In today’s edition of The Daily, we cover a number of developments in the institutional segment, including a new BTC spot index, a delay in the launch of a futures platform and an investment by Binance in an over-the-counter (OTC) trading desk in San Francisco. We also cover an investigation into Tether and, on a lighter note, why Kobe Bryant is going to a crypto event.

Also Read: Bchd Developers Announce Neutrino Wallet for Bitcoin Cash in Beta

Price Index Based on OTC Trading

MV Index Solutions, a Vaneck company with about $14 billion invested in its products, launched the MVIS Bitcoin US OTC Spot Index on Tuesday. The BTC index is based on price feeds from established U.S. digital asset trading operations. It tracks the price performance on three OTC liquidity providers, including Circle Trade, Cumberland and Genesis Trading.

MV Index Solutions, a Vaneck company with about $14 billion invested in its products, launched the MVIS Bitcoin US OTC Spot Index on Tuesday. The BTC index is based on price feeds from established U.S. digital asset trading operations. It tracks the price performance on three OTC liquidity providers, including Circle Trade, Cumberland and Genesis Trading.

“Vaneck continues to support market structure developments in the digital asset space. MVIS’ work with our core OTC partners, Cumberland, Circle Trade and Genesis Trading, is a major step forward towards greater transparency and price discovery in the institutional Bitcoin market,” said Gabor Gurbacs, director of digital asset strategies at Vaneck/MVIS. “The index may pave the way for institutionally oriented products, such as ETFs, as well as provide further tools to institutional investors to execute institutional size trades at transparent prices on the OTC markets.”

Bakkt Launch Now Planned for Late January 2019

Intercontinental Exchange (ICE), the owner of the New York Stock Exchange (NYSE), has announced that it will delay the launch of its bitcoin futures platform, which was originally slated to open in December. The start of trading on Bakkt is now set for Jan. 24, 2019.

Intercontinental Exchange (ICE), the owner of the New York Stock Exchange (NYSE), has announced that it will delay the launch of its bitcoin futures platform, which was originally slated to open in December. The start of trading on Bakkt is now set for Jan. 24, 2019.

“As is often true with product launches, there are new processes, risks and mitigants to test and retest, and in the case of crypto, a new asset class to which these resources are being applied. So it makes sense to adjust our timeline as we work with the industry toward launch,” stated Bakkt CEO Kelly Loeffler.

Loeffler also revealed that Bakkt now has insurance for bitcoin in cold storage. It is now in the process of securing insurance for the warm wallet within the Bakkt Warehouse architecture, she added.

Market Manipulation Investigation Focuses on Tether

The U.S. Department of Justice investigation to determine if anyone is manipulating cryptocurrency prices is reportedly zeroing in on Tether (USDT). Federal prosecutors are said to have recently started focusing on allegations that Tether and Bitfinex have been used to illegally influence the market, according to three people familiar with the matter. They are looking into how Tether Ltd. prints new coins and why they primarily enter the market via Bitfinex, the unidentified sources added.

The U.S. Department of Justice investigation to determine if anyone is manipulating cryptocurrency prices is reportedly zeroing in on Tether (USDT). Federal prosecutors are said to have recently started focusing on allegations that Tether and Bitfinex have been used to illegally influence the market, according to three people familiar with the matter. They are looking into how Tether Ltd. prints new coins and why they primarily enter the market via Bitfinex, the unidentified sources added.

The investigation follows a report by University of Texas Professor John Griffin and co-author Amin Shams that links Tether to the 2017 bull market.

Binance Backs China-Focused OTC Trading Desk

Binance Labs, the incubation arm of the cryptocurrency exchange, has made a $3 million investment in San Francisco-based OTC crypto company Koi Trading. With desks in Hong Kong and Beijing, Koi Trading offers global market-making for cryptocurrency exchanges and high-frequency trading, as well as support services such as quantitative research and compliance consulting. Its founding team consists of three former core team members of Hbus, the U.S. partner exchange of Huobi.

Binance Labs, the incubation arm of the cryptocurrency exchange, has made a $3 million investment in San Francisco-based OTC crypto company Koi Trading. With desks in Hong Kong and Beijing, Koi Trading offers global market-making for cryptocurrency exchanges and high-frequency trading, as well as support services such as quantitative research and compliance consulting. Its founding team consists of three former core team members of Hbus, the U.S. partner exchange of Huobi.

Koi Trading said it looks for underserved clientele in China and the U.S., even in today’s market. The company explained that OTC trading in China boasts a daily volume of at least 150 million yuan ($21.6 million). However, without trusted escrow agents most trades are arranged via messaging apps, so it is difficult to secure professional service providers.

“With Koi’s robust AML program, extensive banking relations in the U.S., investment from Binance Labs, and strong trust amongst counterparties in Greater China, we aim to be the market nexus that reduces trust and information asymmetry and improves cryptocurrency OTC deal close rate,” said Hao Chen, founder and CEO of Koi Trading.

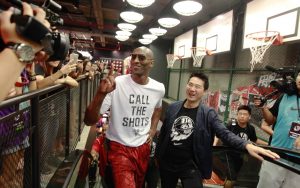

Kobe Bryant to Attend Cryptocurrency Summit

Tron has announced that Kobe Bryant will be a special guest at Nitron Summit 2019, which will take place in San Francisco in January. The former NBA superstar is scheduled to share his “life experience and insights” at the event, presumably with an emphasis on how he transitioned from basketball to the business world. Bryant is the co-head of his own investment firm, Bryant Stibel, which has invested in 15 ventures, including a sports media website, a video game publisher and an online education platform in China.

Tron has announced that Kobe Bryant will be a special guest at Nitron Summit 2019, which will take place in San Francisco in January. The former NBA superstar is scheduled to share his “life experience and insights” at the event, presumably with an emphasis on how he transitioned from basketball to the business world. Bryant is the co-head of his own investment firm, Bryant Stibel, which has invested in 15 ventures, including a sports media website, a video game publisher and an online education platform in China.

“Kobe Bryant is a basketball genius. I have been a huge fan of Kobe and deeply inspired by his journey,” Tron founder Justin Sun commented. “It’s my great honor to have Kobe as our special guest for the Nitron Summit. It’s worth mentioning that Kobe Bryant is not only a basketball genius, but also an investment genius. We look forward to hearing his great speeches at the summit.”

What do you think about today’s news tidbits? Share your thoughts in the comments section below.

Images courtesy of Shutterstock.

Verify and track bitcoin cash transactions on our BCH Block Explorer, the best of its kind anywhere in the world. Also, keep up with your holdings, BCH and other coins, on our market charts at Satoshi’s Pulse, another original and free service from Bitcoin.com.

The post The Daily: BTC Spot Index Launches, Futures Platform Delayed appeared first on Bitcoin News.