By Jamie Redman,

Bitcoin debit cards have become more popular over the past two years with various choices on the table for consumers to choose from. Cards enable a user to load the account with bitcoin reserves and spend the funds where major credit cards are accepted.

Bitcoin.com decided to review the popular bitcoin debit card currently available to U.S. cryptocurrency supporters. We hope to explain in detail how this loadable card works so our readers can get an idea of what it’s like to utilize these types of cards.

The Bitpay Visa Debit Card

Just recently I ordered the Bitpay bitcoin Visa card, available to U.S. residents in all fifty states. The card cost me $9.99, and you have to pay for the product in bitcoin. There wasn’t much to fill out for verification purposes. Registration required my social security number, email, and current mailing address. Other than those requests nothing more was required from me for identity. After registration, I paid for the card with a Bitpay invoice and was told I would receive the card in 7-10 business days.

Just recently I ordered the Bitpay bitcoin Visa card, available to U.S. residents in all fifty states. The card cost me $9.99, and you have to pay for the product in bitcoin. There wasn’t much to fill out for verification purposes. Registration required my social security number, email, and current mailing address. Other than those requests nothing more was required from me for identity. After registration, I paid for the card with a Bitpay invoice and was told I would receive the card in 7-10 business days.

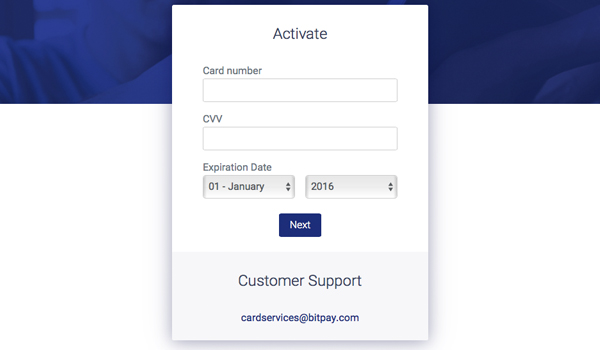

Five days later I had received my card, including a PIN and references to card fees. The PIN is used like a traditional debit purchase and also for ATM access. After getting my card and reviewing the fees, I went to the Bitpay Visa card activation page. The page asks for the credit card number, three-digit CVV, and your email. As soon as the information is processed, you now have access to an account page.

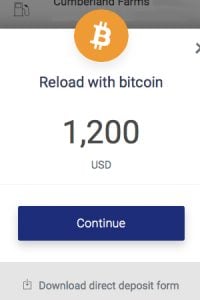

The account page is where you load bitcoins onto the card. There is a button that says “add funds, of” and you type in how much money you want to load in USD. I decided how much I wanted to add to the card and entered the amount, which then processes a new Bitpay invoice. Like any Bitpay invoice you have 15 minutes to pay and I scanned the address with my phone’s wallet, thereby paying the amount. Immediately the invoice is marked as received, but funds are not accessible until the transaction receives one confirmation. It must have been a busy day because I had to wait for my transaction to confirm. When it did, my card was loaded with funds.

Simple to Use, but Basically a Conversion Tool

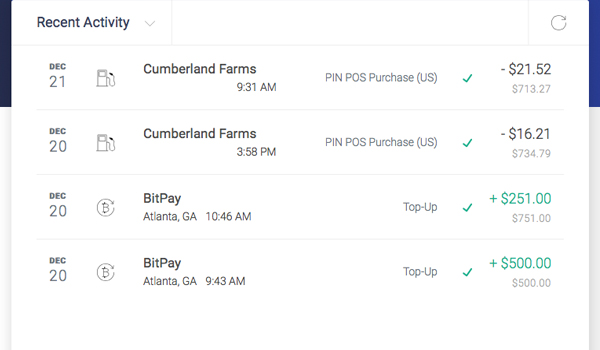

One should note that bitcoin transactions sent to the Bitpay card are basically sales and you receive the funds in USD at the current BTC spot price. As soon as the funds are loaded, the USD amount never changes. This is different than using Coinbase’s Shift card which deducts bitcoin spends based on the spot price as merchant transactions are processed. Users can load $10,000 per day and up to $25,000 can be held on the Bitpay Visa. Such amounts are probably not secure enough tied to such cards. With money on my Bitpay card, I traveled to the nearest convenience store to make a purchase.

Overall using the Bitpay debit card was pleasant and simple. It definitely uses immediate fiat conversion which is a downside, but basically allows for easy bitcoin sales with a personal debit card in real-time. Purchases were simple and after every one I had visible access to these transactions on my account page. Fees are explained throughout the whole process and are relatively inexpensive and can be avoided. ATM fees are $2, ACH transfers are $5, and there’s a charge of $5 if you don’t use the card for 90 days. I will definitely be using my new Bitpay card from time to time as it does add a nice level of convenience.