Weekly Recap

| Asset | Current Value | Weekly Change |

| S&P 500 | 2363 | 0.80% |

| DAX | 12312 | 2.06% |

| WTI Crude Oil | 50.81 | 5.92% |

| GOLD | 1247.50 | -0.24% |

| Bitcoin | 1072 | 1.19% |

| EUR/USD | 1.0657 | -1.49% |

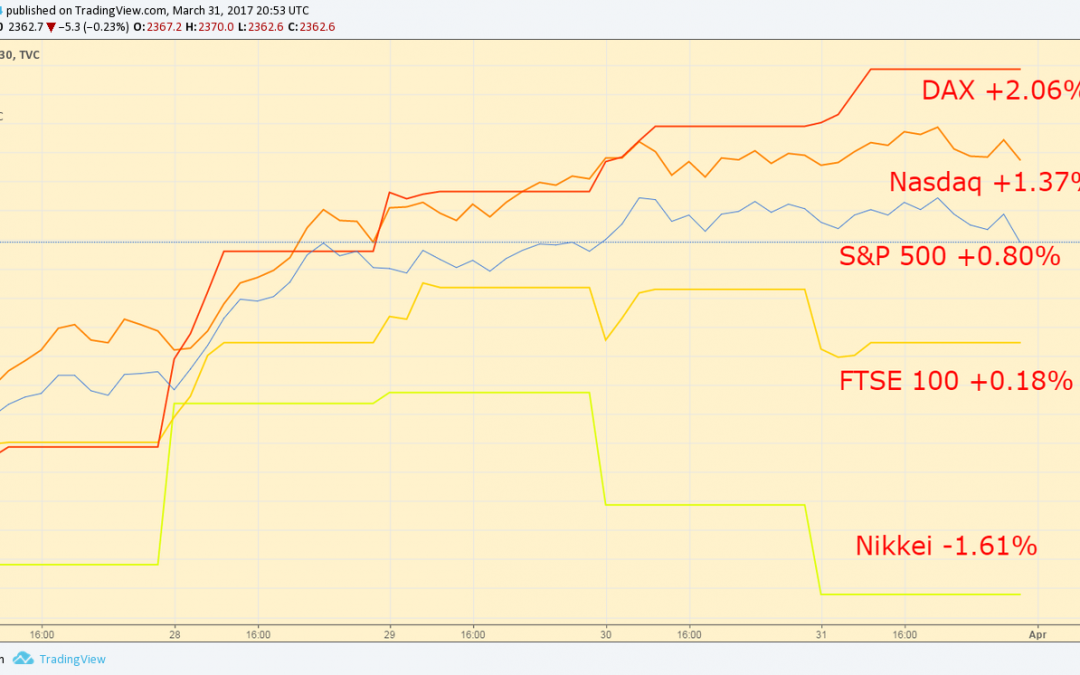

The correction that took hold of global stock markets last week didn’t last too long and the leaders of the rally, namely the Nasdaq and the DAX, were once again flirting with all-time highs this week. The US healthcare bill debate was put on the sideline, as the media’s attention switched to the Brexit process that officially started on Tuesday with the triggering of Article 50 by the British Government. The Pound experienced some volatility thanks to the announcement, but the currency finished the week on a positive note, even as the FTSE 100 underperformed most of its peers.

Weekly progress of the main global indices, Comparison Chart (% gains)

The end of the first quarter brought active trading in the second half of the week, as per usual, but volatility remained muted following the most volatile period in a while. Oil bounced back strongly after the key technical breakdown of the previous week, and the WTI contract finished above the crucial $50 per barrel on Friday. Gold hovered around the $1250 level all week long, successfully ignoring the rally in the Dollar, as it remains encouragingly strong despite the rate hike cycle of the Federal Reserve. The Euro lost ground against all of its major counterparts, while the Yen and the Franc remained stable throughout the week.

Cryptocurrencies had a great week, with several up-and-coming altcoins gaining significant ground during the period. Ripple and Litecoin were the most notable winners of the week, but Ethereum and Monero also held on to their recent gains. Bitcoin traded sideways, but it remained above the crucial $1000 level, while Dash was the only clear loser of the week.

Economic numbers continued to provide support for the global bull market, with only a few negative surprises throughout the week. In fact, there were several blowout numbers, such as the German retail sales reading, the US consumer confidence index (a new 16-year high!!), and US pending home sales. The only worrying sign is the rise in US initial jobless claim, but even if it’s a quite reliable early indicator, the 258,000 number is still far from being scary.

Technical Corner

The recent correction in global stocks was led by the US financial sector, as the largest US banks suffered double-digit losses following the Fed-meeting. Investors evaluated the central bank’s statement as a sign of a less aggressive rate hike schedule. That pushed bank’s lower, as the hikes are generally considered bullish for them in the current environment. That said, the sell-off was very much in the cards already, as technicals screamed for a correction.

The US financial sector (XLF), Daily Chart

The sector was well in overbought territory following the strong post-election advance, and the ETF that represents the segment also showed a significant momentum divergence before the decline. The extent of the previous rally is well described by the fact that a 12% correction only carried XLF to around the middle of the rising trend channel (this is a multi-trillion dollar industry, mind you).

This week’s bounce took the sector back to a previously important resistance level at $23.75, after precisely reaching the 23.6% Fibonacci retracement level at $23.07. The MACD indicator is now in neutral territory, but further sideways price action, or another sell-off, is still likely before a sustainable rally can develop. It will be interesting to see how the segment performs, as it should be a good tell for the direction of the whole US market in the coming weeks.

Key Economic Releases of the Week

| Day | Country | Release | Actual | Expected | Previous |

| Monday | EUROZONE | German Ifo Business Climate | 112.3 | 111.2 | 111 |

| Tuesday | US | CB Consumer Confidence | 125.6 | 113.9 | 114.8 |

| Wednesday | US | Pending Home Sales (monthly) | 5.50% | 2.30% | -2.80% |

| Wednesday | US | Crude Oil Inventories | 0.9 million | 1.2 million | 5.0 million |

| Thursday | GERMANY | Prelim CPI | 0.20% | 0.40% | 0.60% |

| Thursday | US | Final GDP | 2.10% | 2.00% | 1.90% |

| Thursday | US | Initial Jobless Claims (weekly) | 258,000 | 244,000 | 261,000 |

| Friday | GERMANY | Retail Sales | 1.80% | 0.70% | -0.80% |

| Friday | UK | Current Account | -12.1 billion | -16.3 bil | -25.5 bil |

| Friday | UK | Final GDP (quarterly) | 0.70% | 0.70% | 0.70% |

| Friday | CANADA | GDP (monthly) | 0.60% | 0.30% | 0.30% |

| Friday | US | Chicago PMI | 57.6 | 57.2 | 57.4 |

The Story of the Week: Apple Hits New High Again And Tops $750 Billion

Apple, Weekly Chart Analysis

The most valuable company in the world keeps on delivering respectable returns to its shareholders, despite its already enormous size. As an example of just what $750 billion dollars mean, a country with such a GDP would be in the top 20 largest economies globally. With that in mind, the fact that the value of the company went down by more than 30% in the past years alone is mind-boggling.

The obvious question is that did the value of the company really change that much in that short period of time? Well, the correct answer is that probably not. The emotional rollercoaster of the stock market led to these fluctuations, together with the change in global investor sentiment, while also being heavily influenced by the amount of “free” money supplied by the central banks.

So, will this be another triple digit rally, or is the stock about to turn lower? The answer is tricky, since we are after an 8-year bull market that helped Apple immensely, and a new bear market could wipe out a large chunk of its recent gains (yes, even such a strong brand is vulnerable). What’s sure is that the trend is still clearly bullish, and the company also keeps on paying dividends. That said, taking some chips off the table when the stock is getting overbought, like right now, is not a bad idea, as a good entry point is always ahead.