Bitcoin’s price continues to hover just above $9,200, but two key signals suggest the top cryptocurrency is super bullish for a nice rally to $12,000

Bitcoin is currently hovering in a region that has acted as a major support zone for the past two months. While the bears are capable of pushing prices to lows of $9,000, and even $8,600 in the short term, two fundamental Bitcoin indicators suggest the benchmark cryptocurrency is seriously bullish.

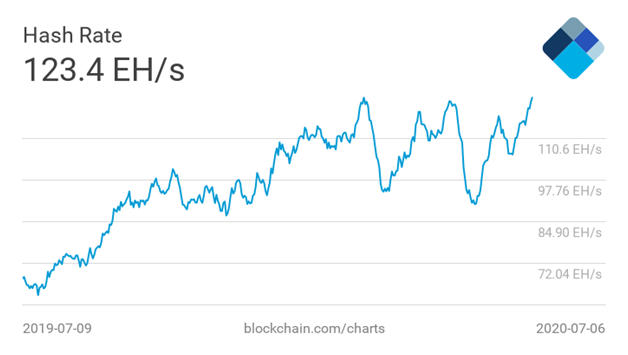

Hash rate hits new highs

It appears more Bitcoin miners have switched on their mining rigs as computational power on the network has surged to new highs over the past week.

According to market data firm Coinmetrics, Bitcoin’s seven-day moving average hash rate has hit its all-time high. According to the data, Bitcoin’s mining hash rate has risen to 123 exahashes (E/Hs). The 30-day average is also up, reaching 114 E/Hs, to hit its second-highest level ever on the timeframe.

At the same time, miners seem to be hodling even more as price remains ranged above $9,000. Net inventory for the past week is currently at 790 bitcoins, up from an average of 340 bitcoins over the past one to five weeks.

A look at the Miner’s Rolling Inventory (MRI) reveals that over the past five weeks, miners have hoarded more coins compared to 12 weeks ago. MRI has dropped from an average of 100.4% three months ago, to 94.97% over the past five weeks. The one-week MRI stands at 88.6%.

The implication is that miners have not only increased the network’s hash rate, but are also holding onto most of the minted coins as the market anticipates a price uptick.

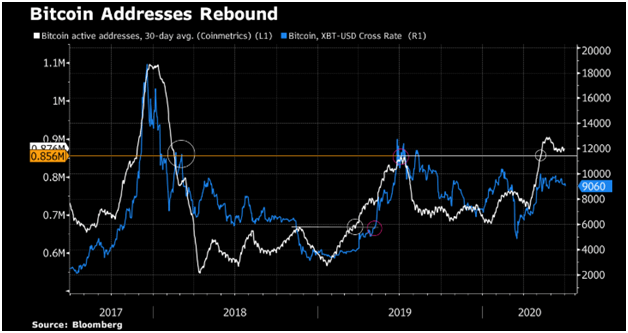

Increased number of unique Bitcoin addresses

According to a Bloomberg report, Bitcoin is on the path to winning the ongoing battle for widespread adoption. The publication cites the increased demand for Bitcoin among institutional investors as an indicator of this.

And that’s not all.

Demand is also found when gauged with the number of unique addresses.

According to the Coinmetrics data, the metric’s 30-day average has hit highs seen last year; reflecting the price recoveries seen in 2019.

This historical pattern suggests that BTC/USD is likely to bounce to prices closer to $12,000, with further consolidation seen in the highs of February 2018.

The question traders are asking themselves: is Bitcoin currently undervalued based on this signal?

The post These two indicators suggest Bitcoin is seriously bullish appeared first on Coin Journal.