About $7.65 billion entered the cryptocurrency market in just three hours via a widely unknown altcoin on Monday.

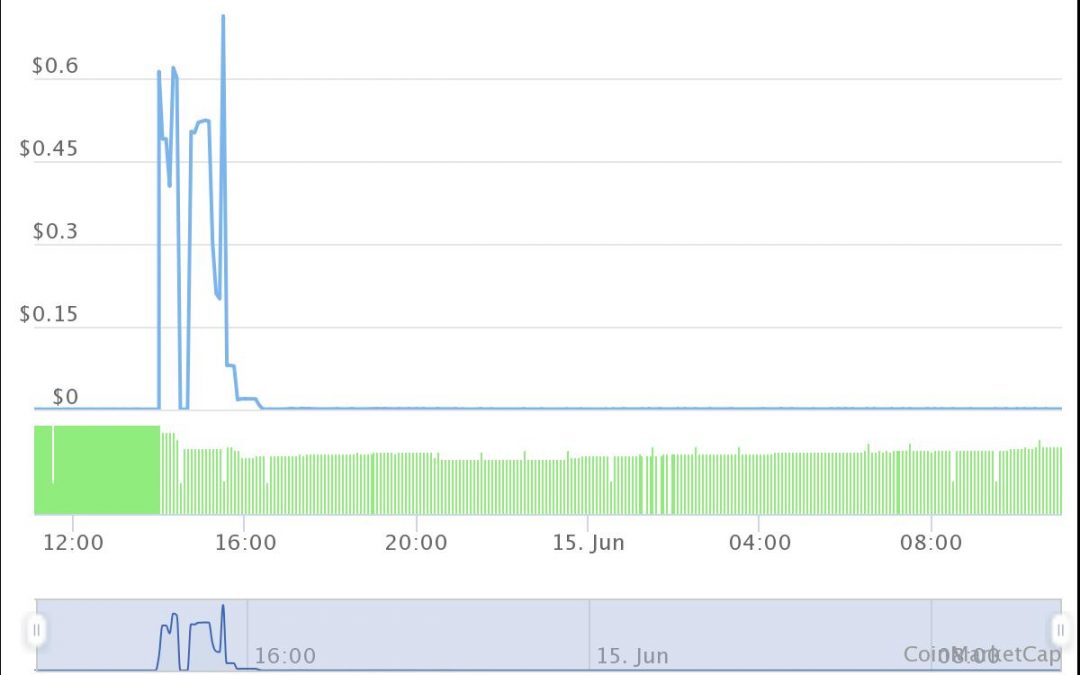

Dubbed as WebDollar (WEBD), the token’s per-unit price surged from $0.0003711 to $0.6121 between 9:00 GMT and 12:00 GMT. That marked a little over 164,842% gains in its market valuation. Nevertheless, the price spike accompanied declines in volumes; they dropped from around $345,000 to $318,940 during the rally.

Breaking down those three hours of wild price action illustrated a sequence of incredible pumps and dumps.

According to data fetched by CoinMarketCap, the first WEBD jump took its market capitalization from $1.84 million at 9:54 GMT to $1.5 billion at 9:59 GMT — that’s just three minutes.

Later, as of 10:39 GMT, the market capitalization fell back to $5.12 million, followed by another spike to $9.5 billion at 11:29 GMT.

At one point in time, WebDollar had become the 18th largest cryptocurrency project by market cap, beating more established blockchain protocols such as Stellar, VeChain and Tron.

But then, the volatile madness came to an end as the token’s market valuation crashed by more than 99% less than two hours after topping at $9.5 billion. As of 7:00 GMT on Tuesday, it was $10.38 million. Meanwhile, WebDollar’s crypto ranking fell from 18th to 873rd.

The IndoEx factor

WebDollar’s price action on Monday showed characteristics of a pump-and-dump token. Apprehensively, the project’s market capitalization sprinted upward and downward by multi-billion dollars even as its trading volume remained confined within the $400,000 range. And looking closely, 99.23% of its trading activity originated from a single exchange called IndoEx.

IndoEx LTD is registered in the United Kingdom under company number 12029621. The exchange is said to be headed by a person named Spencer Collins, who serves as its CEO and chief financial officer. Another entity, called Grace North, currently serves as IndoEx’s chief technology officer.

Cointelegraph’s attempt to locate the two executives on LinkedIn and Twitter returned no results. Meanwhile, a run through IndoEx’s reviews by its previous customers showed them accusing both Spencer and North of bearing fake identities.

‘Spencer Collins (CEO/CFO), Grace North (CTO) is fake person, work as support in telegram chat,” wrote Leo99 in his grievance on Bitcoin forum BitcoinTalk.org. “Continually postpone solving all problems for the future or ignore messages.”

A deeper look into IndoEx LTD’s official filings with the U.K. Registrar office showed that it received a First Gazette Notice in November 2020 for not sharing details about its shareholders. The company responded to the authority with only one name, Collins Spencer, who holds 1,200 shares, hinting that IndoEx is an individually-owned company.

The U.K. Registrar later struck off the notice against IndoEx LTD. Nonetheless, the exchange continues to operate without approval from the U.K. Financial Conduct Authority (FCA).

The research led to three key takeaways:

- The WEBD price pump-and-dump originated from one exchange called IndoEx, operating under a U.K.-registered entity called IndoEx LTD.

- Collins Spencer, the only stakeholder in the company, does not exist anywhere on social media.

- IndoEx’s Linkedin profile boasts about having 10–50 employees, but only three of them are using the business-oriented social media service. All of them have hidden LinkedIn profiles and are from Indonesia, not the United Kingdom.

Evidence so far points that IndoEx was instrumental in single-handedly pumping and dumping the WEBD token on Monday. The token was trading flat during Tuesday.