Tezos (XTZ) has declined by about 14% since its all-time high of $7.21 on April 10

Tezos’ price rose to a new all-time high of $7.21 last week, with weekly gains of over 25%. The XTZ/USD pair had surged from lows of $4.97, gaining momentum after breaching a major resistance zone and helped by positive sentiment following news of an upcoming upgrade that launched via the Tenderbake testnet.

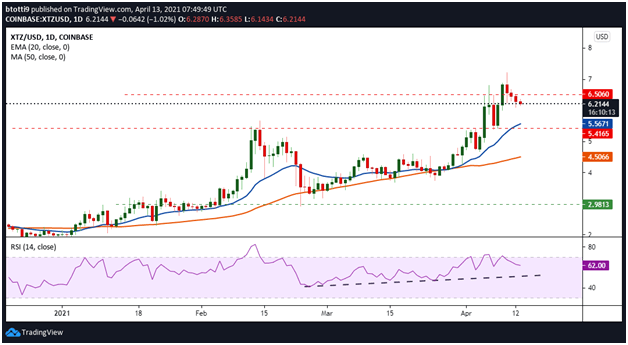

Profit booking has seen XTZ trade in a downtrend since the peak, with current prices of $6.21 putting XTZ/USD over 14% below the all-time high. Despite the negative trajectory over the past four days, Tezos remains bullish and could yet retest recent highs or even break higher.

The positive outlook will nonetheless subside if bears extend their damage beyond the support of the 20-day exponential moving average.

Tezos price outlook

XTZ/USD has traded lower over the past four candles on the daily chart, with bulls seeking to remain in the picture by buying the dips.

The pullback has allowed prices to retest the zone at which bulls rebounded last week on their way to the new all-time high. If buyers stop the rot at the horizontal support level at $6.20, the uptrend could resume and see bulls seek a fresh challenge beyond $7.21.

The daily RSI has slipped slightly after turning from the overbought line, but remains above 50 and crucially holds a positive divergence outlook.

This suggests bulls still hold the upper hand. If XTZ corrects higher and breaks above $6.50, the next target would be $7.20. A clear break above this overhead resistance zone would allow bulls to target $8.00, with potential for more gains.

On the downside, the primary support area is at the 20-day EMA ($5.56), with Tezos holding onto the bullish view if the price bounces higher from here. If not, bears might eye up $5.00, or the 50 SMA at $4.50 below that.

The post Tezos price analysis: XTZ remains bullish despite 14% pullback appeared first on Coin Journal.