It would be an unusual week in bitcoin where there weren’t glum tidings to report, be it an exchange hack, regulatory clampdown, or edict from the east. It just so happens that this week witnessed all three – and on the same day, no less. You could call it bad luck, or you could call the event, which sent bitcoin below $9,000, where it’s flirted ever since, a black swan: a random occurrence that is impossible to predict.

Also read: Anecdotal Reports Suggest Google is Cracking Down on ICO Advertising

A Triumvirate of Black Swans Descend

They say that bad luck comes in threes, and on Wednesday bitcoin was struck by a triple whammy which sent prices tumbling. This perfect storm of negative news came in the form of an SEC statement on unregulated exchanges, reports of Japanese regulators shutting down exchanges, and a major incident at Binance in which compromised user accounts were used to manipulate the price of viacoin. As is often the case, these stories were not as gloomy as the market initially interpreted them.

The SEC has been bumping its gums about crypto for weeks, as regulators are wont to do, and there was nothing in its latest report which heralded impending doom for cryptocurrency exchanges. Similarly, it turns out that the Japanese watchdog wasn’t wielding the banhammer indiscriminately; rather it was focusing on a couple of small, unlicensed exchanges whose existence has little bearing on the nation’s cryptocurrency trade. Finally, the Binance incident ended happily, with the fraudulent trades reset and balances restored. Not only did the attackers fail to profit, but they actually wound up losing out on the scam.

The SEC has been bumping its gums about crypto for weeks, as regulators are wont to do, and there was nothing in its latest report which heralded impending doom for cryptocurrency exchanges. Similarly, it turns out that the Japanese watchdog wasn’t wielding the banhammer indiscriminately; rather it was focusing on a couple of small, unlicensed exchanges whose existence has little bearing on the nation’s cryptocurrency trade. Finally, the Binance incident ended happily, with the fraudulent trades reset and balances restored. Not only did the attackers fail to profit, but they actually wound up losing out on the scam.

East v West

Regulatory stories have dominated the news cycle once again, and most of them were American. The tone coming from the west versus that from the east has been tangibly different. This week alone, Asia has brought us news of a South Korean travel site accepting a dozen cryptos as payment and a Taiwanese airline following suit. When was the last time we had a major U.S. or European retailer announce support for bitcoin? Instead of merchant adoption, all we seem to hear is pronouncements on how ICOs are liable for class action lawsuits and cryptocurrencies are commodities. But what about all the good things bitcoin did?

In fairness to regulators, they’re just doing their job, even if their overzealousness is causing investors to become more confused than ever about what exactly they’re buying into. The truth is, officials from competing agencies don’t know what to make of crypto, and until they can multilaterally reach a consensus, perhaps they should refrain from issuing contradictory decrees.

If You Can’t Join Them, Beat Them

One of this week’s more popular stories concerned Paypal filing an “expedited cryptocurrency transaction system”. We’re starting to see this sort of thing a lot: “enemies” of bitcoin filing bitcoin-like patents as a means of hedging their bets and staying relevant. It’s no coincidence that Paypal shares jumped 5% off the news. Whatever the payment processing company are plotting, a proprietary cryptocurrency seems unlikely at this stage, with CEO Dan Schulman declaring, in a recent talk:

Regulations need to be sorted out and a whole number of other things. [Crypto is] an experiment right now that is very unclear which direction it will go.

One experiment which didn’t go down well was the decision of Mt Gox’ creditor to dump a ton of BTC onto exchanges. The coins were liquidated over a period of several months, but in each case their release caused the price of bitcoin to drop, such was the volume of coins being sold at market prices. As a consequence, some of Gox’ original victims found themselves rekt again after their long positions were suddenly wiped out. Why couldn’t the coins have been sold in an OTC deal? It’s a question that many people, including Kraken CEO Jesse Powell, have been wondering.

Some Light Relief and Not Before Time

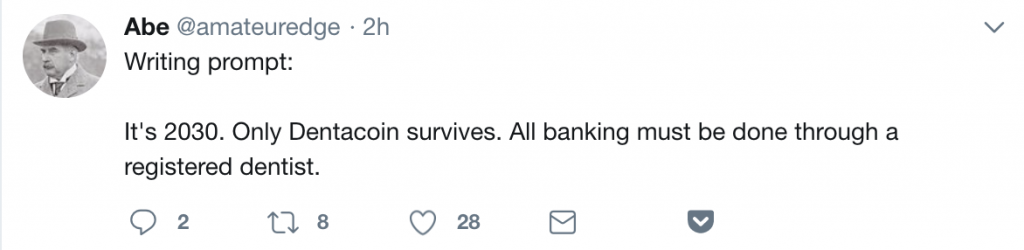

In those weeks where bitcoin, alts, and every other crypto asset is getting pummeled to death, any light relief is gratefully received. It came from the story of decentralized banking ICO Miroskii and its intriguing project team, led by Ryan Gosling. That, and the story of Bitcoin.org co-owner Cobra, who was accused of switching sides after declaring his support for bitcoin cash, were the closest we got to humor – unless you count the shocking performance of Chinese shitcoins, which is only funny if you’re not holding Asian alt bags.

This is crypto, so who knows what next week’s gonna bring, but if we had to wager a few satoshis, we’d say regulation, more regulation, and another bearish statement from the SEC. Only Silk Road kids will remember this, but there was once a time when the only thing officials were getting hot and bothered over was the possibility of bitcoin being used to purchase drugs. How time flies and priorities change.

What was your favorite story from this week in bitcoin? Let us know in the comments section below.

Images courtesy of Shutterstock, and Twitter.

Need to calculate your bitcoin holdings? Check our tools section.

The post This Week in Bitcoin: Black Swans appeared first on Bitcoin News.