The U.S. Securities and Exchange Commission (SEC)’s investigation over shady behavior in the cryptocurrency market will only continue, said former chairman Harvey Pitt.

Also Read: Popular Chat App Kakao’s Exchange Upbit Claims Number One Spot in South Korea

Tighter Regulation on the Horizon

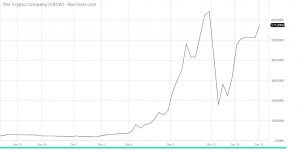

SEC this Tuesday halted trading of The Crypto Co. over manipulation concerns after a massive stock leap. And the regulatory body’s cracking down on suspicious cryptocurrencies will only continue, according to former chairman Harvey Pitt who said Thursday on CNBC’s “Fast Money”:

“We’re in line for some serious regulatory responses to all of this and that will be forthcoming after the first of the year.”

Pitt disclosed that further regulation is on the way. “Everyone else is investing in it, and the price seems to be going up,” Pitt said. “That’s a real problem because there’s a lack of education and knowledge on the part of many of the people who are actually doing the investing.”

The SEC has been highly critical of tokens that operate like securities. Back in August, the regulator suspended trading in three stocks over concerns about the issuing companies’ ICOs.

Pitt identified many cryptocurrency offerings as “offerings of securities,” which therefore fit under the SEC’s legal authority. For him, that means insider trading is a very real possibility. He added:

“There absolutely can be insider trading. When people have advanced knowledge of the offerings of these interests and take advantage of the offering long before it occurs.”

Caution for Pump-and-Dump Schemes

Coupled with the SEC’s crackdown, the Financial Industry Regulatory Authority (FINRA) this Thursday warned investors of bitcoin cold-calling scams as well.

“Beware of potential stock scams when considering the purchase of shares of companies that tout high returns associated with cryptocurrencies, such as bitcoin,” FINRA wrote in the statement.

The most common scenario in which an investor can get duped is the “pump-and-dump” scheme, said Gerri Walsh, FINRA senior vice president for investor education. “Pump and dump” is a form of securities fraud common among penny stocks, in which shareholders attempt to artificially inflate the price of stock through misleading statements.

At a time when attaching “blockchain” to a company name is a surefire way to blow up stock values, there is plenty of incentive for these schemes.

FINRA issued a guideline to inform investors that investors could use FINRA BrokerCheck® to check the professional background of the individuals involved in selling the investment. The regulator warns investors to be wary of stocks with huge spikes in price, which could signal manipulation or fraud.

FINRA issued a guideline to inform investors that investors could use FINRA BrokerCheck® to check the professional background of the individuals involved in selling the investment. The regulator warns investors to be wary of stocks with huge spikes in price, which could signal manipulation or fraud.

“We warn investors to look behind the name of the company, look behind the ticker of the stock. Take a look at a company’s filings,” Walsh said. She recommended investors look at the SEC’s list of trading suspensions to check whether the company has been deemed a threat to investors.

“There can be legitimate ways to get involved. Our concern with investors is they might field a call from a less legitimate actor,” she added.

Are you an emotional investor? Have you ever been duped in the crypto world? Leave your thoughts in the comments below!

Images via Shutterstock, Barchart.

Need to calculate your bitcoin holdings? Check our tools section.

The post The SEC Crackdown on Suspicious Cryptocurrencies Is Getting Serious appeared first on Bitcoin News.