped by Bitconnect has learned their lesson, but judging by the number of “victims” who are now piling into the Bitconnect X ICO or Davorcoin – yet another Ponzi – the signs aren’t encouraging.

To finish this week’s highlights, of which there are too many to list as usual, we have another tale from South Korea, suggesting that normal banking service may soon be resumed for cryptocurrency exchanges, which is just as well given the rate at which new exchanges are springing up in the country. While the mantle of crypto-friendliest Asian nation resides with Japan for now, in Europe, Belarus is staking a claim as a new haven for crypto’s rax averse.

If you’ve had the temerity to skip straight to the end of this review for the This Week in Bitcoin podcast, here it is. In it you’ll get the tl;dr on this week’s burning stories, delivered by your amiable host Matt Aaron. Catch you next week for more highlights from the heart-stopping world of bitcoin.

What was your favorite story from this week in bitcoin? Let us know in the comments section below.

Images courtesy of Shutterstock and Dallas.

Need to calculate your bitcoin holdings? Check our tools section.

The post This Week in Bitcoin: Up, Down and Sideways appeared first on Bitcoin News.