Through late 2017 and early 2018, ripple was the darling of cryptocurrency. Mainstream media couldn’t get enough of it, South Koreans couldn’t get enough of it, and nor could crypto newcomers, who had XRP top of their shopping list. Crypto moves at a blistering pace, though, and ripple’s decline has been as rapid as its rise. Now the dust has settled and the hype dissipated, a retrospective reveals the mass hysteria behind the rise and fall of ripple.

Also read: Markets Update: Cryptocurrency Prices Rebound But Uncertainty Still Lingers

Ripple: A Case Study in Collective Obsessional Behavior

In the Middle Ages, a group of nuns in a French convent began randomly mewing like cats. In 1518, the Dancing Plague in Strasbourg caused people to keel over from exhaustion after gyrating for days. In 1962, a laughter epidemic broke out in a girls’ boarding school in Tanzania. And in late 2017, the world became convinced that ripple was a valuable commodity. As ripple’s market capitalization surged, there was even talk of it overtaking bitcoin to become the world’s dominant cryptocurrency. Looking through the timeline reveals the sequence of events that contributed to the rise and fall of XRP.

Phase 1: Stagnation

Up until two months ago, ripple was the great sleeper of cryptocurrency. Due to the vast number of XRP in existence, its huge market cap meant it was a constant presence in the cryptocurrency top 10. Traders hated it though, dubbing it Cripple, while decentralization purists had more ideological reasons for disliking XRP, arguing that it wasn’t even a cryptocurrency.

After briefly surging in May, ripple entered into a lengthy slump. Between August and December 2017, XRP traded at between 16 and 26 cents, while other altcoins were recording exponential gains. It seemed that ripple’s time would never come. But then, on December 9, XRP began to climb.

Phase 2: Take-Off

Between December 9 and 16, ripple grows from 24 cents to 88 cents, gaining 366% in a week.

12/13: Forbes asks “Is XRP The Next Crypto Rocket ‘To The Moon’?

Phase 3: Enthusiasm

From December 17-22, ripple rises from 76 cents to $1.19, growing another 160% in under a week. The coin is now up 500% in a fortnight.

12/17: Oracle Times writes “3 Reasons Why Amazon Will Choose Ripple (XRP) in 2018”

12/22: Bloomberg writes “Bitcoin Is So 2017 as Ripple Soars at Year End”

Phase 4: Greed

Ripple finishes the year with another huge leap, going from $1.19 on December 23 to $2.24 on December 29, gaining 188%.

12/30: News.bitcoin.com asks “Is the Centralized Ripple Database With the Biggest Pre-Mine Really a Bitcoin Competitor?

Phase 5: Delusion

Ripple starts the year with another run, going from a low of $1.93 on December 31 to an all-time high of $3.86 on January 4.

01/02: In a soon to be notorious feature, CNBC educates its readers on “How to buy ripple, one of the hottest bitcoin competitors”. On the same day, Forbes’ Laura Shin points out that two of Ripple’s founders are now billionaires, with Chris Larsen the 15th richest man in America. Meanwhile, anecdotal evidence stacks up suggesting that office workers, moms, manual laborers, and many others with no previous knowledge or interest in cryptocurrency are asking about ripple.

01/03: News.Bitcoin.com notes how ripple’s market cap is now 40% that of bitcoin’s, raising the possibility of “The Rippening”.

01/04: As ripple hits its all time high, news.Bitcoin.com explains that Ripple Gateways Can Freeze Users’ Funds at Any Time. Ripple’s chief cryptographer David Schwartz rages hard and pens a Quora rebuttal in which he notes that “Ripple is not a gateway and only gateways can freeze.” So exactly what the article title said then.

On the same day, NYT’s Nathaniel Popper writes a Ripple feature that’s widely perceived as negative, quoting Ari Paul as saying “I’m not aware of banks using or planning to use the XRP token at the scale of tens of billions of dollars necessary to support XRP’s valuation”. Popper finishes “even virtual currency analysts who believe in Ripple’s software have said there is a big difference between Ripple the company being successful, and Ripple the token gaining enough traction to justify current prices.”

01/05: Ripple CEO Brad Garlinghouse lashes out at Popper on Twitter:

Phase 6: New Paradigm

Over the next four days, ripple dips slightly, but by January 8 is still sitting at $3.36, up 1,400% in a month.

01/05: Coinbase rejects rumors that it is planning to add new assets, scorching the prospect of XRP being listed.

01/05: Coinbase rejects rumors that it is planning to add new assets, scorching the prospect of XRP being listed.

01/07: British newspapers are now heavily shilling ripple, with the Express describing it as “the exciting new cryptocurrency that has sparked interest from crypto investors”. In another piece filed the same day, it asks “Is it better to invest in XRP than Bitcoin?”

01/08: News.Bitcoin.com describes ripple as vaporware, noting “Ripple claims to have signed up over 100 banks, but the trouble is none of them seem to be using XRP tokens for money transfer”. Ripple supporters are not amused.

Phase 7: Denial

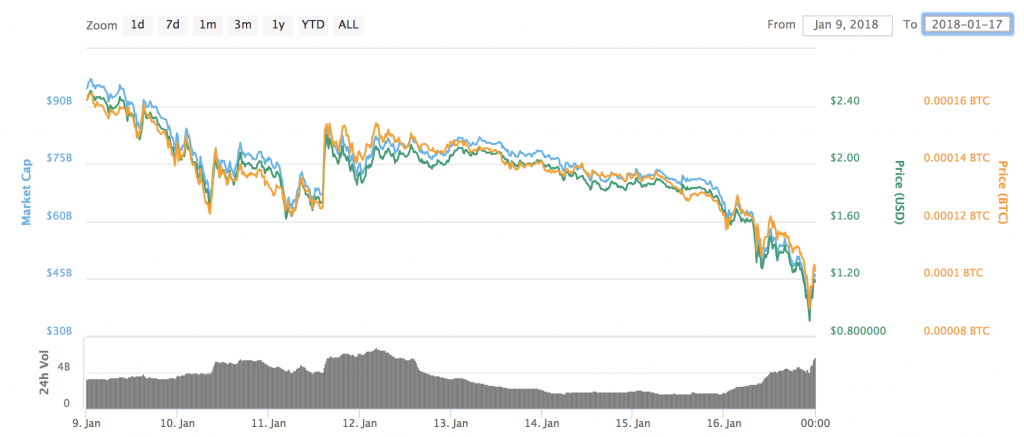

Over the course of the next week, ripple begins to drop and then keeps on dropping, reaching a low of 89 cents on January 16 as the entire crypto market takes a tumble. It is now down 430% from its peak 12 days earlier and is no longer the second largest cryptocurrency.

01/10: Three days after touting ripple as a bitcoin competitor, the Express writes: “Why is XRP falling so fast? What’s happening to Ripple?”

01/11: News that Ripple has signed an agreement with a money transfer service causes XRP to climb 20% before sliding again as it becomes apparent that Moneygram are only testing ripple in a single location.

01/16: Forbes documents the decline of ripple, quoting one analyst as saying: “You couldn’t turn on your TV last week and not hear about XRP or its CEO…Once Coinbase said they weren’t adding any new assets the pullback started. Now everyone is continuing to take profits.”

One commenter tweets “That CNBC pump is gonna be stock footage in every documentary they make about 2018 for the next 50 years.”

Phase 8: Return to Normal

As the crypto markets start to recover, ripple claws back some of its losses, reaching $1.43 on January 21. It is still up almost 600% from the start of December, but is down 270% from its peak. “Early adopters” who bought XRP a month ago are in profit, but the masses who bought in at peak mania are heavily in the red. The mainstream media stop writing about ripple, and housewives shelve plans to put their savings into “the next bitcoin”.

01/18: Financial Times writes how it “spoke to 16 banks and financial services companies publicly linked to Ripple. Most had not yet gone beyond testing…none of the banks who spoke to the FT had used XRP.”

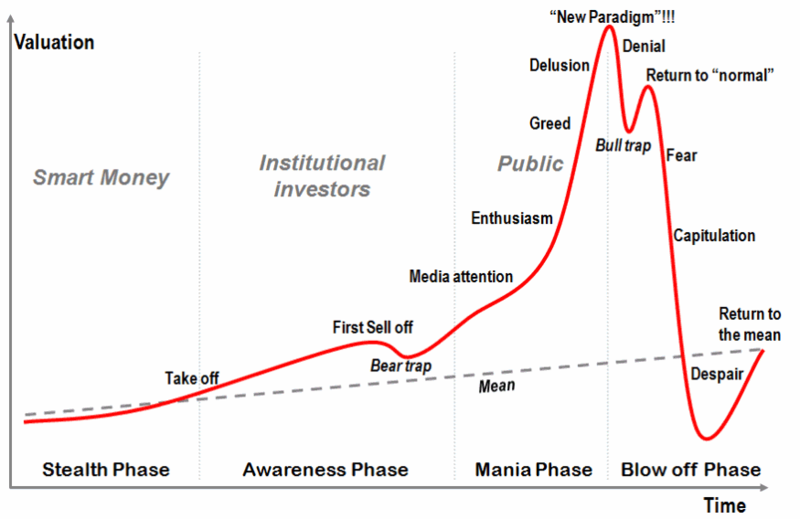

Where ripple goes next remains to be seen, though the Classic Stages of a Bubble chart has some firm suggestions:

The reality may prove more prosaic: ripple is unlikely to disappear from trace, but nor is it likely to trouble bitcoin’s market cap, which is now 3.5x greater than that of the centralized pretender which, for three heady days in January 2018, looked like it might actually be capable of achieving The Rippening. If Ripple can finally persuade a major bank to use XRP, and not just for test purposes, it could see another surge. Right now though, the heady days of $3+ ripple seem like a lifetime ago.

Ripple isn’t the first asset to be shilled to the moon and back, and it certainly won’t be the last. When the cryptocurrency history books are written, ripple will go down as a textbook case of mass hysteria, right up there with the dancing plague and the laughter epidemic.

Do you think ripple has peaked or does XRP still have further to run? Let us know in the comments section below.

Images courtesy of Shutterstock, and Coinmarketcap.

Express yourself freely at Bitcoin.com’s user forums. We don’t censor on political grounds. Check forum.Bitcoin.com.

The post The Rise and Fall of Ripple is a Case Study in Mass Hysteria appeared first on Bitcoin News.